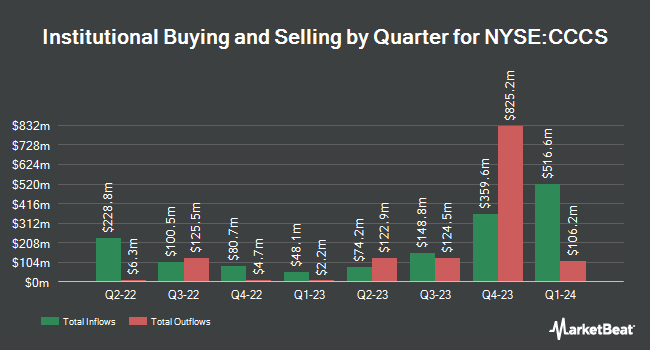

Raymond James & Associates raised its position in CCC Intelligent Solutions Holdings Inc. (NYSE:CCCS - Free Report) by 16.0% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 1,559,611 shares of the company's stock after purchasing an additional 215,587 shares during the period. Raymond James & Associates owned approximately 0.25% of CCC Intelligent Solutions worth $17,234,000 as of its most recent filing with the SEC.

Several other hedge funds also recently bought and sold shares of CCCS. American International Group Inc. lifted its holdings in CCC Intelligent Solutions by 68.6% during the first quarter. American International Group Inc. now owns 2,789 shares of the company's stock worth $33,000 after acquiring an additional 1,135 shares in the last quarter. CWM LLC increased its stake in CCC Intelligent Solutions by 352.6% during the 2nd quarter. CWM LLC now owns 3,105 shares of the company's stock worth $34,000 after purchasing an additional 2,419 shares in the last quarter. Twin Tree Management LP acquired a new stake in CCC Intelligent Solutions during the 1st quarter worth approximately $53,000. Quarry LP lifted its stake in CCC Intelligent Solutions by 304.0% in the second quarter. Quarry LP now owns 11,219 shares of the company's stock valued at $125,000 after buying an additional 8,442 shares in the last quarter. Finally, Parkside Financial Bank & Trust boosted its holdings in shares of CCC Intelligent Solutions by 15.2% in the second quarter. Parkside Financial Bank & Trust now owns 11,849 shares of the company's stock valued at $132,000 after buying an additional 1,564 shares during the period. 95.79% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling at CCC Intelligent Solutions

In related news, insider Brian Herb sold 20,887 shares of CCC Intelligent Solutions stock in a transaction dated Wednesday, July 31st. The shares were sold at an average price of $10.24, for a total transaction of $213,882.88. Following the completion of the sale, the insider now owns 217,872 shares of the company's stock, valued at approximately $2,231,009.28. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. In other CCC Intelligent Solutions news, CAO Rodney Christo sold 4,177 shares of the company's stock in a transaction on Wednesday, July 31st. The stock was sold at an average price of $10.24, for a total value of $42,772.48. The sale was disclosed in a document filed with the SEC, which can be accessed through this link. Also, insider Brian Herb sold 20,887 shares of CCC Intelligent Solutions stock in a transaction on Wednesday, July 31st. The stock was sold at an average price of $10.24, for a total value of $213,882.88. Following the sale, the insider now directly owns 217,872 shares of the company's stock, valued at $2,231,009.28. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 238,387 shares of company stock valued at $2,414,009 in the last quarter. 6.67% of the stock is currently owned by insiders.

Analyst Ratings Changes

Several equities research analysts recently commented on the stock. Barrington Research reaffirmed an "outperform" rating and issued a $14.00 price objective on shares of CCC Intelligent Solutions in a research report on Wednesday, July 31st. Jefferies Financial Group reduced their price objective on CCC Intelligent Solutions from $14.00 to $13.00 and set a "buy" rating for the company in a research report on Wednesday, July 31st. Finally, Bank of America assumed coverage on CCC Intelligent Solutions in a research report on Tuesday, August 20th. They issued a "buy" rating and a $15.00 target price on the stock. Three research analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $13.75.

Get Our Latest Stock Report on CCCS

CCC Intelligent Solutions Stock Performance

Shares of CCC Intelligent Solutions stock traded down $0.15 during trading on Friday, hitting $11.00. 2,606,559 shares of the stock were exchanged, compared to its average volume of 3,440,543. The company has a current ratio of 2.79, a quick ratio of 2.79 and a debt-to-equity ratio of 0.40. The company has a fifty day moving average price of $10.84 and a 200-day moving average price of $11.03. The stock has a market capitalization of $6.84 billion, a price-to-earnings ratio of -52.38, a price-to-earnings-growth ratio of 6.26 and a beta of 0.62. CCC Intelligent Solutions Holdings Inc. has a 1-year low of $9.79 and a 1-year high of $12.68.

CCC Intelligent Solutions (NYSE:CCCS - Get Free Report) last announced its quarterly earnings results on Tuesday, July 30th. The company reported $0.09 earnings per share for the quarter, topping analysts' consensus estimates of $0.08 by $0.01. CCC Intelligent Solutions had a return on equity of 5.16% and a net margin of 2.36%. The firm had revenue of $232.60 million for the quarter, compared to the consensus estimate of $230.16 million. During the same quarter in the previous year, the business earned $0.02 earnings per share. The business's revenue was up 9.9% compared to the same quarter last year. As a group, equities analysts predict that CCC Intelligent Solutions Holdings Inc. will post 0.16 EPS for the current fiscal year.

About CCC Intelligent Solutions

(

Free Report)

CCC Intelligent Solutions Holdings Inc, operates as a software as a service company for the property and casualty insurance economy in the United States and China. The company's cloud-based software as a service platform connects trading partners, facilitates commerce, and supports mission-critical, artificial intelligence enabled digital workflow across the insurance economy, including insurers, repairers, automakers, parts suppliers, lenders and more.

Featured Stories

Before you consider CCC Intelligent Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CCC Intelligent Solutions wasn't on the list.

While CCC Intelligent Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.