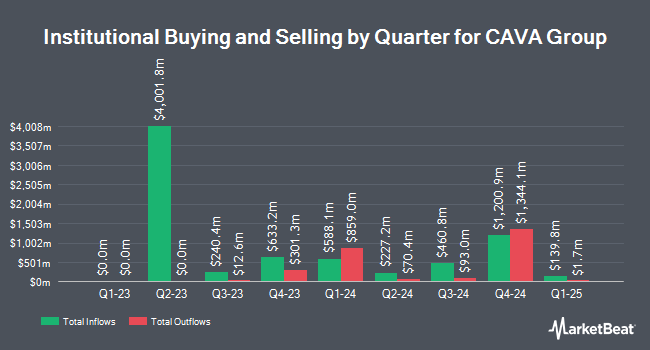

Sanctuary Advisors LLC bought a new stake in CAVA Group, Inc. (NYSE:CAVA - Free Report) in the 2nd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm bought 16,591 shares of the company's stock, valued at approximately $1,539,000.

Several other hedge funds and other institutional investors also recently made changes to their positions in the company. Private Advisor Group LLC grew its stake in shares of CAVA Group by 69.1% during the first quarter. Private Advisor Group LLC now owns 33,619 shares of the company's stock worth $2,355,000 after purchasing an additional 13,739 shares during the period. Xponance Inc. lifted its holdings in CAVA Group by 95.2% during the second quarter. Xponance Inc. now owns 9,846 shares of the company's stock worth $913,000 after acquiring an additional 4,803 shares in the last quarter. CHURCHILL MANAGEMENT Corp bought a new position in CAVA Group during the first quarter worth about $3,213,000. Intech Investment Management LLC bought a new position in CAVA Group during the second quarter worth about $1,728,000. Finally, Cetera Investment Advisers bought a new position in CAVA Group during the first quarter worth about $2,455,000. 73.15% of the stock is owned by institutional investors and hedge funds.

Insiders Place Their Bets

In other CAVA Group news, CFO Tricia K. Tolivar sold 5,000 shares of the business's stock in a transaction that occurred on Monday, August 26th. The stock was sold at an average price of $125.64, for a total transaction of $628,200.00. Following the transaction, the chief financial officer now owns 292,600 shares of the company's stock, valued at $36,762,264. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. In other news, Director Theodoros Xenohristos sold 98,490 shares of the company's stock in a transaction that occurred on Monday, August 26th. The stock was sold at an average price of $125.77, for a total value of $12,387,087.30. Following the transaction, the director now owns 424,846 shares of the company's stock, valued at approximately $53,432,881.42. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CFO Tricia K. Tolivar sold 5,000 shares of the company's stock in a transaction that occurred on Monday, August 26th. The shares were sold at an average price of $125.64, for a total value of $628,200.00. Following the completion of the transaction, the chief financial officer now directly owns 292,600 shares in the company, valued at $36,762,264. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 304,994 shares of company stock valued at $38,310,084 over the last 90 days.

CAVA Group Stock Performance

CAVA traded down $1.62 on Thursday, hitting $130.24. 1,235,035 shares of the company were exchanged, compared to its average volume of 2,783,308. CAVA Group, Inc. has a 12 month low of $29.66 and a 12 month high of $133.95. The company has a market cap of $14.85 billion, a PE ratio of 317.66 and a beta of 3.33. The stock's fifty day moving average is $113.38 and its 200-day moving average is $91.09.

CAVA Group (NYSE:CAVA - Get Free Report) last announced its quarterly earnings results on Thursday, August 22nd. The company reported $0.17 earnings per share for the quarter, topping analysts' consensus estimates of $0.13 by $0.04. The firm had revenue of $233.50 million for the quarter, compared to the consensus estimate of $219.47 million. CAVA Group had a return on equity of 7.37% and a net margin of 5.04%. The business's revenue was up 35.1% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.21 earnings per share. As a group, equities research analysts expect that CAVA Group, Inc. will post 0.43 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Several research analysts have weighed in on CAVA shares. Loop Capital lifted their target price on CAVA Group from $80.00 to $122.00 and gave the stock a "hold" rating in a report on Monday, August 26th. Jefferies Financial Group lifted their target price on CAVA Group from $94.00 to $117.00 and gave the stock a "buy" rating in a report on Friday, August 23rd. TD Cowen lifted their target price on CAVA Group from $115.00 to $130.00 and gave the stock a "buy" rating in a report on Monday, September 23rd. JPMorgan Chase & Co. lifted their target price on CAVA Group from $77.00 to $90.00 and gave the stock a "neutral" rating in a report on Monday, August 26th. Finally, Morgan Stanley lowered CAVA Group from an "overweight" rating to an "equal weight" rating and boosted their price target for the company from $90.00 to $110.00 in a report on Thursday, August 29th. Eight analysts have rated the stock with a hold rating and eight have issued a buy rating to the company. According to MarketBeat.com, CAVA Group presently has an average rating of "Moderate Buy" and a consensus price target of $115.64.

Read Our Latest Report on CAVA Group

CAVA Group Company Profile

(

Free Report)

CAVA Group, Inc owns and operates a chain of restaurants under the CAVA brand in the United States. The company also offers dips, spreads, and dressings through grocery stores. In addition, the company provides online and mobile ordering platforms. Cava Group, Inc was founded in 2006 and is headquartered in Washington, the District of Columbia.

Featured Articles

Before you consider CAVA Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CAVA Group wasn't on the list.

While CAVA Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.