Centene (NYSE:CNC - Get Free Report) was downgraded by analysts at StockNews.com from a "strong-buy" rating to a "buy" rating in a research report issued on Monday.

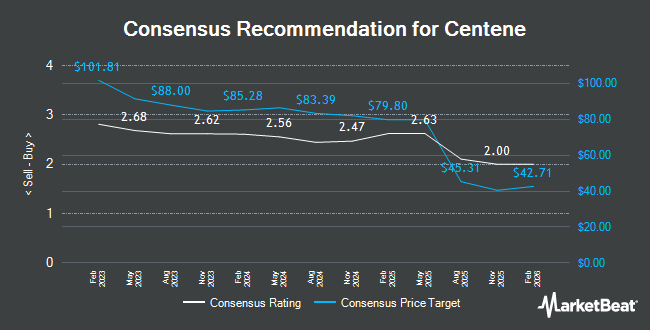

CNC has been the subject of a number of other reports. JPMorgan Chase & Co. decreased their price objective on shares of Centene from $85.00 to $80.00 and set a "neutral" rating for the company in a report on Wednesday, July 10th. Barclays lowered their price objective on Centene from $98.00 to $97.00 and set an "overweight" rating on the stock in a report on Thursday, September 5th. Wells Fargo & Company reduced their target price on Centene from $93.00 to $91.00 and set an "overweight" rating for the company in a report on Friday, September 13th. Stephens reiterated an "equal weight" rating and set a $78.00 price target on shares of Centene in a report on Monday, August 5th. Finally, Jefferies Financial Group cut shares of Centene from a "buy" rating to a "hold" rating and reduced their price objective for the stock from $83.00 to $69.00 in a research note on Wednesday, July 24th. Seven research analysts have rated the stock with a hold rating and seven have given a buy rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $84.17.

View Our Latest Stock Analysis on CNC

Centene Stock Down 4.0 %

Shares of CNC traded down $2.56 during midday trading on Monday, reaching $61.66. 8,621,622 shares of the stock were exchanged, compared to its average volume of 3,818,189. The company has a market cap of $32.91 billion, a price-to-earnings ratio of 12.26, a P/E/G ratio of 0.98 and a beta of 0.48. The firm has a 50 day simple moving average of $72.55 and a 200-day simple moving average of $72.24. Centene has a 12-month low of $59.77 and a 12-month high of $81.42. The company has a quick ratio of 1.17, a current ratio of 1.17 and a debt-to-equity ratio of 0.64.

Centene (NYSE:CNC - Get Free Report) last posted its earnings results on Friday, July 26th. The company reported $2.42 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $2.44 by ($0.02). Centene had a net margin of 1.79% and a return on equity of 14.45%. The business had revenue of $39.84 billion during the quarter, compared to analyst estimates of $36.83 billion. During the same quarter last year, the firm earned $2.10 earnings per share. Centene's revenue was up 5.9% compared to the same quarter last year. Research analysts forecast that Centene will post 6.8 EPS for the current year.

Hedge Funds Weigh In On Centene

Several institutional investors and hedge funds have recently added to or reduced their stakes in the company. Swedbank AB bought a new stake in shares of Centene during the first quarter valued at approximately $914,080,000. Capital International Investors raised its stake in shares of Centene by 60.2% in the 1st quarter. Capital International Investors now owns 5,216,486 shares of the company's stock valued at $409,390,000 after buying an additional 1,959,460 shares in the last quarter. AQR Capital Management LLC lifted its holdings in shares of Centene by 22.9% during the 2nd quarter. AQR Capital Management LLC now owns 4,461,517 shares of the company's stock worth $295,799,000 after acquiring an additional 832,318 shares during the period. Legal & General Group Plc increased its stake in Centene by 14.2% in the second quarter. Legal & General Group Plc now owns 5,113,759 shares of the company's stock valued at $339,042,000 after acquiring an additional 636,683 shares during the period. Finally, Skandinaviska Enskilda Banken AB publ grew its stake in shares of Centene by 42.3% in the 2nd quarter. Skandinaviska Enskilda Banken AB publ now owns 1,400,276 shares of the company's stock valued at $92,838,000 after purchasing an additional 416,003 shares during the period. 93.63% of the stock is currently owned by institutional investors.

Centene Company Profile

(

Get Free Report)

Centene Corporation operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, commercial organizations, and military families in the United States. The company operates through Medicaid, Medicare, Commercial, and Other segments. The Medicaid segment offers health plan coverage, including medicaid expansion, aged, blind, disabled, children's health insurance program, foster care, medicare-medicaid plans, long-term services and support.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Centene, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Centene wasn't on the list.

While Centene currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.