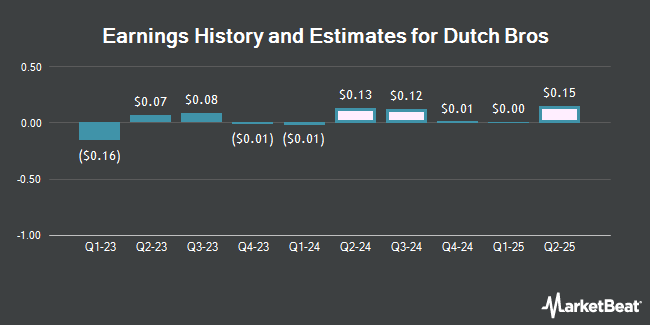

Dutch Bros Inc. (NYSE:BROS - Free Report) - Stock analysts at Wedbush lifted their Q3 2024 EPS estimates for Dutch Bros in a research note issued to investors on Monday, October 14th. Wedbush analyst N. Setyan now forecasts that the company will earn $0.12 per share for the quarter, up from their previous forecast of $0.11. Wedbush has a "Outperform" rating and a $45.00 price target on the stock. The consensus estimate for Dutch Bros' current full-year earnings is $0.32 per share. Wedbush also issued estimates for Dutch Bros' Q4 2024 earnings at $0.00 EPS.

Several other equities analysts have also recently issued reports on the company. UBS Group upgraded Dutch Bros from a "neutral" rating to a "buy" rating and set a $39.00 price objective on the stock in a research note on Thursday, August 15th. TD Cowen restated a "buy" rating and issued a $47.00 price target on shares of Dutch Bros in a research report on Thursday, September 12th. Stifel Nicolaus lowered their price objective on shares of Dutch Bros from $40.00 to $38.00 and set a "buy" rating for the company in a research report on Thursday, August 8th. Barclays cut their target price on shares of Dutch Bros from $35.00 to $31.00 and set an "equal weight" rating on the stock in a report on Friday, August 9th. Finally, Piper Sandler lowered Dutch Bros from an "overweight" rating to a "neutral" rating and lowered their target price for the company from $41.00 to $36.00 in a report on Monday, August 19th. Three analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $40.20.

Check Out Our Latest Research Report on BROS

Dutch Bros Stock Performance

NYSE:BROS traded up $0.67 during trading hours on Wednesday, reaching $34.87. 2,339,960 shares of the stock were exchanged, compared to its average volume of 2,741,705. The stock has a market capitalization of $6.18 billion, a P/E ratio of 193.72, a P/E/G ratio of 2.55 and a beta of 2.49. The firm has a 50 day simple moving average of $32.24 and a 200-day simple moving average of $34.65. The company has a quick ratio of 1.88, a current ratio of 2.19 and a debt-to-equity ratio of 0.82. Dutch Bros has a 52 week low of $23.31 and a 52 week high of $43.49.

Dutch Bros (NYSE:BROS - Get Free Report) last issued its quarterly earnings results on Wednesday, August 7th. The company reported $0.19 EPS for the quarter, topping the consensus estimate of $0.13 by $0.06. The business had revenue of $324.92 million for the quarter, compared to analysts' expectations of $317.39 million. Dutch Bros had a net margin of 1.95% and a return on equity of 3.99%. The company's quarterly revenue was up 30.0% compared to the same quarter last year. During the same quarter last year, the company posted $0.07 earnings per share.

Insider Transactions at Dutch Bros

In other news, Chairman Travis Boersma sold 426,891 shares of the stock in a transaction on Monday, August 19th. The stock was sold at an average price of $31.59, for a total value of $13,485,486.69. Following the completion of the transaction, the chairman now owns 467,228 shares of the company's stock, valued at approximately $14,759,732.52. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this link. In related news, major shareholder Dm Individual Aggregator, Llc sold 28,710 shares of the business's stock in a transaction that occurred on Tuesday, August 27th. The stock was sold at an average price of $32.02, for a total transaction of $919,294.20. Following the sale, the insider now owns 432,518 shares of the company's stock, valued at $13,849,226.36. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, Chairman Travis Boersma sold 426,891 shares of the company's stock in a transaction that occurred on Monday, August 19th. The stock was sold at an average price of $31.59, for a total value of $13,485,486.69. Following the completion of the sale, the chairman now owns 467,228 shares of the company's stock, valued at $14,759,732.52. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 1,128,885 shares of company stock worth $36,124,009. Company insiders own 46.50% of the company's stock.

Hedge Funds Weigh In On Dutch Bros

Hedge funds have recently modified their holdings of the company. Arcadia Investment Management Corp MI acquired a new position in shares of Dutch Bros in the 2nd quarter worth approximately $27,000. Quest Partners LLC boosted its holdings in Dutch Bros by 3,321.7% during the second quarter. Quest Partners LLC now owns 787 shares of the company's stock worth $33,000 after buying an additional 764 shares in the last quarter. Transcendent Capital Group LLC acquired a new position in Dutch Bros in the first quarter worth approximately $26,000. Jamison Private Wealth Management Inc. increased its holdings in shares of Dutch Bros by 150.2% in the third quarter. Jamison Private Wealth Management Inc. now owns 833 shares of the company's stock valued at $27,000 after buying an additional 500 shares in the last quarter. Finally, Abound Wealth Management acquired a new stake in shares of Dutch Bros during the 2nd quarter valued at $39,000. 85.54% of the stock is currently owned by institutional investors and hedge funds.

Dutch Bros Company Profile

(

Get Free Report)

Dutch Bros Inc, together with its subsidiaries, operates and franchises drive-thru shops in the United States. The company operates through Company-Operated Shops and Franchising and Other segments. It serves through company-operated shops and online channels under Dutch Bros; Dutch Bros Coffee; Dutch Bros Rebel; Dutch Bros; and Blue Rebel brands.

Further Reading

Before you consider Dutch Bros, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dutch Bros wasn't on the list.

While Dutch Bros currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.