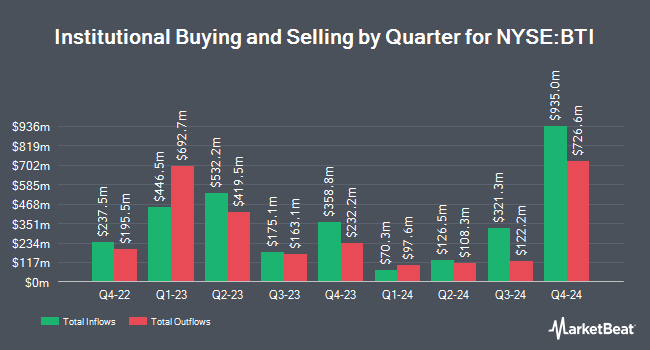

Pathway Financial Advisers LLC lifted its stake in British American Tobacco p.l.c. (NYSE:BTI - Free Report) by 3,609.1% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 57,194 shares of the company's stock after purchasing an additional 55,652 shares during the quarter. Pathway Financial Advisers LLC's holdings in British American Tobacco were worth $2,092,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other hedge funds have also made changes to their positions in the company. Bank of Montreal Can lifted its position in shares of British American Tobacco by 26.2% in the second quarter. Bank of Montreal Can now owns 113,811 shares of the company's stock worth $3,658,000 after purchasing an additional 23,626 shares in the last quarter. Atria Investments Inc raised its position in British American Tobacco by 19.5% during the first quarter. Atria Investments Inc now owns 74,416 shares of the company's stock valued at $2,270,000 after acquiring an additional 12,150 shares in the last quarter. Russell Investments Group Ltd. raised its position in British American Tobacco by 131.8% during the first quarter. Russell Investments Group Ltd. now owns 2,796 shares of the company's stock valued at $85,000 after acquiring an additional 1,590 shares in the last quarter. Auxier Asset Management raised its position in British American Tobacco by 16.0% during the second quarter. Auxier Asset Management now owns 186,796 shares of the company's stock valued at $5,778,000 after acquiring an additional 25,800 shares in the last quarter. Finally, ORG Partners LLC bought a new position in British American Tobacco during the first quarter valued at approximately $732,000. 21.44% of the stock is owned by hedge funds and other institutional investors.

British American Tobacco Stock Performance

BTI stock traded down $0.11 during midday trading on Wednesday, hitting $34.35. 7,554,234 shares of the company traded hands, compared to its average volume of 4,816,516. British American Tobacco p.l.c. has a twelve month low of $28.25 and a twelve month high of $39.54. The company has a quick ratio of 0.58, a current ratio of 0.88 and a debt-to-equity ratio of 0.60. The business has a 50 day simple moving average of $36.65 and a 200-day simple moving average of $33.62. The stock has a market capitalization of $76.29 billion, a price-to-earnings ratio of 7.11 and a beta of 0.52.

Analyst Upgrades and Downgrades

Several equities analysts recently weighed in on the stock. Barclays raised shares of British American Tobacco to a "strong-buy" rating in a research report on Thursday, October 17th. StockNews.com lowered shares of British American Tobacco from a "strong-buy" rating to a "buy" rating in a research report on Sunday, August 11th. Finally, Morgan Stanley lowered shares of British American Tobacco from an "overweight" rating to an "underweight" rating and set a $33.00 price objective on the stock. in a research report on Thursday, October 3rd.

Check Out Our Latest Research Report on British American Tobacco

About British American Tobacco

(

Free Report)

British American Tobacco p.l.c. engages in the provision of tobacco and nicotine products to consumers worldwide. It also offers vapour, heated, and modern oral nicotine products; combustible cigarettes; and traditional oral products, such as snus and moist snuff. The company offers its products under the Vuse, glo, Velo, Grizzly, Kodiak, Dunhill, Kent, Lucky Strike, Pall Mall, Rothmans, Camel, Natural American Spirit, Newport, Vogue, Viceroy, Kool, Peter Stuyvesant, Craven A, State Express 555 and Shuang Xi brands.

See Also

Before you consider British American Tobacco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and British American Tobacco wasn't on the list.

While British American Tobacco currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.