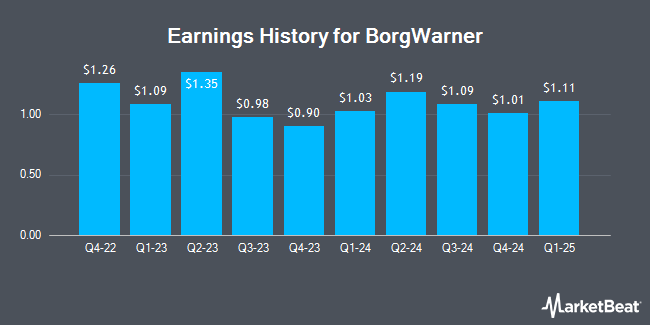

BorgWarner (NYSE:BWA - Get Free Report) announced its quarterly earnings data on Thursday. The auto parts company reported $1.09 earnings per share for the quarter, topping analysts' consensus estimates of $0.92 by $0.17, Briefing.com reports. BorgWarner had a net margin of 4.97% and a return on equity of 15.50%. The business had revenue of $3.45 billion for the quarter, compared to analysts' expectations of $3.50 billion. During the same quarter in the prior year, the company earned $0.98 earnings per share. The business's revenue was down 4.8% compared to the same quarter last year. BorgWarner updated its FY 2024 guidance to 4.150-4.300 EPS and its FY24 guidance to $4.15-$4.30 EPS.

BorgWarner Stock Performance

Shares of BorgWarner stock traded down $0.19 during trading hours on Friday, reaching $33.44. 2,671,043 shares of the stock traded hands, compared to its average volume of 2,713,774. The company has a 50 day moving average price of $34.06 and a 200 day moving average price of $33.86. BorgWarner has a one year low of $29.51 and a one year high of $38.22. The company has a quick ratio of 1.26, a current ratio of 1.62 and a debt-to-equity ratio of 0.52. The firm has a market capitalization of $7.62 billion, a price-to-earnings ratio of 10.75, a P/E/G ratio of 0.73 and a beta of 1.20.

Insider Buying and Selling

In other news, EVP Tania Wingfield sold 2,066 shares of the business's stock in a transaction on Tuesday, August 13th. The shares were sold at an average price of $32.00, for a total transaction of $66,112.00. Following the completion of the sale, the executive vice president now owns 46,016 shares of the company's stock, valued at $1,472,512. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. In other news, EVP Tania Wingfield sold 2,066 shares of the business's stock in a transaction dated Tuesday, August 13th. The stock was sold at an average price of $32.00, for a total value of $66,112.00. Following the transaction, the executive vice president now directly owns 46,016 shares in the company, valued at $1,472,512. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CAO Tonit M. Calaway sold 10,868 shares of the stock in a transaction dated Monday, August 5th. The stock was sold at an average price of $31.74, for a total value of $344,950.32. Following the sale, the chief accounting officer now owns 206,083 shares of the company's stock, valued at $6,541,074.42. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 0.45% of the stock is currently owned by insiders.

Analyst Ratings Changes

BWA has been the subject of a number of analyst reports. Barclays raised their price objective on BorgWarner from $45.00 to $47.00 and gave the company an "overweight" rating in a research report on Thursday, August 1st. Robert W. Baird lifted their price target on BorgWarner from $38.00 to $39.00 and gave the stock a "neutral" rating in a research report on Thursday, August 1st. Wells Fargo & Company dropped their price target on shares of BorgWarner from $44.00 to $42.00 and set an "overweight" rating on the stock in a research note on Thursday, August 1st. The Goldman Sachs Group reduced their price objective on shares of BorgWarner from $38.00 to $36.00 and set a "neutral" rating for the company in a research note on Tuesday, October 1st. Finally, Evercore ISI upgraded shares of BorgWarner from an "in-line" rating to an "outperform" rating and upped their target price for the stock from $39.00 to $43.00 in a research note on Monday, October 14th. Six equities research analysts have rated the stock with a hold rating and twelve have given a buy rating to the stock. Based on data from MarketBeat.com, BorgWarner presently has an average rating of "Moderate Buy" and a consensus target price of $41.25.

Get Our Latest Stock Report on BorgWarner

BorgWarner Company Profile

(

Get Free Report)

BorgWarner Inc, together with its subsidiaries, provides solutions for combustion, hybrid, and electric vehicles worldwide. It offers turbochargers, eBoosters, eTurbos, timing systems, emissions systems, thermal systems, gasoline ignition technology, smart remote actuators, powertrain sensors, cabin heaters, battery modules and systems, battery heaters, and battery charging.

See Also

Before you consider BorgWarner, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BorgWarner wasn't on the list.

While BorgWarner currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.