Camden Property Trust (NYSE:CPT - Get Free Report) was downgraded by analysts at StockNews.com from a "hold" rating to a "sell" rating in a report released on Friday.

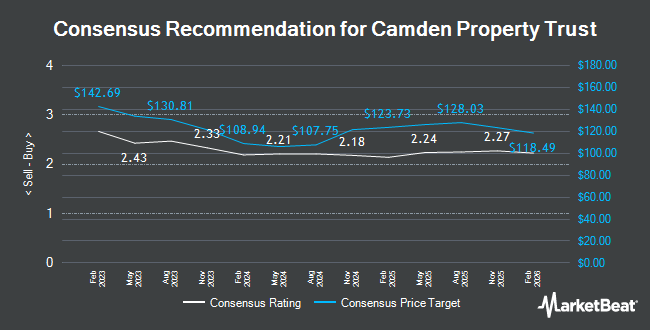

Several other research firms also recently weighed in on CPT. Deutsche Bank Aktiengesellschaft lifted their target price on Camden Property Trust from $90.00 to $115.00 and gave the company a "hold" rating in a research report on Tuesday, September 10th. Royal Bank of Canada cut Camden Property Trust from an "outperform" rating to a "sector perform" rating and set a $122.00 price objective on the stock. in a research report on Monday, September 9th. Jefferies Financial Group assumed coverage on shares of Camden Property Trust in a report on Friday, October 11th. They issued a "hold" rating and a $123.00 target price for the company. Bank of America upgraded shares of Camden Property Trust from an "underperform" rating to a "buy" rating and upped their price target for the stock from $111.00 to $147.00 in a research report on Monday, August 12th. Finally, Wells Fargo & Company upgraded shares of Camden Property Trust from an "underweight" rating to an "equal weight" rating and raised their price objective for the company from $104.00 to $127.00 in a research report on Monday, August 26th. One equities research analyst has rated the stock with a sell rating, fourteen have issued a hold rating and five have given a buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $121.76.

Check Out Our Latest Stock Report on Camden Property Trust

Camden Property Trust Stock Performance

Shares of NYSE CPT traded down $2.06 during midday trading on Friday, hitting $113.73. 2,376,625 shares of the company's stock traded hands, compared to its average volume of 992,370. The company has a debt-to-equity ratio of 0.72, a quick ratio of 0.37 and a current ratio of 0.37. The stock has a market capitalization of $12.13 billion, a price-to-earnings ratio of 31.24, a price-to-earnings-growth ratio of 4.40 and a beta of 0.90. The firm has a fifty day moving average of $122.21 and a 200 day moving average of $113.12. Camden Property Trust has a 1 year low of $85.30 and a 1 year high of $127.69.

Camden Property Trust (NYSE:CPT - Get Free Report) last released its quarterly earnings results on Thursday, August 1st. The real estate investment trust reported $0.40 earnings per share for the quarter, missing the consensus estimate of $1.67 by ($1.27). Camden Property Trust had a return on equity of 7.98% and a net margin of 25.64%. The business had revenue of $387.15 million during the quarter, compared to the consensus estimate of $384.76 million. During the same quarter in the previous year, the business posted $1.70 earnings per share. On average, analysts forecast that Camden Property Trust will post 6.78 earnings per share for the current year.

Institutional Investors Weigh In On Camden Property Trust

Hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Kings Path Partners LLC purchased a new stake in Camden Property Trust during the 2nd quarter valued at $33,000. Federated Hermes Inc. bought a new stake in shares of Camden Property Trust in the 2nd quarter worth about $33,000. Family Firm Inc. purchased a new position in shares of Camden Property Trust during the 2nd quarter worth about $39,000. Versant Capital Management Inc boosted its stake in shares of Camden Property Trust by 2,187.5% during the 2nd quarter. Versant Capital Management Inc now owns 366 shares of the real estate investment trust's stock worth $40,000 after purchasing an additional 350 shares during the period. Finally, American Capital Advisory LLC raised its position in Camden Property Trust by 42.7% in the 3rd quarter. American Capital Advisory LLC now owns 428 shares of the real estate investment trust's stock worth $53,000 after purchasing an additional 128 shares during the period. 97.22% of the stock is currently owned by hedge funds and other institutional investors.

Camden Property Trust Company Profile

(

Get Free Report)

Camden Property Trust, an S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Camden owns and operates 172 properties containing 58,250 apartment homes across the United States.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Camden Property Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Camden Property Trust wasn't on the list.

While Camden Property Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.