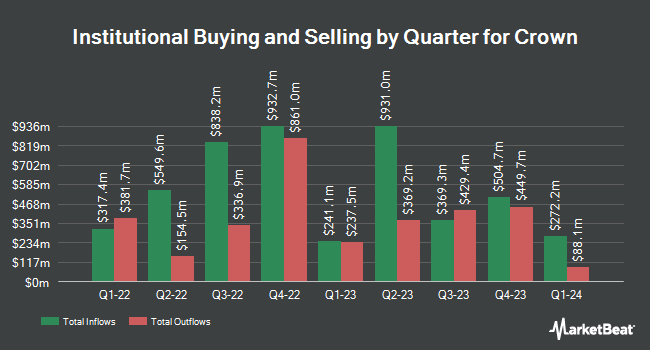

Metropolis Capital Ltd raised its holdings in Crown Holdings, Inc. (NYSE:CCK - Free Report) by 269.7% in the 3rd quarter, according to its most recent 13F filing with the SEC. The fund owned 1,455,752 shares of the industrial products company's stock after acquiring an additional 1,062,001 shares during the period. Crown accounts for about 4.8% of Metropolis Capital Ltd's holdings, making the stock its 11th biggest position. Metropolis Capital Ltd owned 1.21% of Crown worth $139,578,000 at the end of the most recent quarter.

Other institutional investors also recently bought and sold shares of the company. Mutual of America Capital Management LLC raised its holdings in Crown by 10.3% in the 1st quarter. Mutual of America Capital Management LLC now owns 153,739 shares of the industrial products company's stock valued at $12,185,000 after acquiring an additional 14,362 shares during the last quarter. Empowered Funds LLC purchased a new stake in shares of Crown during the 1st quarter valued at $6,854,000. Russell Investments Group Ltd. grew its stake in shares of Crown by 21.0% during the 1st quarter. Russell Investments Group Ltd. now owns 341,216 shares of the industrial products company's stock valued at $27,045,000 after buying an additional 59,267 shares during the period. Entropy Technologies LP grew its stake in shares of Crown by 1,127.4% during the 1st quarter. Entropy Technologies LP now owns 27,456 shares of the industrial products company's stock valued at $2,176,000 after buying an additional 25,219 shares during the period. Finally, CANADA LIFE ASSURANCE Co grew its stake in shares of Crown by 16.4% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 103,013 shares of the industrial products company's stock valued at $8,163,000 after buying an additional 14,501 shares during the period. 90.93% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several brokerages have recently issued reports on CCK. Loop Capital boosted their price objective on shares of Crown from $120.00 to $129.00 and gave the company a "buy" rating in a research note on Monday. Wells Fargo & Company upped their price target on shares of Crown from $97.00 to $105.00 and gave the stock an "equal weight" rating in a research report on Monday. StockNews.com raised shares of Crown from a "hold" rating to a "buy" rating in a research report on Tuesday, October 15th. Bank of America upped their price objective on shares of Crown from $98.00 to $102.00 and gave the company a "buy" rating in a research report on Wednesday, July 24th. Finally, Mizuho set a $110.00 price objective on shares of Crown in a research report on Friday, October 18th. Three research analysts have rated the stock with a hold rating and eleven have issued a buy rating to the company's stock. According to MarketBeat, Crown presently has an average rating of "Moderate Buy" and an average price target of $106.62.

View Our Latest Analysis on CCK

Insider Activity

In other news, Director James H. Miller sold 1,006 shares of the stock in a transaction that occurred on Monday, September 23rd. The shares were sold at an average price of $95.60, for a total value of $96,173.60. Following the completion of the transaction, the director now directly owns 12,424 shares in the company, valued at $1,187,734.40. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. In related news, Director James H. Miller sold 1,006 shares of the firm's stock in a transaction that occurred on Monday, September 23rd. The shares were sold at an average price of $95.60, for a total transaction of $96,173.60. Following the completion of the sale, the director now directly owns 12,424 shares in the company, valued at approximately $1,187,734.40. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, CEO Timothy J. Donahue sold 7,500 shares of the firm's stock in a transaction that occurred on Friday, September 6th. The stock was sold at an average price of $90.58, for a total transaction of $679,350.00. Following the sale, the chief executive officer now owns 578,678 shares of the company's stock, valued at $52,416,653.24. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 23,506 shares of company stock worth $2,116,899 over the last three months. Corporate insiders own 0.90% of the company's stock.

Crown Stock Performance

Shares of NYSE:CCK traded down $0.17 during trading hours on Wednesday, hitting $96.00. The stock had a trading volume of 1,059,194 shares, compared to its average volume of 1,135,745. The stock's fifty day simple moving average is $92.07 and its 200 day simple moving average is $84.72. Crown Holdings, Inc. has a 1-year low of $69.61 and a 1-year high of $98.46. The firm has a market capitalization of $11.59 billion, a price-to-earnings ratio of 27.61, a PEG ratio of 2.19 and a beta of 0.86. The company has a debt-to-equity ratio of 2.00, a quick ratio of 0.73 and a current ratio of 1.05.

Crown (NYSE:CCK - Get Free Report) last announced its quarterly earnings results on Monday, July 22nd. The industrial products company reported $1.81 EPS for the quarter, beating the consensus estimate of $1.59 by $0.22. Crown had a net margin of 3.68% and a return on equity of 23.96%. The company had revenue of $3.04 billion for the quarter, compared to analyst estimates of $3.06 billion. During the same quarter last year, the business earned $1.68 earnings per share. Crown's revenue was down 2.2% compared to the same quarter last year. Sell-side analysts anticipate that Crown Holdings, Inc. will post 6.15 earnings per share for the current fiscal year.

Crown Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Thursday, August 29th. Stockholders of record on Thursday, August 15th were issued a $0.25 dividend. This represents a $1.00 annualized dividend and a dividend yield of 1.04%. The ex-dividend date was Thursday, August 15th. Crown's dividend payout ratio (DPR) is presently 28.82%.

About Crown

(

Free Report)

Crown Holdings, Inc, together with its subsidiaries, engages in the packaging business in the United States and internationally. It operates through Americas Beverage, European Beverage, Asia Pacific, and Transit Packaging segments. The company manufactures and sells recyclable aluminum beverage cans and ends, glass bottles, steel crowns, aluminum caps, non-beverage cans, and aerosol cans and closures.

Further Reading

Before you consider Crown, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crown wasn't on the list.

While Crown currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report