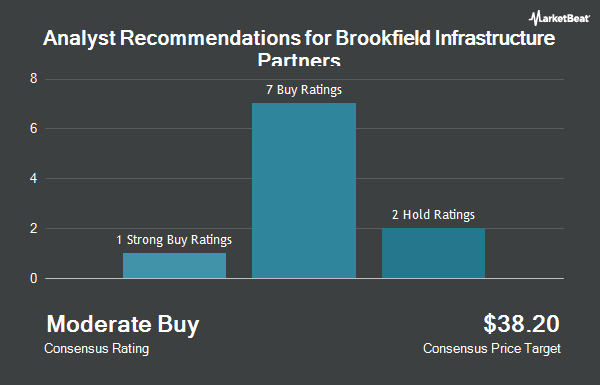

Shares of Brookfield Infrastructure Partners L.P. (NYSE:BIP - Get Free Report) TSE: BIP.UN have earned a consensus rating of "Buy" from the eight brokerages that are currently covering the company, MarketBeat reports. Two research analysts have rated the stock with a hold rating, four have issued a buy rating and two have given a strong buy rating to the company. The average 1 year price target among brokers that have updated their coverage on the stock in the last year is $39.50.

BIP has been the subject of several recent analyst reports. Jefferies Financial Group lifted their price target on Brookfield Infrastructure Partners from $35.00 to $39.00 and gave the company a "buy" rating in a report on Monday, September 30th. StockNews.com raised Brookfield Infrastructure Partners from a "sell" rating to a "hold" rating in a research note on Sunday, September 15th. Finally, Cibc World Mkts raised Brookfield Infrastructure Partners to a "strong-buy" rating in a research note on Friday, August 2nd.

Check Out Our Latest Research Report on Brookfield Infrastructure Partners

Hedge Funds Weigh In On Brookfield Infrastructure Partners

Institutional investors have recently made changes to their positions in the business. Cedar Mountain Advisors LLC acquired a new position in shares of Brookfield Infrastructure Partners in the 3rd quarter valued at approximately $26,000. Clear Point Advisors Inc. bought a new stake in shares of Brookfield Infrastructure Partners in the 1st quarter valued at approximately $33,000. Bank & Trust Co bought a new stake in shares of Brookfield Infrastructure Partners in the 2nd quarter valued at approximately $31,000. Park Place Capital Corp bought a new stake in shares of Brookfield Infrastructure Partners in the 2nd quarter valued at approximately $41,000. Finally, Asset Dedication LLC bought a new stake in shares of Brookfield Infrastructure Partners in the 2nd quarter valued at approximately $46,000. 57.92% of the stock is owned by institutional investors and hedge funds.

Brookfield Infrastructure Partners Price Performance

Brookfield Infrastructure Partners stock traded down $0.76 during midday trading on Tuesday, reaching $34.70. 311,463 shares of the company were exchanged, compared to its average volume of 434,882. The company has a market capitalization of $16.10 billion, a price-to-earnings ratio of 111.94 and a beta of 1.06. The firm's 50-day simple moving average is $33.62 and its 200-day simple moving average is $30.71. Brookfield Infrastructure Partners has a 1 year low of $21.03 and a 1 year high of $36.50. The company has a debt-to-equity ratio of 1.58, a quick ratio of 0.76 and a current ratio of 0.81.

Brookfield Infrastructure Partners (NYSE:BIP - Get Free Report) TSE: BIP.UN last posted its quarterly earnings data on Thursday, August 1st. The utilities provider reported ($0.10) EPS for the quarter, missing analysts' consensus estimates of $0.70 by ($0.80). The company had revenue of $5.14 billion for the quarter, compared to analysts' expectations of $1.91 billion. Brookfield Infrastructure Partners had a return on equity of 0.51% and a net margin of 0.82%. The company's revenue for the quarter was up 20.7% compared to the same quarter last year. During the same quarter in the prior year, the business posted $0.72 EPS. On average, analysts anticipate that Brookfield Infrastructure Partners will post 3.15 EPS for the current year.

Brookfield Infrastructure Partners Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, September 27th. Investors of record on Friday, August 30th were given a dividend of $0.405 per share. This represents a $1.62 annualized dividend and a yield of 4.67%. The ex-dividend date of this dividend was Friday, August 30th. Brookfield Infrastructure Partners's dividend payout ratio (DPR) is presently 522.58%.

Brookfield Infrastructure Partners Company Profile

(

Get Free ReportBrookfield Infrastructure Partners L.P. owns and operates utilities, transport, midstream, and data businesses in North and South America, Europe, and the Asia Pacific. The company's Utilities segment operates approximately 2,900 km of electricity transmission lines; 4,200 km of natural gas pipelines; 8.1 million electricity and natural gas connections; and 0.6 million long-term contracted sub-metering services.

Featured Articles

Before you consider Brookfield Infrastructure Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield Infrastructure Partners wasn't on the list.

While Brookfield Infrastructure Partners currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.