CCC Intelligent Solutions (NYSE:CCCS - Get Free Report)'s stock had its "outperform" rating restated by equities research analysts at Barrington Research in a report released on Tuesday, Benzinga reports. They currently have a $14.00 price target on the stock. Barrington Research's price objective suggests a potential upside of 28.09% from the stock's current price.

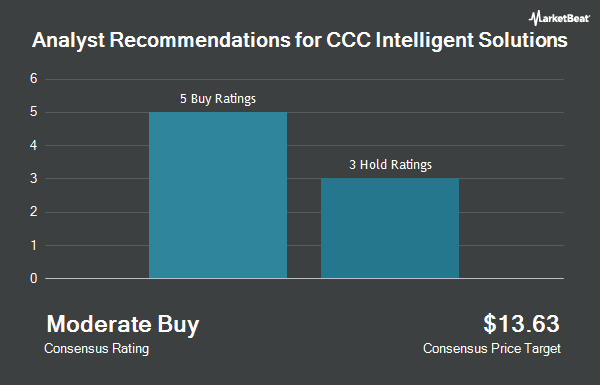

Several other research analysts have also commented on CCCS. Bank of America assumed coverage on CCC Intelligent Solutions in a research report on Tuesday, August 20th. They set a "buy" rating and a $15.00 price target on the stock. Barclays cut their price target on CCC Intelligent Solutions from $14.00 to $13.00 and set an "equal weight" rating on the stock in a research report on Tuesday. Finally, Jefferies Financial Group cut their price target on CCC Intelligent Solutions from $14.00 to $13.00 and set a "buy" rating on the stock in a research report on Wednesday, July 31st. Three investment analysts have rated the stock with a hold rating and six have issued a buy rating to the company. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $13.56.

Get Our Latest Research Report on CCCS

CCC Intelligent Solutions Stock Down 0.2 %

Shares of CCCS traded down $0.02 during midday trading on Tuesday, hitting $10.93. The company had a trading volume of 4,983,156 shares, compared to its average volume of 3,447,256. The company's 50-day simple moving average is $10.85 and its 200-day simple moving average is $11.02. The company has a debt-to-equity ratio of 0.40, a quick ratio of 2.79 and a current ratio of 2.79. The firm has a market capitalization of $6.80 billion, a P/E ratio of -52.05, a P/E/G ratio of 6.26 and a beta of 0.62. CCC Intelligent Solutions has a 1 year low of $9.79 and a 1 year high of $12.68.

CCC Intelligent Solutions (NYSE:CCCS - Get Free Report) last issued its earnings results on Monday, October 28th. The company reported $0.10 earnings per share for the quarter, topping the consensus estimate of $0.09 by $0.01. CCC Intelligent Solutions had a return on equity of 5.16% and a net margin of 2.36%. The business had revenue of $238.48 million for the quarter, compared to analyst estimates of $237.41 million. During the same quarter last year, the company earned $0.03 EPS. The business's quarterly revenue was up 7.8% on a year-over-year basis. As a group, sell-side analysts expect that CCC Intelligent Solutions will post 0.16 EPS for the current year.

Insider Buying and Selling at CCC Intelligent Solutions

In related news, Director Eileen Schloss sold 99,925 shares of CCC Intelligent Solutions stock in a transaction that occurred on Monday, August 5th. The stock was sold at an average price of $9.89, for a total value of $988,258.25. Following the sale, the director now directly owns 54,047 shares in the company, valued at $534,524.83. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. In related news, CAO Rodney Christo sold 4,177 shares of CCC Intelligent Solutions stock in a transaction that occurred on Wednesday, July 31st. The stock was sold at an average price of $10.24, for a total value of $42,772.48. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Also, Director Eileen Schloss sold 99,925 shares of the business's stock in a transaction on Monday, August 5th. The stock was sold at an average price of $9.89, for a total value of $988,258.25. Following the sale, the director now owns 54,047 shares in the company, valued at approximately $534,524.83. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 238,387 shares of company stock worth $2,414,009. 6.67% of the stock is currently owned by insiders.

Institutional Trading of CCC Intelligent Solutions

Institutional investors have recently bought and sold shares of the company. Sei Investments Co. raised its holdings in shares of CCC Intelligent Solutions by 15.3% in the first quarter. Sei Investments Co. now owns 1,887,533 shares of the company's stock worth $22,575,000 after acquiring an additional 250,314 shares during the last quarter. Comerica Bank raised its holdings in shares of CCC Intelligent Solutions by 103.1% in the first quarter. Comerica Bank now owns 774,261 shares of the company's stock worth $9,260,000 after acquiring an additional 392,966 shares during the last quarter. Dragoneer Investment Group LLC raised its holdings in shares of CCC Intelligent Solutions by 31.5% in the second quarter. Dragoneer Investment Group LLC now owns 15,904,993 shares of the company's stock worth $176,704,000 after acquiring an additional 3,809,200 shares during the last quarter. Swiss National Bank raised its holdings in shares of CCC Intelligent Solutions by 14.5% in the first quarter. Swiss National Bank now owns 475,900 shares of the company's stock worth $5,692,000 after acquiring an additional 60,400 shares during the last quarter. Finally, Harbor Capital Advisors Inc. raised its holdings in shares of CCC Intelligent Solutions by 200.1% in the second quarter. Harbor Capital Advisors Inc. now owns 203,543 shares of the company's stock worth $2,261,000 after acquiring an additional 135,710 shares during the last quarter. 95.79% of the stock is currently owned by hedge funds and other institutional investors.

About CCC Intelligent Solutions

(

Get Free Report)

CCC Intelligent Solutions Holdings Inc, operates as a software as a service company for the property and casualty insurance economy in the United States and China. The company's cloud-based software as a service platform connects trading partners, facilitates commerce, and supports mission-critical, artificial intelligence enabled digital workflow across the insurance economy, including insurers, repairers, automakers, parts suppliers, lenders and more.

Read More

Before you consider CCC Intelligent Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CCC Intelligent Solutions wasn't on the list.

While CCC Intelligent Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.