Raymond James & Associates boosted its stake in shares of Cabot Co. (NYSE:CBT - Free Report) by 24.4% during the 3rd quarter, according to its most recent filing with the SEC. The firm owned 40,741 shares of the specialty chemicals company's stock after purchasing an additional 7,999 shares during the period. Raymond James & Associates owned approximately 0.07% of Cabot worth $4,554,000 at the end of the most recent quarter.

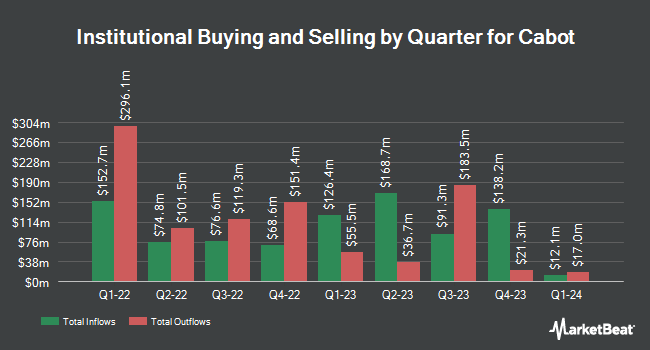

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Wolff Wiese Magana LLC purchased a new position in Cabot in the 3rd quarter worth approximately $25,000. CWM LLC grew its stake in shares of Cabot by 60.6% in the second quarter. CWM LLC now owns 416 shares of the specialty chemicals company's stock worth $38,000 after acquiring an additional 157 shares in the last quarter. UMB Bank n.a. grew its stake in shares of Cabot by 53.9% during the third quarter. UMB Bank n.a. now owns 371 shares of the specialty chemicals company's stock worth $41,000 after purchasing an additional 130 shares in the last quarter. EverSource Wealth Advisors LLC grew its stake in shares of Cabot by 33.4% during the second quarter. EverSource Wealth Advisors LLC now owns 475 shares of the specialty chemicals company's stock worth $48,000 after purchasing an additional 119 shares in the last quarter. Finally, 1620 Investment Advisors Inc. acquired a new position in shares of Cabot during the second quarter worth $49,000. 93.18% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

CBT has been the subject of a number of research reports. UBS Group reduced their target price on shares of Cabot from $103.00 to $98.00 and set a "neutral" rating for the company in a report on Tuesday, August 6th. JPMorgan Chase & Co. upped their target price on shares of Cabot from $95.00 to $105.00 and gave the stock a "neutral" rating in a research report on Wednesday, August 7th. Three equities research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. According to MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $101.75.

Get Our Latest Research Report on CBT

Cabot Stock Performance

Shares of NYSE CBT traded up $1.19 during midday trading on Friday, hitting $109.02. The company's stock had a trading volume of 599,616 shares, compared to its average volume of 258,150. Cabot Co. has a 1-year low of $65.93 and a 1-year high of $117.14. The firm's fifty day moving average price is $108.20 and its 200-day moving average price is $100.81. The company has a debt-to-equity ratio of 0.72, a quick ratio of 1.45 and a current ratio of 2.22. The firm has a market cap of $5.98 billion, a P/E ratio of 12.96, a P/E/G ratio of 0.90 and a beta of 1.20.

Cabot (NYSE:CBT - Get Free Report) last released its quarterly earnings results on Monday, August 5th. The specialty chemicals company reported $1.92 EPS for the quarter, topping analysts' consensus estimates of $1.72 by $0.20. The company had revenue of $1.02 billion for the quarter, compared to the consensus estimate of $1 billion. Cabot had a net margin of 12.05% and a return on equity of 26.99%. Cabot's revenue was up 5.0% on a year-over-year basis. During the same period in the previous year, the firm earned $1.42 EPS. On average, sell-side analysts forecast that Cabot Co. will post 7.07 EPS for the current fiscal year.

Insider Activity at Cabot

In other news, CEO Sean D. Keohane sold 25,617 shares of the business's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $101.55, for a total value of $2,601,406.35. Following the completion of the sale, the chief executive officer now directly owns 331,174 shares in the company, valued at approximately $33,630,719.70. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other news, CEO Sean D. Keohane sold 25,617 shares of the firm's stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $101.55, for a total transaction of $2,601,406.35. Following the completion of the transaction, the chief executive officer now directly owns 331,174 shares of the company's stock, valued at approximately $33,630,719.70. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP Jeff Ji Zhu sold 1,201 shares of the stock in a transaction dated Monday, August 26th. The stock was sold at an average price of $106.19, for a total transaction of $127,534.19. Following the sale, the executive vice president now owns 96,000 shares of the company's stock, valued at $10,194,240. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 71,939 shares of company stock valued at $7,308,812. Corporate insiders own 3.07% of the company's stock.

Cabot Company Profile

(

Free Report)

Cabot Corporation operates as a specialty chemicals and performance materials company. The company operates through two segments, Reinforcement Materials and Performance Chemicals. It offers reinforcing carbons that are used in tires as a rubber reinforcing agent and performance additive, as well as in industrial products, such as hoses, belts, extruded profiles, and molded goods; and engineered elastomer composites solutions.

Featured Articles

Before you consider Cabot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cabot wasn't on the list.

While Cabot currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.