BorgWarner (NYSE:BWA - Get Free Report) had its target price lifted by research analysts at Deutsche Bank Aktiengesellschaft from $38.00 to $39.00 in a note issued to investors on Monday, Benzinga reports. The firm currently has a "hold" rating on the auto parts company's stock. Deutsche Bank Aktiengesellschaft's target price indicates a potential upside of 16.59% from the company's current price.

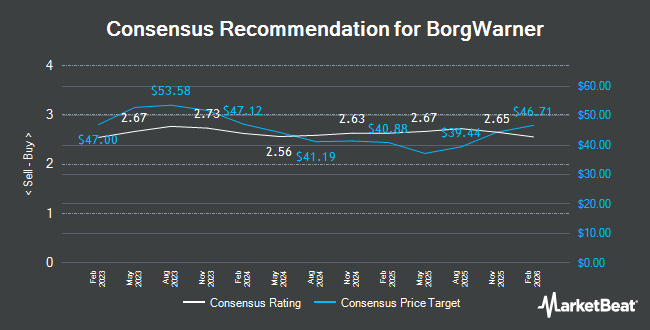

A number of other analysts have also commented on the stock. Wolfe Research assumed coverage on shares of BorgWarner in a research note on Thursday, September 5th. They set a "peer perform" rating for the company. Robert W. Baird upped their target price on shares of BorgWarner from $38.00 to $39.00 and gave the stock a "neutral" rating in a research note on Thursday, August 1st. Barclays upped their target price on shares of BorgWarner from $45.00 to $47.00 and gave the stock an "overweight" rating in a research note on Thursday, August 1st. UBS Group upped their target price on shares of BorgWarner from $41.00 to $42.00 and gave the stock a "buy" rating in a research note on Wednesday, July 10th. Finally, Wells Fargo & Company reduced their target price on shares of BorgWarner from $44.00 to $42.00 and set an "overweight" rating for the company in a research note on Thursday, August 1st. Six research analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $41.44.

Get Our Latest Stock Report on BWA

BorgWarner Stock Up 0.0 %

Shares of BorgWarner stock traded up $0.01 during trading on Monday, reaching $33.45. 2,652,971 shares of the company traded hands, compared to its average volume of 2,713,488. The company has a debt-to-equity ratio of 0.66, a current ratio of 1.84 and a quick ratio of 1.26. BorgWarner has a 1-year low of $29.51 and a 1-year high of $38.22. The company has a 50 day moving average price of $34.06 and a 200-day moving average price of $33.89. The firm has a market capitalization of $7.62 billion, a PE ratio of 8.60, a P/E/G ratio of 0.73 and a beta of 1.20.

BorgWarner (NYSE:BWA - Get Free Report) last announced its quarterly earnings results on Thursday, October 31st. The auto parts company reported $1.09 EPS for the quarter, beating analysts' consensus estimates of $0.92 by $0.17. The business had revenue of $3.45 billion during the quarter, compared to analyst estimates of $3.50 billion. BorgWarner had a net margin of 6.33% and a return on equity of 15.51%. BorgWarner's quarterly revenue was down 4.8% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.98 EPS. As a group, equities research analysts expect that BorgWarner will post 4.09 earnings per share for the current fiscal year.

Insider Buying and Selling

In other BorgWarner news, EVP Tania Wingfield sold 2,066 shares of the stock in a transaction that occurred on Tuesday, August 13th. The shares were sold at an average price of $32.00, for a total transaction of $66,112.00. Following the transaction, the executive vice president now directly owns 46,016 shares in the company, valued at $1,472,512. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. 0.45% of the stock is owned by company insiders.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently bought and sold shares of the business. Matrix Trust Co bought a new position in shares of BorgWarner in the third quarter worth approximately $25,000. LRI Investments LLC bought a new position in shares of BorgWarner in the first quarter worth approximately $35,000. Sentry Investment Management LLC bought a new position in shares of BorgWarner in the second quarter worth approximately $32,000. Olistico Wealth LLC bought a new position in shares of BorgWarner in the second quarter worth approximately $35,000. Finally, Whittier Trust Co. of Nevada Inc. grew its holdings in shares of BorgWarner by 12,144.4% in the first quarter. Whittier Trust Co. of Nevada Inc. now owns 1,102 shares of the auto parts company's stock worth $38,000 after purchasing an additional 1,093 shares during the last quarter. 95.67% of the stock is currently owned by institutional investors.

BorgWarner Company Profile

(

Get Free Report)

BorgWarner Inc, together with its subsidiaries, provides solutions for combustion, hybrid, and electric vehicles worldwide. It offers turbochargers, eBoosters, eTurbos, timing systems, emissions systems, thermal systems, gasoline ignition technology, smart remote actuators, powertrain sensors, cabin heaters, battery modules and systems, battery heaters, and battery charging.

Featured Articles

Before you consider BorgWarner, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BorgWarner wasn't on the list.

While BorgWarner currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.