Brookfield Infrastructure Partners (NYSE:BIP - Get Free Report) TSE: BIP.UN is scheduled to issue its quarterly earnings data before the market opens on Wednesday, November 6th. Analysts expect the company to announce earnings of $0.80 per share for the quarter. Parties interested in listening to the company's conference call can do so using this link.

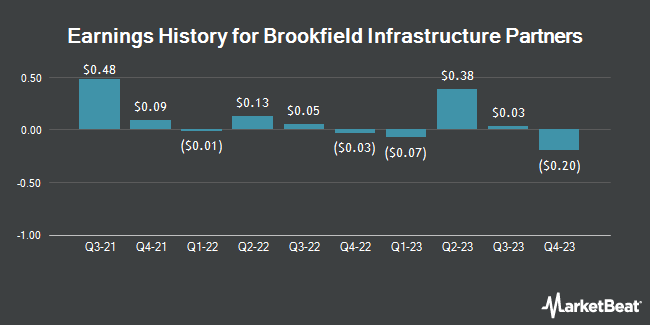

Brookfield Infrastructure Partners (NYSE:BIP - Get Free Report) TSE: BIP.UN last posted its earnings results on Thursday, August 1st. The utilities provider reported ($0.10) earnings per share for the quarter, missing analysts' consensus estimates of $0.70 by ($0.80). The business had revenue of $5.14 billion during the quarter, compared to the consensus estimate of $1.91 billion. Brookfield Infrastructure Partners had a net margin of 0.82% and a return on equity of 0.51%. The business's revenue was up 20.7% compared to the same quarter last year. During the same period in the previous year, the firm earned $0.72 EPS. On average, analysts expect Brookfield Infrastructure Partners to post $3 EPS for the current fiscal year and $3 EPS for the next fiscal year.

Brookfield Infrastructure Partners Price Performance

BIP traded up $0.21 during midday trading on Wednesday, reaching $34.92. 372,474 shares of the company's stock were exchanged, compared to its average volume of 434,585. The company has a quick ratio of 0.76, a current ratio of 0.81 and a debt-to-equity ratio of 1.58. The business has a 50-day simple moving average of $33.68 and a two-hundred day simple moving average of $30.77. The firm has a market capitalization of $16.20 billion, a price-to-earnings ratio of 111.94 and a beta of 1.06. Brookfield Infrastructure Partners has a one year low of $22.21 and a one year high of $36.50.

Brookfield Infrastructure Partners Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, September 27th. Investors of record on Friday, August 30th were given a dividend of $0.405 per share. The ex-dividend date of this dividend was Friday, August 30th. This represents a $1.62 annualized dividend and a dividend yield of 4.64%. Brookfield Infrastructure Partners's dividend payout ratio (DPR) is presently 522.58%.

Wall Street Analysts Forecast Growth

Several research analysts have issued reports on BIP shares. Cibc World Mkts upgraded Brookfield Infrastructure Partners to a "strong-buy" rating in a research note on Friday, August 2nd. StockNews.com upgraded shares of Brookfield Infrastructure Partners from a "sell" rating to a "hold" rating in a research report on Sunday, September 15th. Finally, Jefferies Financial Group boosted their price target on shares of Brookfield Infrastructure Partners from $35.00 to $39.00 and gave the company a "buy" rating in a research report on Monday, September 30th. Three research analysts have rated the stock with a hold rating, four have issued a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $39.50.

Get Our Latest Stock Report on BIP

Brookfield Infrastructure Partners Company Profile

(

Get Free Report)

Brookfield Infrastructure Partners L.P. owns and operates utilities, transport, midstream, and data businesses in North and South America, Europe, and the Asia Pacific. The company's Utilities segment operates approximately 2,900 km of electricity transmission lines; 4,200 km of natural gas pipelines; 8.1 million electricity and natural gas connections; and 0.6 million long-term contracted sub-metering services.

Read More

Before you consider Brookfield Infrastructure Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield Infrastructure Partners wasn't on the list.

While Brookfield Infrastructure Partners currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.