Sanctuary Advisors LLC acquired a new stake in Cullen/Frost Bankers, Inc. (NYSE:CFR - Free Report) in the 2nd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund acquired 20,532 shares of the bank's stock, valued at approximately $2,199,000.

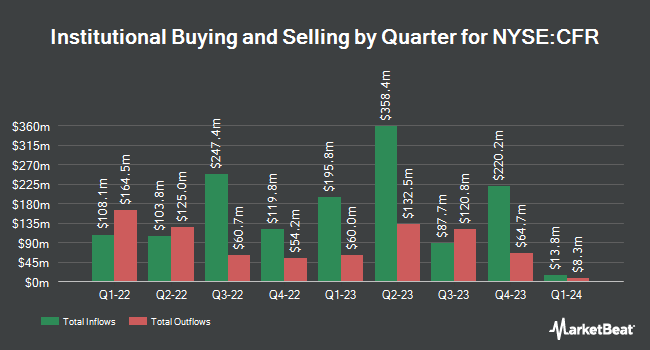

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. KBC Group NV increased its holdings in Cullen/Frost Bankers by 71.5% during the 4th quarter. KBC Group NV now owns 3,341 shares of the bank's stock valued at $362,000 after purchasing an additional 1,393 shares during the period. Goldman Sachs Group Inc. increased its stake in shares of Cullen/Frost Bankers by 44.1% during the fourth quarter. Goldman Sachs Group Inc. now owns 798,403 shares of the bank's stock valued at $86,619,000 after buying an additional 244,197 shares during the period. Oppenheimer & Co. Inc. raised its holdings in shares of Cullen/Frost Bankers by 1.6% during the fourth quarter. Oppenheimer & Co. Inc. now owns 17,397 shares of the bank's stock valued at $1,887,000 after acquiring an additional 270 shares in the last quarter. Quadrature Capital Ltd boosted its holdings in Cullen/Frost Bankers by 32.7% in the fourth quarter. Quadrature Capital Ltd now owns 12,855 shares of the bank's stock valued at $1,395,000 after acquiring an additional 3,168 shares in the last quarter. Finally, Personal CFO Solutions LLC purchased a new position in Cullen/Frost Bankers during the 4th quarter valued at $210,000. Institutional investors own 86.90% of the company's stock.

Cullen/Frost Bankers Stock Up 0.1 %

Shares of CFR traded up $0.08 on Tuesday, hitting $113.46. 445,351 shares of the stock traded hands, compared to its average volume of 441,813. The company has a market capitalization of $7.26 billion, a PE ratio of 13.39, a P/E/G ratio of 1.39 and a beta of 1.00. Cullen/Frost Bankers, Inc. has a one year low of $82.25 and a one year high of $123.17. The company has a debt-to-equity ratio of 0.06, a quick ratio of 0.64 and a current ratio of 0.64. The business has a 50 day simple moving average of $110.07 and a 200 day simple moving average of $107.16.

Cullen/Frost Bankers (NYSE:CFR - Get Free Report) last posted its quarterly earnings results on Thursday, July 25th. The bank reported $2.21 earnings per share for the quarter, topping the consensus estimate of $2.07 by $0.14. Cullen/Frost Bankers had a return on equity of 17.43% and a net margin of 19.51%. The firm had revenue of $528.81 million during the quarter, compared to analysts' expectations of $506.83 million. During the same quarter in the previous year, the business earned $2.47 earnings per share. As a group, equities analysts forecast that Cullen/Frost Bankers, Inc. will post 8.61 earnings per share for the current fiscal year.

Cullen/Frost Bankers Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, September 13th. Shareholders of record on Friday, August 30th were paid a dividend of $0.95 per share. The ex-dividend date of this dividend was Friday, August 30th. This represents a $3.80 annualized dividend and a yield of 3.35%. This is a boost from Cullen/Frost Bankers's previous quarterly dividend of $0.92. Cullen/Frost Bankers's dividend payout ratio is currently 44.92%.

Analyst Ratings Changes

A number of equities research analysts have recently weighed in on CFR shares. DA Davidson lifted their target price on shares of Cullen/Frost Bankers from $127.00 to $134.00 and gave the company a "buy" rating in a research note on Friday, July 26th. JPMorgan Chase & Co. cut their price objective on Cullen/Frost Bankers from $140.00 to $130.00 and set an "overweight" rating on the stock in a research report on Thursday, June 27th. Maxim Group upped their target price on Cullen/Frost Bankers from $132.00 to $138.00 and gave the stock a "buy" rating in a report on Friday, July 26th. Wedbush decreased their target price on Cullen/Frost Bankers from $124.00 to $123.00 and set a "neutral" rating for the company in a research report on Tuesday, September 24th. Finally, Truist Financial reduced their price target on Cullen/Frost Bankers from $126.00 to $123.00 and set a "hold" rating on the stock in a research note on Friday, September 20th. Four analysts have rated the stock with a sell rating, eight have given a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat.com, Cullen/Frost Bankers currently has a consensus rating of "Hold" and an average price target of $121.14.

View Our Latest Report on CFR

Insider Activity

In related news, EVP Candace K. Wolfshohl sold 5,000 shares of the stock in a transaction that occurred on Friday, July 26th. The shares were sold at an average price of $119.65, for a total transaction of $598,250.00. Following the transaction, the executive vice president now owns 18,753 shares in the company, valued at $2,243,796.45. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. In other news, EVP Howard L. Kasanoff sold 3,000 shares of the stock in a transaction that occurred on Wednesday, July 31st. The shares were sold at an average price of $119.20, for a total value of $357,600.00. Following the transaction, the executive vice president now owns 1,598 shares in the company, valued at $190,481.60. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, EVP Candace K. Wolfshohl sold 5,000 shares of the company's stock in a transaction that occurred on Friday, July 26th. The shares were sold at an average price of $119.65, for a total transaction of $598,250.00. Following the sale, the executive vice president now directly owns 18,753 shares of the company's stock, valued at approximately $2,243,796.45. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 2.89% of the company's stock.

Cullen/Frost Bankers Company Profile

(

Free Report)

Cullen/Frost Bankers, Inc operates as the bank holding company for Frost Bank that provides commercial and consumer banking services in Texas. The company offers commercial banking services to corporations, including financing for industrial and commercial properties, interim construction related to industrial and commercial properties, equipment, inventories and accounts receivables, and acquisitions; and treasury management services, as well as originates commercial leasing services.

Featured Articles

Before you consider Cullen/Frost Bankers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cullen/Frost Bankers wasn't on the list.

While Cullen/Frost Bankers currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report