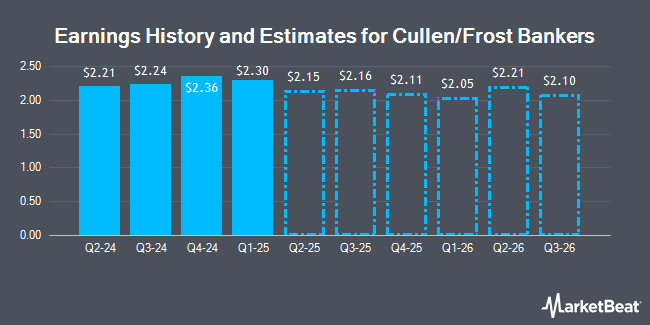

Cullen/Frost Bankers, Inc. (NYSE:CFR - Free Report) - Equities researchers at Zacks Research raised their Q3 2024 EPS estimates for Cullen/Frost Bankers in a research note issued to investors on Monday, October 28th. Zacks Research analyst R. Department now expects that the bank will earn $2.15 per share for the quarter, up from their previous estimate of $2.10. The consensus estimate for Cullen/Frost Bankers' current full-year earnings is $8.59 per share. Zacks Research also issued estimates for Cullen/Frost Bankers' Q4 2024 earnings at $1.95 EPS, Q1 2025 earnings at $1.94 EPS, Q3 2025 earnings at $2.11 EPS, Q2 2026 earnings at $2.18 EPS and Q3 2026 earnings at $2.18 EPS.

Other equities research analysts have also issued reports about the stock. Truist Financial lowered their price target on shares of Cullen/Frost Bankers from $126.00 to $123.00 and set a "hold" rating on the stock in a report on Friday, September 20th. Stephens increased their target price on shares of Cullen/Frost Bankers from $116.00 to $131.00 and gave the stock an "equal weight" rating in a research note on Friday, July 26th. Maxim Group increased their target price on shares of Cullen/Frost Bankers from $132.00 to $138.00 and gave the stock a "buy" rating in a research note on Friday, July 26th. DA Davidson increased their target price on shares of Cullen/Frost Bankers from $127.00 to $134.00 and gave the stock a "buy" rating in a research note on Friday, July 26th. Finally, Jefferies Financial Group lowered their target price on shares of Cullen/Frost Bankers from $117.00 to $108.00 and set a "hold" rating on the stock in a research note on Wednesday, July 3rd. Four investment analysts have rated the stock with a sell rating, eight have assigned a hold rating and three have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $121.31.

Read Our Latest Stock Analysis on Cullen/Frost Bankers

Cullen/Frost Bankers Stock Performance

NYSE:CFR traded up $0.68 during mid-day trading on Wednesday, hitting $130.47. The company's stock had a trading volume of 839,829 shares, compared to its average volume of 447,367. Cullen/Frost Bankers has a 1 year low of $88.86 and a 1 year high of $133.03. The company has a debt-to-equity ratio of 0.06, a current ratio of 0.64 and a quick ratio of 0.64. The stock has a market cap of $8.38 billion, a price-to-earnings ratio of 15.52, a PEG ratio of 1.56 and a beta of 1.00. The business's fifty day moving average is $114.52 and its two-hundred day moving average is $108.59.

Institutional Trading of Cullen/Frost Bankers

A number of hedge funds have recently bought and sold shares of CFR. Asset Dedication LLC increased its holdings in shares of Cullen/Frost Bankers by 63.3% during the 3rd quarter. Asset Dedication LLC now owns 271 shares of the bank's stock worth $30,000 after buying an additional 105 shares during the last quarter. Whittier Trust Co. increased its holdings in shares of Cullen/Frost Bankers by 90.7% during the 1st quarter. Whittier Trust Co. now owns 391 shares of the bank's stock worth $44,000 after buying an additional 186 shares during the last quarter. Allworth Financial LP increased its holdings in shares of Cullen/Frost Bankers by 116.6% during the 3rd quarter. Allworth Financial LP now owns 444 shares of the bank's stock worth $50,000 after buying an additional 239 shares during the last quarter. Abich Financial Wealth Management LLC acquired a new stake in shares of Cullen/Frost Bankers during the 2nd quarter worth approximately $54,000. Finally, North Star Investment Management Corp. acquired a new stake in shares of Cullen/Frost Bankers during the 1st quarter worth approximately $69,000. Institutional investors and hedge funds own 86.90% of the company's stock.

Cullen/Frost Bankers Company Profile

(

Get Free Report)

Cullen/Frost Bankers, Inc operates as the bank holding company for Frost Bank that provides commercial and consumer banking services in Texas. The company offers commercial banking services to corporations, including financing for industrial and commercial properties, interim construction related to industrial and commercial properties, equipment, inventories and accounts receivables, and acquisitions; and treasury management services, as well as originates commercial leasing services.

Further Reading

Before you consider Cullen/Frost Bankers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cullen/Frost Bankers wasn't on the list.

While Cullen/Frost Bankers currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.