Koss Olinger Consulting LLC bought a new stake in shares of Crescent Energy (NYSE:CRGY - Free Report) in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm bought 48,712 shares of the company's stock, valued at approximately $533,000.

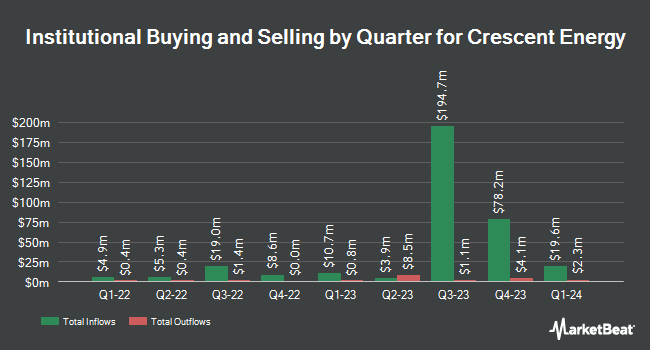

Several other large investors have also recently made changes to their positions in CRGY. American Century Companies Inc. increased its stake in Crescent Energy by 444.8% during the 2nd quarter. American Century Companies Inc. now owns 7,775,940 shares of the company's stock valued at $92,145,000 after purchasing an additional 6,348,598 shares in the last quarter. Marshall Wace LLP increased its position in shares of Crescent Energy by 286.7% during the second quarter. Marshall Wace LLP now owns 2,830,118 shares of the company's stock valued at $33,537,000 after acquiring an additional 2,098,303 shares in the last quarter. Zimmer Partners LP purchased a new position in Crescent Energy in the 1st quarter worth approximately $17,731,000. Dimensional Fund Advisors LP raised its holdings in Crescent Energy by 85.7% in the 2nd quarter. Dimensional Fund Advisors LP now owns 2,656,222 shares of the company's stock worth $31,477,000 after acquiring an additional 1,226,027 shares during the last quarter. Finally, Vanguard Group Inc. lifted its position in Crescent Energy by 13.9% in the 1st quarter. Vanguard Group Inc. now owns 9,308,793 shares of the company's stock valued at $110,775,000 after acquiring an additional 1,137,367 shares in the last quarter. 52.11% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several equities analysts have issued reports on the stock. Evercore ISI restated an "outperform" rating and set a $17.00 target price on shares of Crescent Energy in a research note on Tuesday, September 24th. Wolfe Research began coverage on shares of Crescent Energy in a research report on Thursday, July 18th. They set an "outperform" rating and a $16.00 price objective on the stock. Stephens restated an "overweight" rating and issued a $20.00 target price on shares of Crescent Energy in a report on Tuesday, August 6th. Truist Financial decreased their target price on shares of Crescent Energy from $19.00 to $15.00 and set a "buy" rating for the company in a research note on Monday, September 30th. Finally, Mizuho lowered their price target on Crescent Energy from $14.00 to $13.00 and set a "neutral" rating on the stock in a report on Monday, September 16th. Two research analysts have rated the stock with a hold rating, six have given a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat, Crescent Energy has an average rating of "Buy" and a consensus price target of $16.10.

Check Out Our Latest Analysis on CRGY

Crescent Energy Price Performance

Shares of NYSE CRGY traded down $0.12 during mid-day trading on Monday, reaching $12.30. The company's stock had a trading volume of 1,774,415 shares, compared to its average volume of 2,387,917. The company has a debt-to-equity ratio of 1.13, a current ratio of 1.87 and a quick ratio of 1.87. Crescent Energy has a 52 week low of $9.88 and a 52 week high of $13.85. The stock has a fifty day moving average of $11.60 and a two-hundred day moving average of $11.72. The firm has a market capitalization of $2.18 billion, a PE ratio of -61.50 and a beta of 2.19.

Crescent Energy (NYSE:CRGY - Get Free Report) last released its earnings results on Monday, August 5th. The company reported $0.31 EPS for the quarter, topping the consensus estimate of $0.26 by $0.05. The firm had revenue of $653.28 million for the quarter, compared to the consensus estimate of $619.00 million. Crescent Energy had a net margin of 0.61% and a return on equity of 13.41%. As a group, sell-side analysts anticipate that Crescent Energy will post 1.28 EPS for the current fiscal year.

Crescent Energy Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Tuesday, September 3rd. Shareholders of record on Monday, August 19th were issued a dividend of $0.12 per share. This represents a $0.48 annualized dividend and a yield of 3.90%. The ex-dividend date of this dividend was Monday, August 19th. Crescent Energy's dividend payout ratio is presently -240.00%.

Insiders Place Their Bets

In other Crescent Energy news, Director Michael Duginski acquired 9,344 shares of the stock in a transaction on Thursday, August 8th. The stock was acquired at an average price of $10.62 per share, for a total transaction of $99,233.28. Following the completion of the transaction, the director now directly owns 201,081 shares of the company's stock, valued at $2,135,480.22. This trade represents a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Insiders have bought a total of 12,294 shares of company stock valued at $131,297 in the last quarter. 13.20% of the stock is currently owned by insiders.

About Crescent Energy

(

Free Report)

Crescent Energy Company acquires, develops, and produces crude oil, natural gas, and natural gas liquids (NGLs) reserves. Its portfolio of assets comprises mid-cycle unconventional and conventional assets in the Eagle Ford and Uinta Basins. It also owns and operates various midstream assets, which provide services to customers.

Recommended Stories

Before you consider Crescent Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crescent Energy wasn't on the list.

While Crescent Energy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.