CACI International (NYSE:CACI - Free Report) had its price objective increased by TD Cowen from $545.00 to $570.00 in a report released on Friday morning, Benzinga reports. They currently have a buy rating on the information technology services provider's stock.

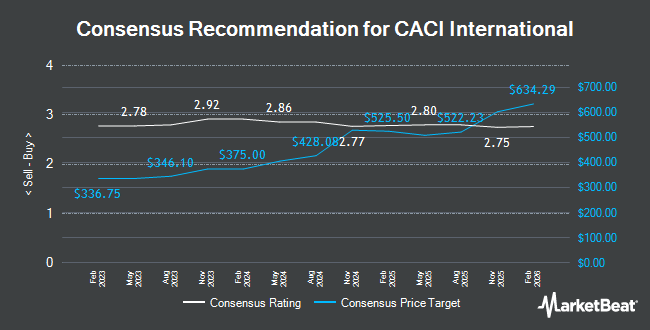

Several other equities research analysts have also recently weighed in on the stock. Bank of America upped their price objective on shares of CACI International from $535.00 to $555.00 and gave the stock a "buy" rating in a research report on Tuesday, September 17th. Raymond James lowered shares of CACI International from an "outperform" rating to a "market perform" rating in a research report on Monday, August 5th. The Goldman Sachs Group boosted their price objective on shares of CACI International from $471.00 to $520.00 and gave the company a "neutral" rating in a research report on Friday. JPMorgan Chase & Co. upped their target price on CACI International from $520.00 to $555.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 2nd. Finally, Truist Financial reiterated a "buy" rating and issued a $650.00 price target (up previously from $520.00) on shares of CACI International in a research note on Friday. Three investment analysts have rated the stock with a hold rating and nine have issued a buy rating to the company's stock. According to MarketBeat.com, CACI International currently has a consensus rating of "Moderate Buy" and a consensus price target of $534.70.

View Our Latest Stock Analysis on CACI

CACI International Stock Performance

Shares of NYSE:CACI traded down $5.19 on Friday, reaching $547.36. 210,023 shares of the company's stock were exchanged, compared to its average volume of 112,582. The company has a current ratio of 1.27, a quick ratio of 1.27 and a debt-to-equity ratio of 0.42. CACI International has a twelve month low of $302.21 and a twelve month high of $570.28. The company has a fifty day moving average of $495.16 and a 200-day moving average of $449.05. The company has a market capitalization of $12.20 billion, a price-to-earnings ratio of 31.62, a PEG ratio of 2.22 and a beta of 0.93.

CACI International (NYSE:CACI - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The information technology services provider reported $5.93 EPS for the quarter, topping analysts' consensus estimates of $5.08 by $0.85. The firm had revenue of $2.06 billion for the quarter, compared to analyst estimates of $1.92 billion. CACI International had a return on equity of 14.31% and a net margin of 5.48%. The company's revenue was up 11.2% on a year-over-year basis. During the same quarter last year, the company earned $4.36 EPS. On average, research analysts predict that CACI International will post 23 EPS for the current fiscal year.

Insider Buying and Selling

In other CACI International news, Director Gregory G. Johnson sold 300 shares of the stock in a transaction dated Thursday, August 22nd. The stock was sold at an average price of $471.00, for a total value of $141,300.00. Following the completion of the transaction, the director now directly owns 5,910 shares in the company, valued at approximately $2,783,610. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. In related news, insider Gregory R. Bradford sold 10,000 shares of the stock in a transaction on Monday, September 16th. The stock was sold at an average price of $492.41, for a total value of $4,924,100.00. Following the completion of the sale, the insider now directly owns 35,538 shares in the company, valued at $17,499,266.58. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Gregory G. Johnson sold 300 shares of the firm's stock in a transaction on Thursday, August 22nd. The stock was sold at an average price of $471.00, for a total value of $141,300.00. Following the transaction, the director now directly owns 5,910 shares of the company's stock, valued at approximately $2,783,610. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 21,270 shares of company stock worth $10,165,972 in the last 90 days. Insiders own 1.23% of the company's stock.

Institutional Trading of CACI International

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the company. Lord Abbett & CO. LLC bought a new stake in shares of CACI International in the 1st quarter valued at $18,271,000. Van ECK Associates Corp boosted its position in CACI International by 293.2% during the first quarter. Van ECK Associates Corp now owns 47,995 shares of the information technology services provider's stock valued at $18,182,000 after acquiring an additional 35,788 shares during the last quarter. BNP Paribas Financial Markets grew its holdings in CACI International by 147.5% during the 1st quarter. BNP Paribas Financial Markets now owns 34,958 shares of the information technology services provider's stock worth $13,243,000 after acquiring an additional 20,835 shares during the period. M&R Capital Management Inc. raised its position in shares of CACI International by 487.2% in the 2nd quarter. M&R Capital Management Inc. now owns 16,930 shares of the information technology services provider's stock worth $7,282,000 after acquiring an additional 14,047 shares in the last quarter. Finally, Kayne Anderson Rudnick Investment Management LLC lifted its stake in shares of CACI International by 26.7% in the 2nd quarter. Kayne Anderson Rudnick Investment Management LLC now owns 48,923 shares of the information technology services provider's stock valued at $21,043,000 after purchasing an additional 10,295 shares during the period. Institutional investors and hedge funds own 86.43% of the company's stock.

CACI International Company Profile

(

Get Free Report)

CACI International Inc, through its subsidiaries, engages in the provision of expertise and technology to enterprise and mission customers in support of national security in the intelligence, defense, and federal civilian sectors. The company operates through two segments, Domestic Operations and International Operations.

See Also

Before you consider CACI International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CACI International wasn't on the list.

While CACI International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.