Clean Harbors (NYSE:CLH - Get Free Report) will issue its quarterly earnings data before the market opens on Wednesday, October 30th. Analysts expect the company to announce earnings of $2.15 per share for the quarter. Individual that wish to register for the company's earnings conference call can do so using this link.

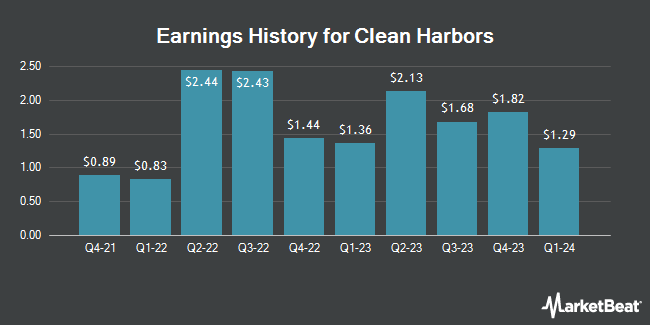

Clean Harbors (NYSE:CLH - Get Free Report) last posted its earnings results on Wednesday, July 31st. The business services provider reported $2.46 EPS for the quarter, beating analysts' consensus estimates of $2.21 by $0.25. Clean Harbors had a net margin of 6.97% and a return on equity of 17.12%. The company had revenue of $1.55 billion for the quarter, compared to analysts' expectations of $1.53 billion. During the same quarter in the prior year, the company posted $2.13 earnings per share. Clean Harbors's revenue for the quarter was up 10.9% compared to the same quarter last year. On average, analysts expect Clean Harbors to post $8 EPS for the current fiscal year and $9 EPS for the next fiscal year.

Clean Harbors Trading Down 0.5 %

Clean Harbors stock traded down $1.25 during trading on Wednesday, hitting $256.72. The company had a trading volume of 161,387 shares, compared to its average volume of 287,016. The stock has a market cap of $13.85 billion, a price-to-earnings ratio of 37.15 and a beta of 1.20. The company has a current ratio of 2.10, a quick ratio of 1.76 and a debt-to-equity ratio of 1.14. Clean Harbors has a 1-year low of $132.92 and a 1-year high of $261.81. The company's 50 day simple moving average is $245.10 and its 200-day simple moving average is $226.95.

Analyst Ratings Changes

A number of analysts have recently weighed in on CLH shares. Truist Financial upped their price objective on Clean Harbors from $240.00 to $260.00 and gave the stock a "buy" rating in a research report on Thursday, July 11th. Oppenheimer increased their price target on Clean Harbors from $252.00 to $270.00 and gave the company an "outperform" rating in a research report on Monday. Stifel Nicolaus reissued a "buy" rating and set a $275.00 price objective (up from $240.00) on shares of Clean Harbors in a research report on Thursday, August 1st. Needham & Company LLC raised their target price on shares of Clean Harbors from $235.00 to $274.00 and gave the company a "buy" rating in a report on Thursday, August 1st. Finally, StockNews.com upgraded shares of Clean Harbors from a "buy" rating to a "strong-buy" rating in a research note on Wednesday, October 16th. One research analyst has rated the stock with a hold rating, seven have assigned a buy rating and two have issued a strong buy rating to the company. According to MarketBeat.com, Clean Harbors currently has a consensus rating of "Buy" and a consensus target price of $250.89.

View Our Latest Analysis on CLH

Insider Transactions at Clean Harbors

In other news, CEO Michael Louis Battles sold 10,000 shares of the business's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $245.74, for a total transaction of $2,457,400.00. Following the transaction, the chief executive officer now directly owns 77,136 shares in the company, valued at $18,955,400.64. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. In other Clean Harbors news, Director Lauren States sold 309 shares of the stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $244.09, for a total value of $75,423.81. Following the completion of the transaction, the director now directly owns 13,458 shares of the company's stock, valued at approximately $3,284,963.22. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, CEO Michael Louis Battles sold 10,000 shares of Clean Harbors stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $245.74, for a total transaction of $2,457,400.00. Following the sale, the chief executive officer now owns 77,136 shares of the company's stock, valued at approximately $18,955,400.64. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 10,617 shares of company stock worth $2,613,132 over the last 90 days. 5.90% of the stock is currently owned by insiders.

About Clean Harbors

(

Get Free Report)

Clean Harbors, Inc provides environmental and industrial services in the United States and internationally. The company operates through two segments, Environmental Services and Safety-Kleen Sustainability Solutions. The Environmental Services segment collects, transports, treats, and disposes hazardous and non-hazardous waste, such as resource recovery, physical treatment, fuel blending, incineration, landfill disposal, wastewater treatment, lab chemicals disposal, and explosives management services; and offers CleanPack services, including collection, identification, categorization, specialized packaging, transportation, and disposal of laboratory chemicals and household hazardous waste.

See Also

Before you consider Clean Harbors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clean Harbors wasn't on the list.

While Clean Harbors currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.