Jade Capital Advisors LLC grew its stake in Compass Minerals International, Inc. (NYSE:CMP - Free Report) by 396.6% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 56,346 shares of the basic materials company's stock after buying an additional 45,000 shares during the period. Jade Capital Advisors LLC owned 0.14% of Compass Minerals International worth $677,000 as of its most recent filing with the Securities and Exchange Commission.

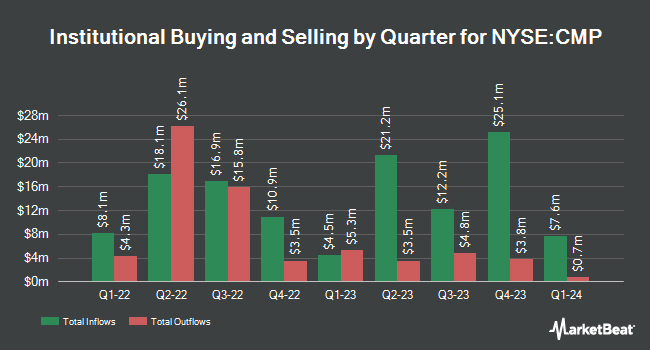

A number of other hedge funds also recently made changes to their positions in the stock. Vanguard Group Inc. raised its position in shares of Compass Minerals International by 3.6% in the 1st quarter. Vanguard Group Inc. now owns 4,579,361 shares of the basic materials company's stock worth $72,079,000 after acquiring an additional 160,632 shares in the last quarter. Thompson Siegel & Walmsley LLC lifted its stake in Compass Minerals International by 0.3% in the second quarter. Thompson Siegel & Walmsley LLC now owns 860,796 shares of the basic materials company's stock valued at $8,892,000 after buying an additional 2,167 shares during the period. Invenomic Capital Management LP bought a new position in shares of Compass Minerals International during the 1st quarter worth approximately $7,486,000. Bank of New York Mellon Corp grew its position in shares of Compass Minerals International by 10.8% during the 2nd quarter. Bank of New York Mellon Corp now owns 405,238 shares of the basic materials company's stock worth $4,186,000 after buying an additional 39,383 shares during the period. Finally, Cove Street Capital LLC increased its stake in shares of Compass Minerals International by 35.3% in the 1st quarter. Cove Street Capital LLC now owns 310,188 shares of the basic materials company's stock valued at $4,882,000 after acquiring an additional 80,980 shares in the last quarter. 99.78% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several research firms have weighed in on CMP. BMO Capital Markets reaffirmed a "market perform" rating and issued a $20.00 price target on shares of Compass Minerals International in a research note on Wednesday, September 18th. StockNews.com upgraded shares of Compass Minerals International to a "sell" rating in a report on Wednesday, September 18th. One research analyst has rated the stock with a sell rating, two have given a hold rating and two have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, Compass Minerals International currently has a consensus rating of "Hold" and a consensus price target of $31.00.

Read Our Latest Stock Analysis on Compass Minerals International

Compass Minerals International Stock Performance

Compass Minerals International stock traded up $0.08 during mid-day trading on Tuesday, reaching $13.38. 413,738 shares of the company's stock were exchanged, compared to its average volume of 823,341. The business's fifty day simple moving average is $10.59 and its 200 day simple moving average is $11.72. The company has a quick ratio of 1.15, a current ratio of 2.98 and a debt-to-equity ratio of 2.25. Compass Minerals International, Inc. has a one year low of $7.51 and a one year high of $27.25. The firm has a market capitalization of $553.05 million, a PE ratio of -6.37 and a beta of 1.11.

Compass Minerals International (NYSE:CMP - Get Free Report) last posted its quarterly earnings results on Tuesday, September 17th. The basic materials company reported ($1.01) earnings per share for the quarter, missing the consensus estimate of ($0.67) by ($0.34). Compass Minerals International had a negative net margin of 14.81% and a positive return on equity of 4.53%. The company had revenue of $202.90 million for the quarter, compared to the consensus estimate of $201.86 million. On average, sell-side analysts expect that Compass Minerals International, Inc. will post 0.31 earnings per share for the current year.

Compass Minerals International Profile

(

Free Report)

Compass Minerals International, Inc, provides essential minerals in the United States, Canada, the United Kingdom, and internationally. It operates through two segments, Salt and Plant Nutrition. The Salt segment produces, markets, and sells sodium chloride and magnesium chloride, including rock salt, mechanically and solar evaporated salt, and brine and flake magnesium chloride products; and purchases potassium chloride and calcium chloride to sell as finished products or to blend with sodium chloride to produce specialty products.

Featured Articles

Before you consider Compass Minerals International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Compass Minerals International wasn't on the list.

While Compass Minerals International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.