Bank of Nova Scotia (NYSE:BNS - Get Free Report) TSE: BNS was upgraded by equities research analysts at TD Securities from a "hold" rating to a "buy" rating in a note issued to investors on Monday, Marketbeat Ratings reports.

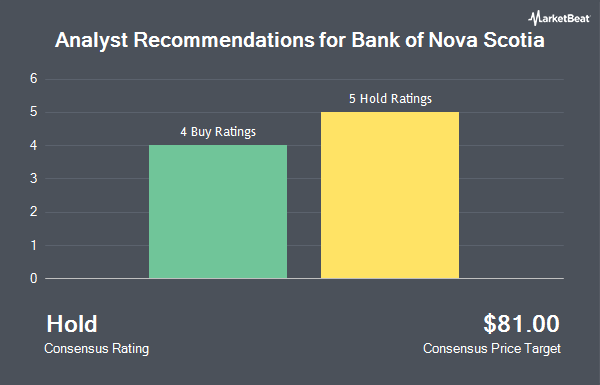

Separately, Cibc World Mkts upgraded Bank of Nova Scotia from a "hold" rating to a "strong-buy" rating in a report on Friday, September 20th. Two equities research analysts have rated the stock with a sell rating, three have assigned a hold rating, one has assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, Bank of Nova Scotia presently has a consensus rating of "Hold" and an average price target of $69.00.

Get Our Latest Stock Analysis on Bank of Nova Scotia

Bank of Nova Scotia Price Performance

NYSE BNS traded up $1.14 during trading hours on Monday, reaching $53.04. 1,625,574 shares of the stock traded hands, compared to its average volume of 1,817,159. The company has a debt-to-equity ratio of 0.61, a current ratio of 1.02 and a quick ratio of 1.02. The company has a market cap of $65.64 billion, a price-to-earnings ratio of 12.69, a price-to-earnings-growth ratio of 1.63 and a beta of 1.05. The stock has a 50 day simple moving average of $52.30 and a two-hundred day simple moving average of $48.66. Bank of Nova Scotia has a 1 year low of $41.80 and a 1 year high of $55.12.

Bank of Nova Scotia (NYSE:BNS - Get Free Report) TSE: BNS last announced its quarterly earnings data on Tuesday, August 27th. The bank reported $1.63 earnings per share for the quarter, beating analysts' consensus estimates of $1.62 by $0.01. Bank of Nova Scotia had a return on equity of 11.14% and a net margin of 9.84%. The company had revenue of $8.36 billion for the quarter, compared to analysts' expectations of $8.53 billion. During the same period last year, the firm posted $1.30 EPS. Bank of Nova Scotia's revenue for the quarter was up 3.7% compared to the same quarter last year. On average, analysts predict that Bank of Nova Scotia will post 4.8 EPS for the current fiscal year.

Institutional Investors Weigh In On Bank of Nova Scotia

Large investors have recently made changes to their positions in the business. Mather Group LLC. increased its position in shares of Bank of Nova Scotia by 1,388.9% during the second quarter. Mather Group LLC. now owns 536 shares of the bank's stock valued at $25,000 after buying an additional 500 shares during the period. Blue Trust Inc. grew its holdings in Bank of Nova Scotia by 3,127.8% in the second quarter. Blue Trust Inc. now owns 581 shares of the bank's stock worth $27,000 after purchasing an additional 563 shares during the period. Headlands Technologies LLC bought a new stake in shares of Bank of Nova Scotia in the 1st quarter worth approximately $53,000. City State Bank purchased a new stake in shares of Bank of Nova Scotia in the third quarter worth $57,000. Finally, EverSource Wealth Advisors LLC grew its position in Bank of Nova Scotia by 102.1% during the 1st quarter. EverSource Wealth Advisors LLC now owns 1,605 shares of the bank's stock valued at $83,000 after purchasing an additional 811 shares during the last quarter. 49.13% of the stock is currently owned by institutional investors.

About Bank of Nova Scotia

(

Get Free Report)

The Bank of Nova Scotia provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally. It operates through Canadian Banking, International Banking, Global Wealth Management, and Global Banking and Markets segments.

Featured Articles

Before you consider Bank of Nova Scotia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of Nova Scotia wasn't on the list.

While Bank of Nova Scotia currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.