New York State Teachers Retirement System lessened its stake in Carlisle Companies Incorporated (NYSE:CSL - Free Report) by 10.5% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 43,357 shares of the conglomerate's stock after selling 5,100 shares during the quarter. New York State Teachers Retirement System owned about 0.09% of Carlisle Companies worth $19,500,000 at the end of the most recent reporting period.

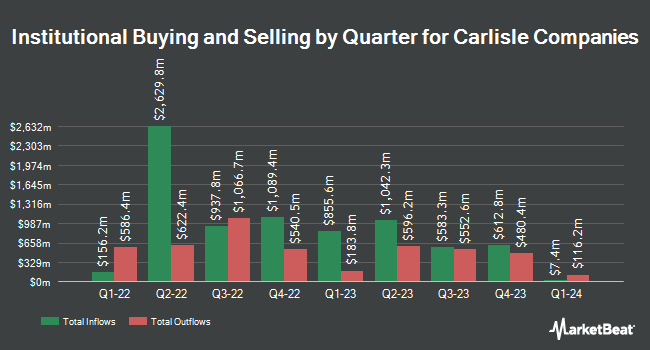

Other large investors also recently bought and sold shares of the company. CANADA LIFE ASSURANCE Co grew its holdings in Carlisle Companies by 7.4% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 68,008 shares of the conglomerate's stock valued at $26,631,000 after purchasing an additional 4,692 shares in the last quarter. Daiwa Securities Group Inc. lifted its stake in shares of Carlisle Companies by 51.2% in the first quarter. Daiwa Securities Group Inc. now owns 13,045 shares of the conglomerate's stock worth $5,112,000 after acquiring an additional 4,415 shares in the last quarter. BI Asset Management Fondsmaeglerselskab A S boosted its holdings in Carlisle Companies by 887.3% in the first quarter. BI Asset Management Fondsmaeglerselskab A S now owns 13,891 shares of the conglomerate's stock valued at $5,443,000 after purchasing an additional 12,484 shares during the last quarter. Silver Lake Advisory LLC acquired a new stake in Carlisle Companies during the 2nd quarter valued at approximately $608,000. Finally, Empowered Funds LLC increased its holdings in Carlisle Companies by 1,523.0% during the 1st quarter. Empowered Funds LLC now owns 11,020 shares of the conglomerate's stock worth $4,318,000 after purchasing an additional 10,341 shares during the last quarter. Institutional investors and hedge funds own 89.52% of the company's stock.

Analysts Set New Price Targets

Several research firms have recently commented on CSL. Robert W. Baird reduced their target price on Carlisle Companies from $506.00 to $500.00 and set an "outperform" rating for the company in a research note on Friday, October 25th. StockNews.com lowered shares of Carlisle Companies from a "buy" rating to a "hold" rating in a report on Tuesday, August 27th. Finally, Oppenheimer upped their target price on shares of Carlisle Companies from $480.00 to $505.00 and gave the company an "outperform" rating in a research note on Tuesday, October 22nd. One investment analyst has rated the stock with a hold rating and four have issued a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $475.00.

Check Out Our Latest Stock Analysis on Carlisle Companies

Carlisle Companies Stock Performance

Carlisle Companies stock traded up $0.03 during mid-day trading on Friday, reaching $422.26. The company's stock had a trading volume of 296,610 shares, compared to its average volume of 326,342. The firm has a market cap of $19.14 billion, a price-to-earnings ratio of 14.94, a PEG ratio of 1.38 and a beta of 0.91. Carlisle Companies Incorporated has a twelve month low of $259.74 and a twelve month high of $481.26. The business has a 50 day moving average price of $435.55 and a 200-day moving average price of $417.49. The company has a current ratio of 2.72, a quick ratio of 2.50 and a debt-to-equity ratio of 0.68.

Carlisle Companies (NYSE:CSL - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The conglomerate reported $5.78 EPS for the quarter, missing the consensus estimate of $5.82 by ($0.04). The business had revenue of $1.33 billion during the quarter, compared to analyst estimates of $1.38 billion. Carlisle Companies had a net margin of 27.05% and a return on equity of 33.29%. The company's quarterly revenue was up 5.9% on a year-over-year basis. During the same period last year, the firm posted $4.68 earnings per share. Sell-side analysts predict that Carlisle Companies Incorporated will post 20.36 EPS for the current fiscal year.

Carlisle Companies Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, January 2nd. Investors of record on Friday, November 15th will be given a dividend of $1.00 per share. This represents a $4.00 dividend on an annualized basis and a yield of 0.95%. Carlisle Companies's dividend payout ratio is currently 14.15%.

Carlisle Companies Company Profile

(

Free Report)

Carlisle Companies Incorporated operates as a manufacturer and supplier of building envelope products and solutions in the United States, Europe, North America, Asia and the Middle East, Africa, and internationally. It operates through two segments: Carlisle Construction Materials and Carlisle Weatherproofing Technologies.

Featured Articles

Before you consider Carlisle Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carlisle Companies wasn't on the list.

While Carlisle Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.