PineStone Asset Management Inc. decreased its holdings in Carrier Global Co. (NYSE:CARR - Free Report) by 36.0% during the 3rd quarter, according to its most recent disclosure with the SEC. The firm owned 4,107,096 shares of the company's stock after selling 2,311,787 shares during the period. Carrier Global makes up about 3.2% of PineStone Asset Management Inc.'s investment portfolio, making the stock its 12th largest position. PineStone Asset Management Inc. owned 0.46% of Carrier Global worth $330,580,000 as of its most recent SEC filing.

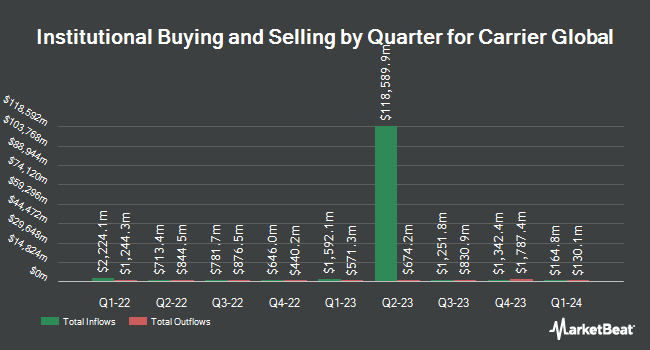

A number of other hedge funds and other institutional investors have also recently bought and sold shares of CARR. JPMorgan Chase & Co. grew its stake in shares of Carrier Global by 280.1% in the first quarter. JPMorgan Chase & Co. now owns 23,098,687 shares of the company's stock valued at $1,342,727,000 after buying an additional 17,021,768 shares in the last quarter. Capital International Investors grew its position in Carrier Global by 4.6% in the first quarter. Capital International Investors now owns 84,827,130 shares of the company's stock valued at $4,931,001,000 after acquiring an additional 3,763,666 shares in the last quarter. Point72 Asset Management L.P. purchased a new stake in shares of Carrier Global during the second quarter valued at approximately $58,415,000. International Assets Investment Management LLC lifted its position in shares of Carrier Global by 8,797.3% during the third quarter. International Assets Investment Management LLC now owns 907,258 shares of the company's stock worth $730,250,000 after purchasing an additional 897,061 shares in the last quarter. Finally, Vanguard Group Inc. boosted its stake in shares of Carrier Global by 0.5% in the first quarter. Vanguard Group Inc. now owns 94,289,980 shares of the company's stock valued at $5,481,077,000 after purchasing an additional 466,829 shares during the period. 91.00% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

CARR has been the topic of a number of recent analyst reports. Barclays cut their price objective on shares of Carrier Global from $90.00 to $89.00 and set an "overweight" rating on the stock in a report on Friday, October 25th. JPMorgan Chase & Co. began coverage on Carrier Global in a report on Thursday, October 10th. They issued a "neutral" rating and a $83.00 price target for the company. Robert W. Baird dropped their price objective on Carrier Global from $88.00 to $86.00 and set an "outperform" rating on the stock in a report on Friday, October 25th. Morgan Stanley assumed coverage on Carrier Global in a research note on Friday, September 6th. They set an "equal weight" rating and a $75.00 target price for the company. Finally, Oppenheimer raised their price target on shares of Carrier Global from $74.00 to $88.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 2nd. Seven investment analysts have rated the stock with a hold rating, six have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, Carrier Global currently has an average rating of "Moderate Buy" and a consensus target price of $81.33.

Get Our Latest Research Report on CARR

Insider Transactions at Carrier Global

In other news, VP Ajay Agrawal sold 62,382 shares of the company's stock in a transaction dated Thursday, August 8th. The shares were sold at an average price of $64.55, for a total transaction of $4,026,758.10. Following the completion of the transaction, the vice president now owns 103,066 shares in the company, valued at approximately $6,652,910.30. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 6.95% of the company's stock.

Carrier Global Stock Performance

Shares of NYSE CARR traded down $0.13 during midday trading on Friday, hitting $72.59. The company's stock had a trading volume of 3,521,046 shares, compared to its average volume of 4,152,387. The company has a debt-to-equity ratio of 0.69, a quick ratio of 0.82 and a current ratio of 1.08. Carrier Global Co. has a 1-year low of $49.62 and a 1-year high of $83.32. The firm's fifty day moving average price is $76.86 and its 200-day moving average price is $68.35. The firm has a market cap of $65.13 billion, a P/E ratio of 18.39, a P/E/G ratio of 2.64 and a beta of 1.32.

Carrier Global Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, November 18th. Stockholders of record on Friday, October 25th will be issued a dividend of $0.19 per share. This represents a $0.76 annualized dividend and a dividend yield of 1.05%. The ex-dividend date of this dividend is Friday, October 25th. Carrier Global's dividend payout ratio (DPR) is presently 19.24%.

Carrier Global announced that its board has approved a share repurchase program on Thursday, October 24th that authorizes the company to buyback $3.00 billion in outstanding shares. This buyback authorization authorizes the company to repurchase up to 4.6% of its stock through open market purchases. Stock buyback programs are often a sign that the company's management believes its shares are undervalued.

Carrier Global Company Profile

(

Free Report)

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies in the United States, Europe, the Asia Pacific, and internationally. It operates through three segments: HVAC, Refrigeration, and Fire & Security.

Further Reading

Before you consider Carrier Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carrier Global wasn't on the list.

While Carrier Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.