Raymond James & Associates lifted its stake in Choice Hotels International, Inc. (NYSE:CHH - Free Report) by 45.4% in the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 364,983 shares of the company's stock after purchasing an additional 113,951 shares during the quarter. Raymond James & Associates owned about 0.76% of Choice Hotels International worth $47,557,000 at the end of the most recent reporting period.

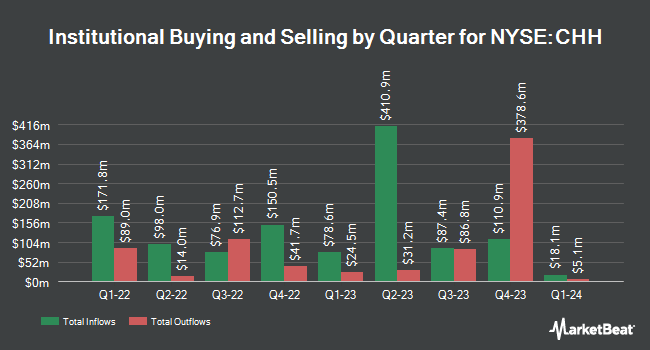

Several other hedge funds also recently added to or reduced their stakes in the company. Allspring Global Investments Holdings LLC raised its holdings in shares of Choice Hotels International by 144.4% in the first quarter. Allspring Global Investments Holdings LLC now owns 198 shares of the company's stock valued at $25,000 after acquiring an additional 117 shares in the last quarter. Blue Trust Inc. increased its holdings in Choice Hotels International by 307.4% during the second quarter. Blue Trust Inc. now owns 220 shares of the company's stock valued at $28,000 after buying an additional 166 shares during the period. Covestor Ltd boosted its position in Choice Hotels International by 163.2% during the 1st quarter. Covestor Ltd now owns 229 shares of the company's stock valued at $29,000 after acquiring an additional 142 shares in the last quarter. Tortoise Investment Management LLC boosted its position in Choice Hotels International by 129.4% during the 2nd quarter. Tortoise Investment Management LLC now owns 250 shares of the company's stock valued at $30,000 after acquiring an additional 141 shares in the last quarter. Finally, Whittier Trust Co. of Nevada Inc. increased its holdings in shares of Choice Hotels International by 1,146.9% in the 2nd quarter. Whittier Trust Co. of Nevada Inc. now owns 399 shares of the company's stock valued at $47,000 after acquiring an additional 367 shares during the period. 65.57% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently commented on the stock. The Goldman Sachs Group initiated coverage on Choice Hotels International in a research report on Wednesday, September 18th. They issued a "sell" rating and a $105.00 target price on the stock. Barclays reduced their target price on shares of Choice Hotels International from $114.00 to $112.00 and set an "underweight" rating for the company in a report on Friday, August 9th. Truist Financial lowered their price target on shares of Choice Hotels International from $144.00 to $134.00 and set a "hold" rating on the stock in a report on Wednesday, September 4th. JPMorgan Chase & Co. cut Choice Hotels International from a "neutral" rating to an "underweight" rating and set a $120.00 price objective for the company. in a report on Friday, July 19th. Finally, StockNews.com raised Choice Hotels International from a "sell" rating to a "hold" rating in a report on Thursday, October 3rd. Three equities research analysts have rated the stock with a sell rating, seven have given a hold rating and two have assigned a buy rating to the company's stock. According to data from MarketBeat.com, Choice Hotels International has an average rating of "Hold" and a consensus target price of $126.00.

Get Our Latest Research Report on Choice Hotels International

Insider Activity at Choice Hotels International

In other news, insider Patrick Cimerola sold 1,714 shares of the business's stock in a transaction on Monday, October 14th. The shares were sold at an average price of $135.00, for a total transaction of $231,390.00. Following the transaction, the insider now directly owns 18,084 shares in the company, valued at $2,441,340. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. In related news, CEO Patrick Pacious sold 10,025 shares of the stock in a transaction dated Tuesday, September 10th. The shares were sold at an average price of $120.37, for a total value of $1,206,709.25. Following the completion of the sale, the chief executive officer now owns 404,666 shares in the company, valued at approximately $48,709,646.42. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Patrick Cimerola sold 1,714 shares of Choice Hotels International stock in a transaction that occurred on Monday, October 14th. The stock was sold at an average price of $135.00, for a total value of $231,390.00. Following the sale, the insider now directly owns 18,084 shares in the company, valued at $2,441,340. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 37,429 shares of company stock worth $4,866,493 in the last quarter. 24.02% of the stock is owned by company insiders.

Choice Hotels International Stock Down 3.1 %

NYSE CHH traded down $4.16 on Wednesday, reaching $131.93. The company had a trading volume of 423,686 shares, compared to its average volume of 482,786. The firm has a market capitalization of $6.35 billion, a PE ratio of 29.20, a P/E/G ratio of 2.20 and a beta of 1.25. The firm has a 50-day moving average of $128.39 and a 200-day moving average of $122.86. The company has a debt-to-equity ratio of 177.75, a current ratio of 0.99 and a quick ratio of 0.99. Choice Hotels International, Inc. has a 1 year low of $108.91 and a 1 year high of $136.83.

Choice Hotels International (NYSE:CHH - Get Free Report) last posted its quarterly earnings results on Thursday, August 8th. The company reported $1.84 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.86 by ($0.02). The business had revenue of $435.20 million during the quarter, compared to the consensus estimate of $438.29 million. Choice Hotels International had a negative return on equity of 3,953.67% and a net margin of 15.42%. The company's quarterly revenue was up 1.8% compared to the same quarter last year. During the same quarter in the previous year, the business posted $1.75 earnings per share. On average, equities research analysts anticipate that Choice Hotels International, Inc. will post 6.38 EPS for the current fiscal year.

Choice Hotels International Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Wednesday, October 16th. Shareholders of record on Tuesday, October 1st were issued a $0.2875 dividend. The ex-dividend date of this dividend was Tuesday, October 1st. This represents a $1.15 annualized dividend and a dividend yield of 0.87%. Choice Hotels International's dividend payout ratio is currently 24.68%.

Choice Hotels International Profile

(

Free Report)

Choice Hotels International, Inc, together with its subsidiaries, operates as a hotel franchisor in the United States and internationally. It operates through Hotel Franchising & Management and Corporate & Other segments. The company franchises lodging properties under the brand names of Comfort Inn, Comfort Suites, Quality, Clarion, Clarion Pointe, Sleep Inn, Ascend Hotel Collection, Econo Lodge, Rodeway Inn, MainStay Suites, Suburban Studios, WoodSpring Suites, Everhome Suites, Cambria Hotels, Radisson Blu, Radisson RED, Radisson, Park Plaza, Country Inn & Suites by Radisson, Radisson Inn & Suites, Park Inn by Radisson, Radisson Individuals, and Radisson Collection.

Recommended Stories

Before you consider Choice Hotels International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Choice Hotels International wasn't on the list.

While Choice Hotels International currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report