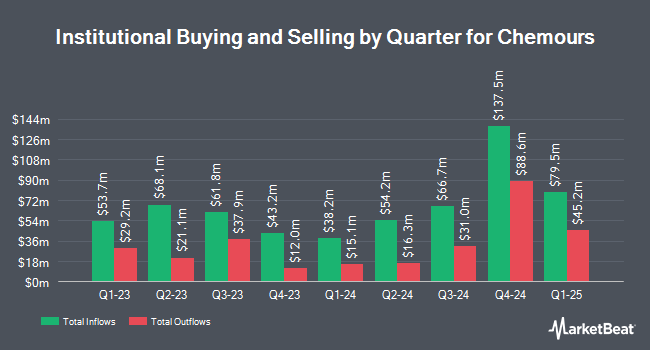

Private Management Group Inc. lifted its holdings in The Chemours Company (NYSE:CC - Free Report) by 72.0% during the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 785,809 shares of the specialty chemicals company's stock after purchasing an additional 329,037 shares during the period. Private Management Group Inc. owned about 0.53% of Chemours worth $15,968,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in CC. Khrom Capital Management LLC raised its stake in Chemours by 156.7% during the 1st quarter. Khrom Capital Management LLC now owns 2,235,659 shares of the specialty chemicals company's stock worth $58,708,000 after acquiring an additional 1,364,634 shares during the period. Marshall Wace LLP raised its stake in Chemours by 23.8% during the 2nd quarter. Marshall Wace LLP now owns 7,009,868 shares of the specialty chemicals company's stock worth $158,213,000 after acquiring an additional 1,347,710 shares during the period. Forest Avenue Capital Management LP grew its holdings in Chemours by 236.9% during the 2nd quarter. Forest Avenue Capital Management LP now owns 845,728 shares of the specialty chemicals company's stock valued at $19,088,000 after buying an additional 594,660 shares in the last quarter. American Century Companies Inc. raised its position in shares of Chemours by 26.7% during the second quarter. American Century Companies Inc. now owns 1,811,957 shares of the specialty chemicals company's stock valued at $40,896,000 after buying an additional 382,100 shares during the last quarter. Finally, Appian Way Asset Management LP purchased a new position in shares of Chemours in the first quarter worth $7,575,000. Institutional investors own 76.26% of the company's stock.

Analyst Ratings Changes

CC has been the subject of several research analyst reports. Barclays cut their target price on shares of Chemours from $22.00 to $21.00 and set an "equal weight" rating for the company in a research note on Wednesday, September 25th. JPMorgan Chase & Co. cut their price objective on Chemours from $25.00 to $18.00 and set a "neutral" rating for the company in a research report on Tuesday, August 6th. UBS Group decreased their target price on Chemours from $30.00 to $28.00 and set a "buy" rating on the stock in a research report on Tuesday, August 6th. BMO Capital Markets raised their price target on Chemours from $30.00 to $32.00 and gave the company an "outperform" rating in a report on Monday, October 7th. Finally, The Goldman Sachs Group reduced their price objective on Chemours from $29.00 to $23.00 and set a "neutral" rating on the stock in a research note on Tuesday, September 3rd. Four investment analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to MarketBeat, Chemours has an average rating of "Hold" and a consensus target price of $25.00.

Check Out Our Latest Analysis on CC

Chemours Trading Down 1.9 %

Shares of CC stock traded down $0.34 during trading hours on Friday, reaching $17.82. 1,621,588 shares of the stock were exchanged, compared to its average volume of 1,553,924. The firm has a market capitalization of $2.66 billion, a price-to-earnings ratio of 22.00 and a beta of 1.74. The Chemours Company has a 12-month low of $15.10 and a 12-month high of $32.70. The company's 50-day moving average price is $18.95 and its 200-day moving average price is $22.28. The company has a current ratio of 1.89, a quick ratio of 1.01 and a debt-to-equity ratio of 5.45.

Chemours (NYSE:CC - Get Free Report) last released its earnings results on Thursday, August 1st. The specialty chemicals company reported $0.38 EPS for the quarter, missing analysts' consensus estimates of $0.57 by ($0.19). Chemours had a net margin of 2.16% and a return on equity of 33.21%. The business had revenue of $1.54 billion for the quarter, compared to the consensus estimate of $1.53 billion. During the same period in the prior year, the company posted $1.10 EPS. The company's quarterly revenue was down 6.4% compared to the same quarter last year. As a group, equities analysts anticipate that The Chemours Company will post 1.32 earnings per share for the current year.

Chemours Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Friday, November 15th will be given a dividend of $0.25 per share. The ex-dividend date of this dividend is Friday, November 15th. This represents a $1.00 annualized dividend and a dividend yield of 5.61%. Chemours's dividend payout ratio (DPR) is 123.46%.

Chemours Company Profile

(

Free Report)

The Chemours Company provides performance chemicals in North America, the Asia Pacific, Europe, the Middle East, Africa, and Latin America. It operates through three segments: Titanium Technologies, Thermal & Specialized Solutions, and Advanced Performance Materials. The Titanium Technologies segment provides TiO2 pigment under the Ti-Pure brand for delivering whiteness, brightness, opacity, durability, efficiency, and protection in various of applications, such as architectural and industrial coatings, flexible and rigid plastic packaging, polyvinylchloride, laminate papers used for furniture and building materials, coated paper, and coated paperboard used for packaging.

See Also

Before you consider Chemours, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chemours wasn't on the list.

While Chemours currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.