Semanteon Capital Management LP bought a new stake in shares of CBIZ, Inc. (NYSE:CBZ - Free Report) during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor bought 16,999 shares of the business services provider's stock, valued at approximately $1,144,000.

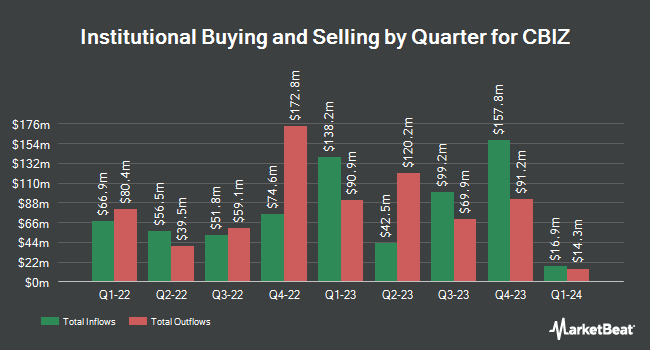

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. AQR Capital Management LLC lifted its stake in CBIZ by 1.2% in the second quarter. AQR Capital Management LLC now owns 14,960 shares of the business services provider's stock worth $1,109,000 after purchasing an additional 176 shares during the last quarter. Wealth Enhancement Advisory Services LLC increased its stake in shares of CBIZ by 1.2% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 16,235 shares of the business services provider's stock worth $1,203,000 after acquiring an additional 185 shares during the period. Inspire Investing LLC raised its stake in shares of CBIZ by 4.2% during the 2nd quarter. Inspire Investing LLC now owns 4,757 shares of the business services provider's stock valued at $352,000 after buying an additional 190 shares during the last quarter. Covestor Ltd raised its position in CBIZ by 45.5% during the first quarter. Covestor Ltd now owns 707 shares of the business services provider's stock valued at $56,000 after acquiring an additional 221 shares in the last quarter. Finally, Arizona State Retirement System increased its holdings in shares of CBIZ by 2.2% during the 2nd quarter. Arizona State Retirement System now owns 12,603 shares of the business services provider's stock valued at $934,000 after purchasing an additional 275 shares in the last quarter. 87.44% of the stock is currently owned by hedge funds and other institutional investors.

CBIZ Stock Up 0.7 %

Shares of CBZ stock traded up $0.49 on Monday, reaching $66.88. 339,445 shares of the stock were exchanged, compared to its average volume of 312,312. The company has a market capitalization of $3.36 billion, a price-to-earnings ratio of 28.70 and a beta of 0.92. The business's 50 day moving average price is $67.91 and its 200 day moving average price is $72.89. The company has a current ratio of 1.48, a quick ratio of 1.48 and a debt-to-equity ratio of 0.43. CBIZ, Inc. has a twelve month low of $50.64 and a twelve month high of $86.36.

CBIZ (NYSE:CBZ - Get Free Report) last posted its earnings results on Thursday, August 1st. The business services provider reported $0.39 EPS for the quarter, missing analysts' consensus estimates of $0.68 by ($0.29). CBIZ had a return on equity of 14.58% and a net margin of 7.12%. The firm had revenue of $420.00 million for the quarter, compared to analyst estimates of $430.38 million. During the same quarter last year, the firm posted $0.55 EPS. The firm's revenue for the quarter was up 5.4% on a year-over-year basis. As a group, sell-side analysts expect that CBIZ, Inc. will post 2.64 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

A number of research analysts have weighed in on the company. StockNews.com lowered CBIZ from a "hold" rating to a "sell" rating in a report on Thursday, September 5th. Sidoti upgraded shares of CBIZ from a "neutral" rating to a "buy" rating and increased their target price for the stock from $80.00 to $86.00 in a report on Monday, August 12th.

Check Out Our Latest Report on CBZ

CBIZ Company Profile

(

Free Report)

CBIZ, Inc provides financial, insurance, and advisory services in the United States and Canada. It operates through Financial Services, Benefits and Insurance Services, and National Practices segments. The Financial Services segment offers accounting and tax, financial advisory, valuation, risk and advisory, and government healthcare consulting services.

Recommended Stories

Before you consider CBIZ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CBIZ wasn't on the list.

While CBIZ currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.