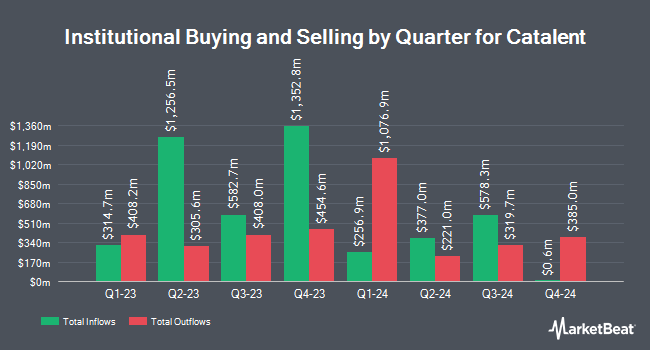

Norris Perne & French LLP MI cut its stake in Catalent, Inc. (NYSE:CTLT - Free Report) by 10.0% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The fund owned 274,761 shares of the company's stock after selling 30,393 shares during the period. Norris Perne & French LLP MI owned approximately 0.15% of Catalent worth $16,642,000 as of its most recent SEC filing.

Other institutional investors have also recently bought and sold shares of the company. Gamco Investors INC. ET AL lifted its stake in shares of Catalent by 403.3% in the 1st quarter. Gamco Investors INC. ET AL now owns 25,300 shares of the company's stock valued at $1,428,000 after purchasing an additional 20,273 shares in the last quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. increased its position in shares of Catalent by 2,792.9% in the first quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 516,390 shares of the company's stock worth $29,150,000 after acquiring an additional 498,540 shares in the last quarter. UniSuper Management Pty Ltd raised its stake in shares of Catalent by 509.4% in the 1st quarter. UniSuper Management Pty Ltd now owns 18,204 shares of the company's stock valued at $1,028,000 after acquiring an additional 15,217 shares during the period. Swedbank AB acquired a new position in shares of Catalent during the 1st quarter valued at $1,659,000. Finally, SG Americas Securities LLC lifted its holdings in shares of Catalent by 147.4% during the 1st quarter. SG Americas Securities LLC now owns 99,588 shares of the company's stock valued at $5,622,000 after acquiring an additional 59,339 shares in the last quarter.

Analyst Ratings Changes

CTLT has been the topic of several research reports. William Blair reissued a "market perform" rating on shares of Catalent in a research report on Tuesday, September 3rd. StockNews.com assumed coverage on Catalent in a research note on Saturday, October 12th. They set a "hold" rating for the company. Robert W. Baird restated a "neutral" rating and set a $63.50 price objective on shares of Catalent in a research note on Tuesday, September 24th. Baird R W downgraded Catalent from a "strong-buy" rating to a "hold" rating in a report on Tuesday, September 24th. Finally, Royal Bank of Canada reiterated a "sector perform" rating and set a $63.50 target price on shares of Catalent in a research note on Thursday, July 11th. Nine equities research analysts have rated the stock with a hold rating, According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $59.83.

Read Our Latest Stock Report on Catalent

Catalent Stock Performance

CTLT stock traded up $0.13 during trading on Friday, hitting $58.73. 1,703,825 shares of the company's stock traded hands, compared to its average volume of 2,040,898. The stock has a market capitalization of $10.66 billion, a price-to-earnings ratio of -10.69, a price-to-earnings-growth ratio of 2.07 and a beta of 1.15. Catalent, Inc. has a 52 week low of $32.38 and a 52 week high of $61.20. The stock has a fifty day moving average price of $60.07 and a two-hundred day moving average price of $57.93. The company has a quick ratio of 1.96, a current ratio of 2.52 and a debt-to-equity ratio of 1.35.

Catalent (NYSE:CTLT - Get Free Report) last announced its quarterly earnings data on Thursday, August 29th. The company reported $0.57 earnings per share for the quarter, beating analysts' consensus estimates of $0.44 by $0.13. Catalent had a negative net margin of 22.72% and a negative return on equity of 0.56%. The business had revenue of $1.30 billion during the quarter, compared to the consensus estimate of $1.23 billion. As a group, equities analysts anticipate that Catalent, Inc. will post 0.95 EPS for the current fiscal year.

Insider Buying and Selling

In other Catalent news, insider David Mcerlane sold 1,994 shares of the stock in a transaction on Thursday, September 26th. The stock was sold at an average price of $59.97, for a total value of $119,580.18. Following the sale, the insider now directly owns 36,304 shares of the company's stock, valued at $2,177,150.88. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Company insiders own 0.31% of the company's stock.

Catalent Profile

(

Free Report)

Catalent, Inc, together with its subsidiaries, develops and manufactures solutions for drugs, protein-based biologics, cell and gene therapies, and consumer health products worldwide. It operates in two segments, Biologics, and Pharma and Consumer Health. The Biologics segment provides formulation, development, and manufacturing for biologic proteins, cell gene, and other nucleic acid therapies; pDNA, iPSCs, oncolytic viruses, and vaccines; formulation, development, and manufacturing for parenteral dose forms, including vials, prefilled syringes, and cartridges; and analytical development and testing services for large molecules.

Read More

Before you consider Catalent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Catalent wasn't on the list.

While Catalent currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.