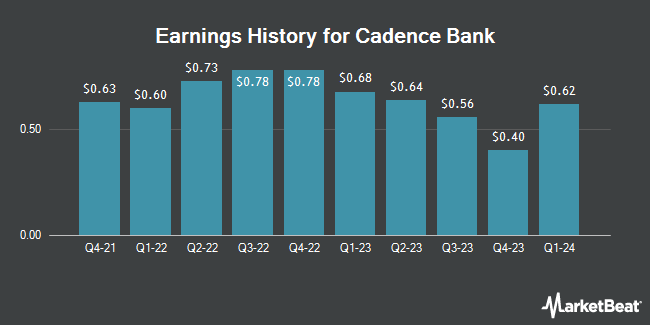

Cadence Bank (NYSE:CADE - Get Free Report) released its quarterly earnings data on Monday. The company reported $0.73 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.64 by $0.09, Yahoo Finance reports. Cadence Bank had a net margin of 24.42% and a return on equity of 8.82%. The firm had revenue of $447.36 million for the quarter, compared to the consensus estimate of $450.97 million. During the same period last year, the firm earned $0.56 earnings per share. The company's quarterly revenue was up 11.0% on a year-over-year basis.

Cadence Bank Stock Performance

Shares of Cadence Bank stock traded up $1.54 during trading on Tuesday, hitting $34.00. 3,179,209 shares of the company's stock were exchanged, compared to its average volume of 1,328,429. The company has a debt-to-equity ratio of 0.05, a quick ratio of 0.86 and a current ratio of 0.86. The business has a 50-day simple moving average of $31.53 and a 200-day simple moving average of $29.84. Cadence Bank has a 52-week low of $19.67 and a 52-week high of $34.18. The stock has a market capitalization of $6.20 billion, a price-to-earnings ratio of 10.48 and a beta of 0.96.

Cadence Bank Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Tuesday, October 1st. Investors of record on Friday, September 13th were issued a dividend of $0.25 per share. The ex-dividend date was Friday, September 13th. This represents a $1.00 annualized dividend and a dividend yield of 2.94%. Cadence Bank's dividend payout ratio (DPR) is presently 31.95%.

Analysts Set New Price Targets

A number of research firms have recently issued reports on CADE. Royal Bank of Canada increased their price objective on shares of Cadence Bank from $31.00 to $35.00 and gave the company a "sector perform" rating in a research note on Wednesday, July 24th. Morgan Stanley upgraded shares of Cadence Bank from an "equal weight" rating to an "overweight" rating and increased their price objective for the company from $36.00 to $39.00 in a research note on Monday, September 30th. Truist Financial lowered their target price on shares of Cadence Bank from $38.00 to $37.00 and set a "buy" rating for the company in a research note on Friday, September 20th. Hovde Group raised their target price on shares of Cadence Bank from $33.00 to $36.50 and gave the company an "outperform" rating in a research note on Wednesday, July 24th. Finally, DA Davidson raised their target price on shares of Cadence Bank from $34.50 to $39.00 and gave the company a "buy" rating in a research note on Wednesday, July 24th. Five analysts have rated the stock with a hold rating, six have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $34.88.

Get Our Latest Stock Report on CADE

About Cadence Bank

(

Get Free Report)

Cadence Bank provides commercial banking and financial services. Its products and services include consumer banking, consumer loans, mortgages, home equity lines and loans, credit cards, commercial and business banking, treasury management, specialized and asset-based lending, commercial real estate, equipment financing, and correspondent banking services.

Featured Articles

Before you consider Cadence Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cadence Bank wasn't on the list.

While Cadence Bank currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.