New York State Teachers Retirement System reduced its stake in shares of TopBuild Corp. (NYSE:BLD - Free Report) by 13.8% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 32,417 shares of the construction company's stock after selling 5,200 shares during the period. New York State Teachers Retirement System owned 0.10% of TopBuild worth $13,188,000 at the end of the most recent quarter.

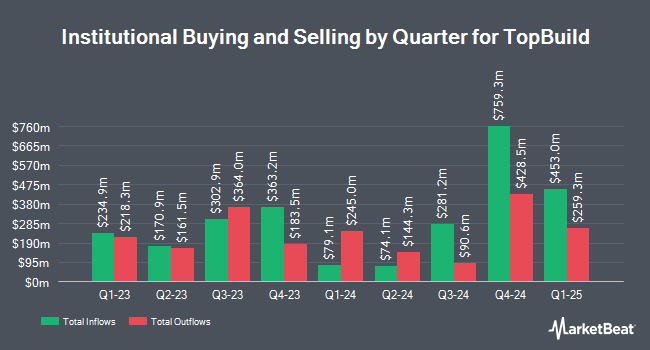

Other institutional investors and hedge funds also recently made changes to their positions in the company. Vanguard Group Inc. boosted its holdings in TopBuild by 0.5% during the first quarter. Vanguard Group Inc. now owns 2,990,027 shares of the construction company's stock valued at $1,317,795,000 after acquiring an additional 15,965 shares during the period. Liontrust Investment Partners LLP boosted its position in shares of TopBuild by 21.1% in the second quarter. Liontrust Investment Partners LLP now owns 332,050 shares of the construction company's stock valued at $127,929,000 after acquiring an additional 57,880 shares during the period. Bank of New York Mellon Corp grew its stake in shares of TopBuild by 0.8% in the second quarter. Bank of New York Mellon Corp now owns 261,965 shares of the construction company's stock worth $100,927,000 after acquiring an additional 2,133 shares during the last quarter. Lazard Asset Management LLC increased its position in TopBuild by 18.2% during the first quarter. Lazard Asset Management LLC now owns 168,423 shares of the construction company's stock worth $74,228,000 after acquiring an additional 25,973 shares during the period. Finally, DekaBank Deutsche Girozentrale raised its stake in TopBuild by 7.6% during the 2nd quarter. DekaBank Deutsche Girozentrale now owns 140,738 shares of the construction company's stock valued at $53,097,000 after purchasing an additional 10,000 shares during the last quarter. Institutional investors and hedge funds own 95.67% of the company's stock.

TopBuild Price Performance

TopBuild stock traded up $0.35 on Friday, reaching $353.73. The company's stock had a trading volume of 207,506 shares, compared to its average volume of 243,895. TopBuild Corp. has a twelve month low of $249.89 and a twelve month high of $495.68. The company has a market cap of $10.67 billion, a price-to-earnings ratio of 18.20, a PEG ratio of 2.21 and a beta of 1.79. The company has a debt-to-equity ratio of 0.57, a quick ratio of 1.82 and a current ratio of 2.34. The business's fifty day moving average price is $386.99 and its 200 day moving average price is $399.85.

TopBuild (NYSE:BLD - Get Free Report) last posted its quarterly earnings data on Tuesday, August 6th. The construction company reported $5.42 earnings per share for the quarter, missing the consensus estimate of $5.68 by ($0.26). TopBuild had a net margin of 11.74% and a return on equity of 25.72%. The company had revenue of $1.37 billion during the quarter, compared to analyst estimates of $1.40 billion. During the same quarter in the previous year, the business posted $5.25 EPS. The company's revenue was up 3.7% compared to the same quarter last year. Equities analysts expect that TopBuild Corp. will post 21.03 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

Several analysts have issued reports on BLD shares. DA Davidson decreased their price target on shares of TopBuild from $470.00 to $460.00 and set a "buy" rating on the stock in a research report on Friday, August 9th. Stephens lowered their price target on TopBuild from $435.00 to $400.00 and set an "equal weight" rating on the stock in a research note on Thursday, August 8th. Truist Financial reduced their price objective on TopBuild from $410.00 to $395.00 and set a "hold" rating for the company in a research report on Wednesday, August 7th. Jefferies Financial Group reduced their target price on TopBuild from $525.00 to $515.00 and set a "buy" rating for the company in a research report on Wednesday, October 9th. Finally, StockNews.com raised shares of TopBuild from a "hold" rating to a "buy" rating in a report on Tuesday, October 29th. Two research analysts have rated the stock with a hold rating and nine have given a buy rating to the stock. Based on data from MarketBeat, TopBuild presently has a consensus rating of "Moderate Buy" and an average price target of $446.89.

Check Out Our Latest Report on TopBuild

About TopBuild

(

Free Report)

TopBuild Corp., together with its subsidiaries, engages in the installation and distribution of insulation and other building material products to the construction industry. The company operates in two segments, Installation and Specialty Distribution. It provides insulation products and accessories, glass and windows, rain gutters, garage doors, fireplaces, roofing materials, closet shelving, and other products.

Recommended Stories

Before you consider TopBuild, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TopBuild wasn't on the list.

While TopBuild currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.