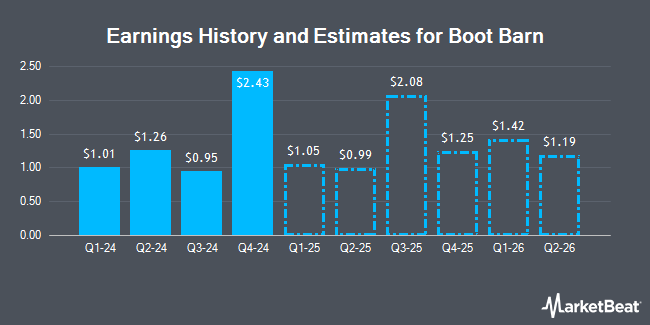

Boot Barn Holdings, Inc. (NYSE:BOOT - Free Report) - Analysts at William Blair boosted their Q4 2025 earnings per share (EPS) estimates for Boot Barn in a report issued on Tuesday, October 29th. William Blair analyst D. Carden now anticipates that the company will post earnings of $1.23 per share for the quarter, up from their previous forecast of $1.15. The consensus estimate for Boot Barn's current full-year earnings is $5.29 per share. William Blair also issued estimates for Boot Barn's Q1 2026 earnings at $1.48 EPS and Q4 2026 earnings at $1.45 EPS.

Several other equities research analysts have also commented on BOOT. Piper Sandler restated an "overweight" rating and issued a $179.00 price target on shares of Boot Barn in a research note on Tuesday. Robert W. Baird raised Boot Barn from a "neutral" rating to an "outperform" rating and set a $167.00 price objective for the company in a report on Wednesday. JPMorgan Chase & Co. boosted their price target on Boot Barn from $160.00 to $181.00 and gave the stock an "overweight" rating in a research report on Tuesday. Citigroup lowered their price target on Boot Barn from $194.00 to $178.00 and set a "buy" rating on the stock in a report on Tuesday. Finally, Williams Trading reiterated a "buy" rating and issued a $173.00 target price on shares of Boot Barn in a research report on Tuesday. One analyst has rated the stock with a sell rating, three have given a hold rating and nine have issued a buy rating to the company's stock. According to data from MarketBeat.com, Boot Barn currently has an average rating of "Moderate Buy" and a consensus target price of $164.55.

Read Our Latest Analysis on Boot Barn

Boot Barn Price Performance

Shares of BOOT stock traded down $2.26 during trading hours on Wednesday, reaching $127.12. The stock had a trading volume of 1,701,095 shares, compared to its average volume of 764,165. The firm has a market capitalization of $3.86 billion, a PE ratio of 26.48 and a beta of 2.12. The firm has a 50-day simple moving average of $154.30 and a 200-day simple moving average of $132.35. Boot Barn has a twelve month low of $66.73 and a twelve month high of $169.83.

Boot Barn (NYSE:BOOT - Get Free Report) last issued its quarterly earnings data on Monday, October 28th. The company reported $0.95 EPS for the quarter, topping analysts' consensus estimates of $0.93 by $0.02. The firm had revenue of $425.80 million during the quarter, compared to the consensus estimate of $424.42 million. Boot Barn had a return on equity of 16.44% and a net margin of 8.89%. The firm's revenue was up 13.7% on a year-over-year basis. During the same period in the prior year, the business earned $0.91 EPS.

Institutional Investors Weigh In On Boot Barn

Institutional investors and hedge funds have recently modified their holdings of the stock. GHP Investment Advisors Inc. acquired a new stake in Boot Barn during the 3rd quarter worth about $25,000. GAMMA Investing LLC lifted its position in shares of Boot Barn by 111.1% in the 2nd quarter. GAMMA Investing LLC now owns 266 shares of the company's stock valued at $34,000 after acquiring an additional 140 shares in the last quarter. Canada Pension Plan Investment Board acquired a new position in Boot Barn in the 2nd quarter worth approximately $64,000. USA Financial Formulas acquired a new position in Boot Barn in the 3rd quarter worth approximately $92,000. Finally, 1620 Investment Advisors Inc. purchased a new position in Boot Barn during the 2nd quarter worth approximately $84,000.

Boot Barn Company Profile

(

Get Free Report)

Boot Barn Holdings, Inc, a lifestyle retail chain, operates specialty retail stores in the United States. The company's specialty retail stores offer western and work-related footwear, apparel, and accessories for men, women, and kids. It offers boots, shirts, jackets, hats, belts and belt buckles, handbags, western-style jewelry, rugged footwear, outerwear, overalls, denim, and flame-resistant and high-visibility clothing.

See Also

Before you consider Boot Barn, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boot Barn wasn't on the list.

While Boot Barn currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.