Louisiana State Employees Retirement System lifted its stake in shares of Bio-Rad Laboratories, Inc. (NYSE:BIO - Free Report) by 341.7% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 5,300 shares of the medical research company's stock after acquiring an additional 4,100 shares during the quarter. Louisiana State Employees Retirement System's holdings in Bio-Rad Laboratories were worth $1,773,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

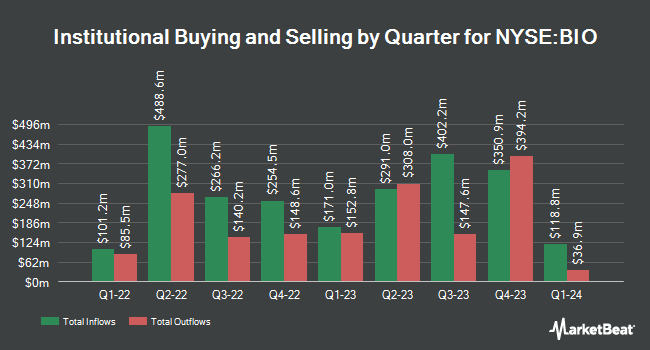

A number of other hedge funds also recently made changes to their positions in the stock. Van ECK Associates Corp bought a new stake in Bio-Rad Laboratories in the second quarter worth approximately $180,040,000. First Eagle Investment Management LLC increased its holdings in Bio-Rad Laboratories by 32,296.9% in the second quarter. First Eagle Investment Management LLC now owns 636,275 shares of the medical research company's stock worth $173,773,000 after purchasing an additional 634,311 shares in the last quarter. Dimensional Fund Advisors LP increased its holdings in Bio-Rad Laboratories by 64.4% in the second quarter. Dimensional Fund Advisors LP now owns 494,604 shares of the medical research company's stock worth $135,081,000 after purchasing an additional 193,700 shares in the last quarter. Select Equity Group L.P. increased its holdings in Bio-Rad Laboratories by 26.2% in the second quarter. Select Equity Group L.P. now owns 649,522 shares of the medical research company's stock worth $177,391,000 after purchasing an additional 134,856 shares in the last quarter. Finally, Earnest Partners LLC increased its holdings in Bio-Rad Laboratories by 30.8% in the first quarter. Earnest Partners LLC now owns 514,906 shares of the medical research company's stock worth $178,091,000 after purchasing an additional 121,272 shares in the last quarter. 65.24% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of brokerages have commented on BIO. StockNews.com cut Bio-Rad Laboratories from a "buy" rating to a "hold" rating in a research note on Thursday, August 1st. Wells Fargo & Company began coverage on Bio-Rad Laboratories in a research note on Tuesday, August 27th. They issued an "equal weight" rating and a $340.00 price objective for the company. Citigroup raised Bio-Rad Laboratories from a "neutral" rating to a "buy" rating and raised their price objective for the company from $350.00 to $400.00 in a research note on Tuesday, October 1st. Finally, Royal Bank of Canada raised their price objective on Bio-Rad Laboratories from $446.00 to $469.00 and gave the company an "outperform" rating in a research note on Thursday. Three investment analysts have rated the stock with a hold rating and three have issued a buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $381.80.

Get Our Latest Stock Analysis on BIO

Bio-Rad Laboratories Stock Up 8.4 %

Shares of NYSE:BIO traded up $27.61 during mid-day trading on Thursday, hitting $358.19. 402,113 shares of the company traded hands, compared to its average volume of 248,829. The stock has a market cap of $9.98 billion, a P/E ratio of -7.54 and a beta of 0.95. The company has a current ratio of 6.28, a quick ratio of 4.63 and a debt-to-equity ratio of 0.18. Bio-Rad Laboratories, Inc. has a 12-month low of $262.12 and a 12-month high of $364.24. The stock has a 50-day moving average price of $331.96 and a two-hundred day moving average price of $307.65.

Bio-Rad Laboratories (NYSE:BIO - Get Free Report) last announced its earnings results on Wednesday, October 30th. The medical research company reported $2.01 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.28 by $0.73. The company had revenue of $649.70 million for the quarter, compared to analysts' expectations of $628.18 million. Bio-Rad Laboratories had a positive return on equity of 3.77% and a negative net margin of 51.73%. Bio-Rad Laboratories's quarterly revenue was up 2.8% on a year-over-year basis. During the same quarter in the previous year, the firm earned $2.33 earnings per share. On average, equities research analysts forecast that Bio-Rad Laboratories, Inc. will post 9.45 earnings per share for the current year.

Insider Buying and Selling

In related news, COO Andrew J. Last sold 3,000 shares of Bio-Rad Laboratories stock in a transaction on Friday, September 6th. The stock was sold at an average price of $329.94, for a total transaction of $989,820.00. Following the sale, the chief operating officer now directly owns 7,559 shares in the company, valued at approximately $2,494,016.46. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. In other Bio-Rad Laboratories news, EVP James Barry sold 623 shares of the business's stock in a transaction on Wednesday, September 4th. The stock was sold at an average price of $330.49, for a total value of $205,895.27. Following the sale, the executive vice president now directly owns 147 shares in the company, valued at $48,582.03. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, COO Andrew J. Last sold 3,000 shares of the business's stock in a transaction on Friday, September 6th. The shares were sold at an average price of $329.94, for a total value of $989,820.00. Following the completion of the sale, the chief operating officer now owns 7,559 shares in the company, valued at approximately $2,494,016.46. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 17.06% of the stock is currently owned by corporate insiders.

Bio-Rad Laboratories Profile

(

Free Report)

Bio-Rad Laboratories, Inc manufactures and distributes life science research and clinical diagnostic products in the United States, Europe, Asia, Canada, and Latin America. It operates through two segments, Life Science and Clinical Diagnostics. The company develops, manufactures, and markets instruments, systems, reagents, and consumables to separate, purify, characterize, and quantitate biological materials such as cells, proteins, and nucleic acids for proteomics, genomics, biopharmaceutical production, cellular biology, and food safety markets.

Read More

Before you consider Bio-Rad Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bio-Rad Laboratories wasn't on the list.

While Bio-Rad Laboratories currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report