Emory University decreased its position in Coursera, Inc. (NYSE:COUR - Free Report) by 25.0% during the 3rd quarter, according to its most recent filing with the SEC. The institutional investor owned 692,766 shares of the company's stock after selling 231,000 shares during the period. Coursera comprises 8.3% of Emory University's portfolio, making the stock its 4th biggest position. Emory University owned about 0.44% of Coursera worth $5,501,000 at the end of the most recent reporting period.

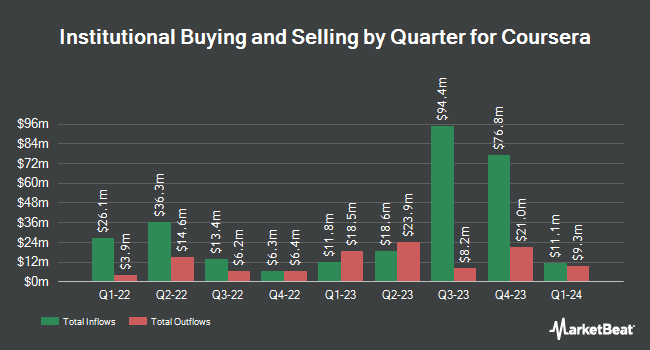

Other large investors have also recently bought and sold shares of the company. Natixis acquired a new position in Coursera during the 1st quarter worth approximately $35,000. CWM LLC boosted its position in Coursera by 7,568.6% during the 2nd quarter. CWM LLC now owns 3,911 shares of the company's stock worth $28,000 after acquiring an additional 3,860 shares during the last quarter. Covestor Ltd boosted its position in Coursera by 72.9% during the 1st quarter. Covestor Ltd now owns 4,378 shares of the company's stock worth $61,000 after acquiring an additional 1,846 shares during the last quarter. nVerses Capital LLC boosted its position in Coursera by 26.1% during the 2nd quarter. nVerses Capital LLC now owns 8,700 shares of the company's stock worth $62,000 after acquiring an additional 1,800 shares during the last quarter. Finally, LGT Group Foundation acquired a new stake in shares of Coursera in the 2nd quarter valued at approximately $73,000. Institutional investors and hedge funds own 89.55% of the company's stock.

Coursera Price Performance

Coursera stock traded down $0.05 during mid-day trading on Wednesday, hitting $7.05. 1,815,734 shares of the company's stock traded hands, compared to its average volume of 2,222,459. The firm has a 50 day simple moving average of $7.73 and a two-hundred day simple moving average of $8.13. Coursera, Inc. has a fifty-two week low of $6.29 and a fifty-two week high of $21.26. The stock has a market cap of $1.11 billion, a price-to-earnings ratio of -13.82 and a beta of 1.42.

Analyst Ratings Changes

Several equities research analysts have recently commented on the company. BMO Capital Markets cut their price objective on Coursera from $10.00 to $9.00 and set an "outperform" rating for the company in a report on Friday, October 25th. Bank of America assumed coverage on Coursera in a report on Thursday, September 19th. They issued a "buy" rating and a $11.00 price objective for the company. Morgan Stanley cut their price objective on Coursera from $15.00 to $10.00 and set an "overweight" rating for the company in a report on Friday, October 25th. Royal Bank of Canada cut their price objective on Coursera from $18.00 to $10.00 and set an "outperform" rating for the company in a report on Friday, October 25th. Finally, The Goldman Sachs Group cut their price objective on Coursera from $9.00 to $7.25 and set a "sell" rating for the company in a report on Friday, October 25th. One investment analyst has rated the stock with a sell rating, one has issued a hold rating and nine have assigned a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $10.93.

View Our Latest Stock Analysis on Coursera

Insider Buying and Selling at Coursera

In other Coursera news, SVP Alan B. Cardenas sold 6,285 shares of the firm's stock in a transaction on Monday, August 19th. The stock was sold at an average price of $8.27, for a total transaction of $51,976.95. Following the completion of the sale, the senior vice president now owns 207,434 shares of the company's stock, valued at $1,715,479.18. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. In other Coursera news, Director Andrew Y. Ng sold 25,000 shares of the stock in a transaction on Wednesday, August 21st. The stock was sold at an average price of $8.40, for a total transaction of $210,000.00. Following the transaction, the director now owns 7,203,892 shares in the company, valued at $60,512,692.80. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, SVP Alan B. Cardenas sold 6,285 shares of the stock in a transaction on Monday, August 19th. The stock was sold at an average price of $8.27, for a total value of $51,976.95. Following the transaction, the senior vice president now owns 207,434 shares in the company, valued at $1,715,479.18. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 39,068 shares of company stock valued at $324,787 in the last quarter. 16.30% of the stock is currently owned by insiders.

About Coursera

(

Free Report)

Coursera, Inc operates an online educational content platform in the United States, Europe, Africa, the Asia Pacific, the Middle East, and internationally. It operates in three segments: Consumer, Enterprise, and Degrees. The company offers guided projects, courses, and specializations, as well as online degrees; and certificates for entry-level professional, non-entry level professional, university, and MasterTrack.

See Also

Before you consider Coursera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coursera wasn't on the list.

While Coursera currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.