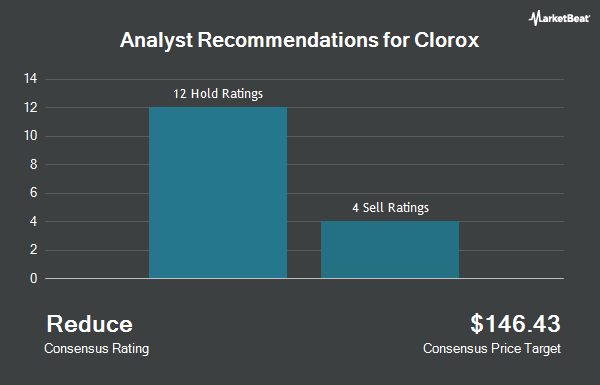

The Clorox Company (NYSE:CLX - Get Free Report) has received an average rating of "Reduce" from the fifteen analysts that are covering the firm, MarketBeat.com reports. Six equities research analysts have rated the stock with a sell recommendation, eight have given a hold recommendation and one has given a buy recommendation to the company. The average 1-year price target among brokerages that have updated their coverage on the stock in the last year is $150.14.

Several research analysts have recently weighed in on CLX shares. TD Cowen started coverage on shares of Clorox in a research report on Tuesday, July 23rd. They set a "sell" rating and a $122.00 price target on the stock. BNP Paribas raised shares of Clorox to a "strong sell" rating in a research note on Friday, September 6th. Evercore ISI cut their price target on shares of Clorox from $140.00 to $139.00 and set an "underperform" rating for the company in a report on Monday, October 14th. Deutsche Bank Aktiengesellschaft upped their price objective on Clorox from $144.00 to $151.00 and gave the company a "hold" rating in a report on Friday, August 2nd. Finally, JPMorgan Chase & Co. raised their target price on Clorox from $148.00 to $174.00 and gave the stock a "neutral" rating in a research note on Friday, October 11th.

Read Our Latest Stock Analysis on CLX

Insider Buying and Selling

In other Clorox news, EVP Angela C. Hilt sold 1,733 shares of the firm's stock in a transaction that occurred on Friday, September 6th. The shares were sold at an average price of $165.52, for a total value of $286,846.16. Following the completion of the transaction, the executive vice president now owns 13,471 shares of the company's stock, valued at $2,229,719.92. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. 0.51% of the stock is owned by insiders.

Institutional Investors Weigh In On Clorox

Large investors have recently bought and sold shares of the stock. Van ECK Associates Corp raised its holdings in shares of Clorox by 1,715.5% in the 2nd quarter. Van ECK Associates Corp now owns 1,461,207 shares of the company's stock valued at $199,411,000 after purchasing an additional 1,380,724 shares in the last quarter. Nuance Investments LLC lifted its holdings in Clorox by 150.6% during the 2nd quarter. Nuance Investments LLC now owns 1,597,674 shares of the company's stock worth $218,035,000 after buying an additional 960,094 shares during the last quarter. Wulff Hansen & CO. lifted its holdings in Clorox by 13,547.0% during the 2nd quarter. Wulff Hansen & CO. now owns 440,116 shares of the company's stock worth $60,063,000 after buying an additional 436,891 shares during the last quarter. Acadian Asset Management LLC boosted its position in shares of Clorox by 26.5% during the 1st quarter. Acadian Asset Management LLC now owns 882,526 shares of the company's stock worth $135,099,000 after acquiring an additional 184,847 shares in the last quarter. Finally, Bank of New York Mellon Corp increased its holdings in shares of Clorox by 14.4% in the 2nd quarter. Bank of New York Mellon Corp now owns 961,387 shares of the company's stock valued at $131,200,000 after acquiring an additional 120,716 shares during the last quarter. Hedge funds and other institutional investors own 78.53% of the company's stock.

Clorox Price Performance

NYSE CLX traded down $0.65 during trading hours on Friday, hitting $161.96. 682,801 shares of the company's stock traded hands, compared to its average volume of 1,230,643. The company has a market capitalization of $20.11 billion, a PE ratio of 83.92, a PEG ratio of 3.19 and a beta of 0.41. The company has a debt-to-equity ratio of 5.04, a current ratio of 1.03 and a quick ratio of 0.63. Clorox has a 52-week low of $114.68 and a 52-week high of $169.09. The firm's 50-day moving average is $159.28 and its 200-day moving average is $145.15.

Clorox (NYSE:CLX - Get Free Report) last posted its quarterly earnings results on Thursday, August 1st. The company reported $1.82 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.54 by $0.28. Clorox had a return on equity of 281.12% and a net margin of 3.95%. The business had revenue of $1.90 billion during the quarter, compared to analyst estimates of $1.97 billion. Equities analysts forecast that Clorox will post 6.64 EPS for the current fiscal year.

Clorox Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, November 7th. Investors of record on Wednesday, October 23rd will be issued a $1.22 dividend. This represents a $4.88 dividend on an annualized basis and a dividend yield of 3.01%. The ex-dividend date is Wednesday, October 23rd. Clorox's dividend payout ratio (DPR) is currently 252.85%.

About Clorox

(

Get Free ReportThe Clorox Company manufactures and markets consumer and professional products worldwide. It operates through four segments: Health and Wellness, Household, Lifestyle, and International. The Health and Wellness segment offers cleaning products, such as laundry additives and home care products primarily under the Clorox, Clorox2, Scentiva, Pine-Sol, Liquid-Plumr, Tilex, and Formula 409 brands; professional cleaning and disinfecting products under the CloroxPro and Clorox Healthcare brands; professional food service products under the Hidden Valley brand; and vitamins, minerals and supplement products under the RenewLife, Natural Vitality, NeoCell, and Rainbow Light brands in the United States.

Featured Stories

Before you consider Clorox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clorox wasn't on the list.

While Clorox currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.