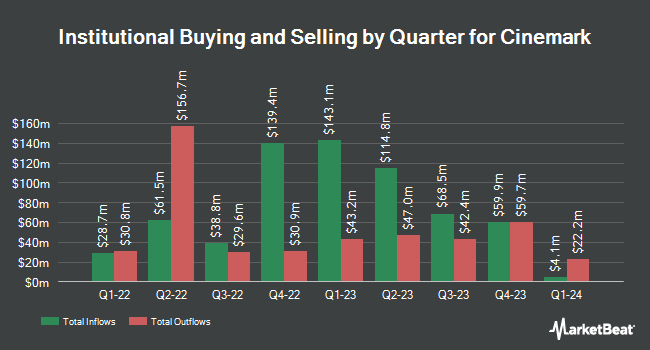

Tectonic Advisors LLC reduced its holdings in shares of Cinemark Holdings, Inc. (NYSE:CNK - Free Report) by 43.3% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 25,152 shares of the company's stock after selling 19,242 shares during the period. Tectonic Advisors LLC's holdings in Cinemark were worth $700,000 at the end of the most recent quarter.

Other large investors have also recently added to or reduced their stakes in the company. Sei Investments Co. increased its stake in Cinemark by 38.1% during the 1st quarter. Sei Investments Co. now owns 115,124 shares of the company's stock worth $2,069,000 after buying an additional 31,739 shares during the period. PEAK6 Investments LLC purchased a new stake in shares of Cinemark in the 1st quarter valued at approximately $2,274,000. Barrow Hanley Mewhinney & Strauss LLC increased its position in shares of Cinemark by 18.1% in the 2nd quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 676,652 shares of the company's stock valued at $14,629,000 after purchasing an additional 103,875 shares during the last quarter. US Bancorp DE increased its position in shares of Cinemark by 68.8% in the 1st quarter. US Bancorp DE now owns 34,846 shares of the company's stock valued at $626,000 after purchasing an additional 14,200 shares during the last quarter. Finally, Maverick Capital Ltd. purchased a new stake in shares of Cinemark in the 2nd quarter valued at approximately $2,253,000.

Cinemark Stock Performance

NYSE:CNK traded up $0.48 during trading hours on Friday, reaching $28.69. 2,046,555 shares of the company's stock were exchanged, compared to its average volume of 2,849,655. The firm has a market capitalization of $3.51 billion, a price-to-earnings ratio of 19.79, a P/E/G ratio of 1.94 and a beta of 2.36. The company has a 50-day moving average of $28.00 and a 200 day moving average of $22.78. The company has a quick ratio of 1.26, a current ratio of 1.29 and a debt-to-equity ratio of 6.23. Cinemark Holdings, Inc. has a 1-year low of $13.19 and a 1-year high of $29.87.

Cinemark (NYSE:CNK - Get Free Report) last issued its quarterly earnings results on Friday, August 2nd. The company reported $0.32 earnings per share for the quarter, topping analysts' consensus estimates of $0.07 by $0.25. Cinemark had a net margin of 5.05% and a return on equity of 41.87%. The firm had revenue of $734.20 million during the quarter, compared to analysts' expectations of $691.74 million. During the same quarter in the prior year, the business earned $0.80 EPS. Cinemark's quarterly revenue was down 22.1% compared to the same quarter last year. Research analysts anticipate that Cinemark Holdings, Inc. will post 1.41 EPS for the current year.

Insider Transactions at Cinemark

In other news, insider Valmir Fernandes sold 25,000 shares of the firm's stock in a transaction on Monday, August 19th. The shares were sold at an average price of $27.19, for a total value of $679,750.00. Following the completion of the sale, the insider now owns 204,729 shares in the company, valued at approximately $5,566,581.51. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Company insiders own 2.30% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have commented on CNK shares. Wedbush increased their price objective on shares of Cinemark from $28.00 to $31.00 and gave the company an "outperform" rating in a research report on Tuesday, September 3rd. The Goldman Sachs Group upped their target price on shares of Cinemark from $16.00 to $20.00 and gave the company a "sell" rating in a report on Thursday, September 19th. B. Riley cut shares of Cinemark from a "buy" rating to a "neutral" rating and set a $31.00 target price for the company. in a report on Tuesday, August 27th. Wells Fargo & Company upped their target price on shares of Cinemark from $28.00 to $31.00 and gave the company an "overweight" rating in a report on Thursday, October 10th. Finally, Benchmark restated a "buy" rating and issued a $23.00 target price on shares of Cinemark in a report on Monday, July 1st. Two equities research analysts have rated the stock with a sell rating, three have assigned a hold rating, six have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, Cinemark currently has an average rating of "Moderate Buy" and a consensus price target of $28.10.

Read Our Latest Analysis on Cinemark

Cinemark Company Profile

(

Free Report)

Cinemark Holdings, Inc, together with its subsidiaries, engages in the motion picture exhibition business. As of February 16, 2024, it operated 501 theatres with 5,719 screens in 42 states and 13 countries in South and Central America. Cinemark Holdings, Inc was founded in 1984 and is headquartered in Plano, Texas.

See Also

Before you consider Cinemark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cinemark wasn't on the list.

While Cinemark currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.