Brixmor Property Group (NYSE:BRX - Get Free Report) updated its FY 2024 earnings guidance on Monday. The company provided earnings per share (EPS) guidance of 2.130-2.150 for the period, compared to the consensus estimate of 2.130. The company issued revenue guidance of -. Brixmor Property Group also updated its FY24 guidance to $2.13-$2.15 EPS.

Analyst Ratings Changes

BRX has been the topic of a number of research analyst reports. KeyCorp raised their price objective on shares of Brixmor Property Group from $26.00 to $28.00 and gave the stock an "overweight" rating in a report on Wednesday, August 7th. Piper Sandler restated an "overweight" rating and issued a $33.00 price target (up from $30.00) on shares of Brixmor Property Group in a report on Wednesday, July 31st. Evercore ISI lifted their target price on Brixmor Property Group from $27.00 to $28.00 and gave the company an "in-line" rating in a research report on Monday, September 16th. Compass Point upped their price target on Brixmor Property Group from $28.00 to $30.00 and gave the stock a "buy" rating in a research report on Tuesday, September 10th. Finally, Scotiabank raised their price target on shares of Brixmor Property Group from $25.00 to $29.00 and gave the stock a "sector outperform" rating in a research note on Monday, August 26th. Five equities research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $28.38.

Get Our Latest Analysis on Brixmor Property Group

Brixmor Property Group Stock Performance

Brixmor Property Group stock traded up $0.27 during trading hours on Monday, hitting $27.74. The company had a trading volume of 1,902,448 shares, compared to its average volume of 2,281,130. The firm has a 50-day moving average of $27.49 and a 200 day moving average of $24.59. The company has a debt-to-equity ratio of 1.88, a current ratio of 1.50 and a quick ratio of 1.50. The firm has a market cap of $8.36 billion, a PE ratio of 29.82, a PEG ratio of 4.43 and a beta of 1.57. Brixmor Property Group has a one year low of $19.88 and a one year high of $28.45.

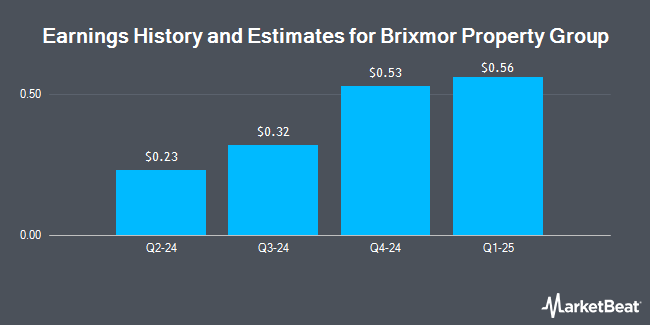

Brixmor Property Group (NYSE:BRX - Get Free Report) last issued its quarterly earnings data on Monday, July 29th. The real estate investment trust reported $0.23 EPS for the quarter, missing analysts' consensus estimates of $0.52 by ($0.29). Brixmor Property Group had a net margin of 23.45% and a return on equity of 10.34%. The firm had revenue of $315.69 million during the quarter, compared to analyst estimates of $317.75 million. During the same period in the prior year, the company earned $0.52 earnings per share. The business's quarterly revenue was up 1.9% compared to the same quarter last year. On average, sell-side analysts expect that Brixmor Property Group will post 2.13 earnings per share for the current year.

Insider Activity at Brixmor Property Group

In other news, Director Sheryl Maxwell Crosland sold 5,000 shares of the company's stock in a transaction on Wednesday, August 14th. The stock was sold at an average price of $25.45, for a total transaction of $127,250.00. Following the completion of the sale, the director now directly owns 46,291 shares in the company, valued at approximately $1,178,105.95. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. 0.76% of the stock is currently owned by corporate insiders.

Brixmor Property Group Company Profile

(

Get Free Report)

Brixmor NYSE: BRX is a real estate investment trust (REIT) that owns and operates a high-quality, national portfolio of open-air shopping centers. Its 362 retail centers comprise approximately 64 million square feet of prime retail space in established trade areas. The Company strives to own and operate shopping centers that reflect Brixmor's vision to be the center of the communities we serve and are home to a diverse mix of thriving national, regional and local retailers.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Brixmor Property Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brixmor Property Group wasn't on the list.

While Brixmor Property Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.