Nisa Investment Advisors LLC trimmed its holdings in shares of Centene Co. (NYSE:CNC - Free Report) by 4.3% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 220,086 shares of the company's stock after selling 9,871 shares during the quarter. Nisa Investment Advisors LLC's holdings in Centene were worth $16,568,000 as of its most recent filing with the Securities & Exchange Commission.

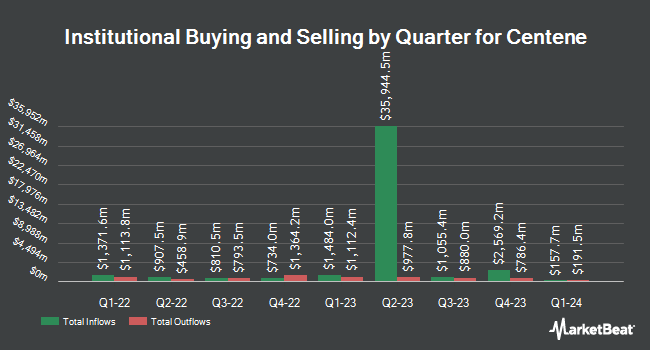

A number of other institutional investors have also added to or reduced their stakes in the business. Park Place Capital Corp lifted its stake in Centene by 1,190.0% during the third quarter. Park Place Capital Corp now owns 387 shares of the company's stock worth $29,000 after purchasing an additional 357 shares during the last quarter. WR Wealth Planners LLC increased its stake in Centene by 41.4% in the 2nd quarter. WR Wealth Planners LLC now owns 468 shares of the company's stock worth $31,000 after purchasing an additional 137 shares during the period. Chris Bulman Inc purchased a new stake in shares of Centene during the second quarter valued at approximately $33,000. Riverview Trust Co increased its stake in shares of Centene by 154.6% in the second quarter. Riverview Trust Co now owns 527 shares of the company's stock worth $35,000 after buying an additional 320 shares during the period. Finally, Thurston Springer Miller Herd & Titak Inc. bought a new stake in Centene during the 2nd quarter valued at $36,000. 93.63% of the stock is currently owned by institutional investors.

Centene Stock Up 1.8 %

Shares of NYSE:CNC traded up $1.08 during trading on Wednesday, reaching $61.70. 3,262,711 shares of the stock traded hands, compared to its average volume of 3,826,914. The stock has a market cap of $32.93 billion, a P/E ratio of 12.23, a price-to-earnings-growth ratio of 0.98 and a beta of 0.48. Centene Co. has a 52-week low of $59.77 and a 52-week high of $81.42. The company has a debt-to-equity ratio of 0.64, a quick ratio of 1.17 and a current ratio of 1.17. The stock has a 50-day moving average of $72.20 and a two-hundred day moving average of $72.17.

Analyst Upgrades and Downgrades

A number of research analysts have commented on CNC shares. Barclays lowered their price target on Centene from $97.00 to $91.00 and set an "overweight" rating for the company in a research report on Tuesday. TD Cowen boosted their price objective on shares of Centene from $80.00 to $89.00 and gave the company a "buy" rating in a research report on Wednesday, July 31st. StockNews.com cut shares of Centene from a "strong-buy" rating to a "buy" rating in a research report on Monday. Jefferies Financial Group downgraded shares of Centene from a "buy" rating to a "hold" rating and decreased their price target for the stock from $83.00 to $69.00 in a research note on Wednesday, July 24th. Finally, Truist Financial reduced their target price on Centene from $92.00 to $89.00 and set a "buy" rating on the stock in a report on Monday, July 15th. Seven analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $83.67.

View Our Latest Stock Report on CNC

Centene Profile

(

Free Report)

Centene Corporation operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, commercial organizations, and military families in the United States. The company operates through Medicaid, Medicare, Commercial, and Other segments. The Medicaid segment offers health plan coverage, including medicaid expansion, aged, blind, disabled, children's health insurance program, foster care, medicare-medicaid plans, long-term services and support.

Read More

Before you consider Centene, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Centene wasn't on the list.

While Centene currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.