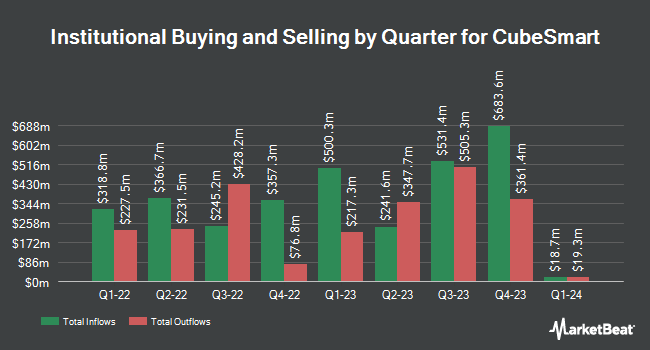

Wealth Enhancement Advisory Services LLC lifted its position in shares of CubeSmart (NYSE:CUBE - Free Report) by 648.5% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 62,456 shares of the real estate investment trust's stock after purchasing an additional 54,112 shares during the quarter. Wealth Enhancement Advisory Services LLC's holdings in CubeSmart were worth $3,362,000 as of its most recent SEC filing.

Several other institutional investors have also recently made changes to their positions in the company. Arkadios Wealth Advisors purchased a new position in shares of CubeSmart in the 3rd quarter valued at about $339,000. Mirae Asset Global Investments Co. Ltd. increased its position in shares of CubeSmart by 34.8% in the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 8,732 shares of the real estate investment trust's stock valued at $465,000 after buying an additional 2,253 shares in the last quarter. Mount Yale Investment Advisors LLC lifted its position in shares of CubeSmart by 15.5% during the 3rd quarter. Mount Yale Investment Advisors LLC now owns 27,964 shares of the real estate investment trust's stock valued at $1,505,000 after buying an additional 3,761 shares in the last quarter. Impact Partnership Wealth LLC lifted its position in shares of CubeSmart by 17.7% during the 3rd quarter. Impact Partnership Wealth LLC now owns 6,979 shares of the real estate investment trust's stock valued at $376,000 after buying an additional 1,050 shares in the last quarter. Finally, Hennion & Walsh Asset Management Inc. grew its stake in CubeSmart by 13.7% in the 3rd quarter. Hennion & Walsh Asset Management Inc. now owns 16,067 shares of the real estate investment trust's stock valued at $865,000 after acquiring an additional 1,938 shares during the period. 97.61% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several analysts have recently issued reports on CUBE shares. UBS Group lowered shares of CubeSmart from a "buy" rating to a "neutral" rating and lifted their target price for the company from $53.00 to $54.00 in a research report on Friday, September 13th. Wells Fargo & Company increased their target price on CubeSmart from $48.00 to $50.00 and gave the company an "equal weight" rating in a report on Monday, October 21st. Barclays dropped their price target on CubeSmart from $55.00 to $54.00 and set an "equal weight" rating for the company in a research report on Monday, October 28th. Scotiabank initiated coverage on CubeSmart in a report on Thursday, August 22nd. They issued a "sector outperform" rating and a $53.00 price objective on the stock. Finally, Evercore ISI upped their target price on shares of CubeSmart from $52.00 to $53.00 and gave the stock an "in-line" rating in a report on Monday, September 16th. One research analyst has rated the stock with a sell rating, six have issued a hold rating and four have issued a buy rating to the company. According to MarketBeat, the company presently has an average rating of "Hold" and an average target price of $51.73.

Read Our Latest Report on CubeSmart

Insider Buying and Selling

In other CubeSmart news, CEO Christopher P. Marr sold 37,000 shares of the stock in a transaction dated Wednesday, August 7th. The stock was sold at an average price of $48.45, for a total value of $1,792,650.00. Following the sale, the chief executive officer now owns 576,836 shares of the company's stock, valued at $27,947,704.20. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. In related news, insider Jeffrey P. Foster sold 7,739 shares of the stock in a transaction on Monday, August 5th. The stock was sold at an average price of $47.30, for a total value of $366,054.70. Following the transaction, the insider now owns 182,460 shares of the company's stock, valued at $8,630,358. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. Also, CEO Christopher P. Marr sold 37,000 shares of CubeSmart stock in a transaction dated Wednesday, August 7th. The stock was sold at an average price of $48.45, for a total value of $1,792,650.00. Following the sale, the chief executive officer now directly owns 576,836 shares of the company's stock, valued at $27,947,704.20. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 88,217 shares of company stock valued at $4,244,344 in the last three months. 1.68% of the stock is owned by corporate insiders.

CubeSmart Trading Down 1.1 %

NYSE:CUBE traded down $0.51 on Friday, reaching $47.33. 1,675,756 shares of the company's stock were exchanged, compared to its average volume of 1,407,238. The firm has a market capitalization of $10.66 billion, a price-to-earnings ratio of 26.74, a price-to-earnings-growth ratio of 8.73 and a beta of 0.84. CubeSmart has a 52-week low of $34.51 and a 52-week high of $55.14. The company has a quick ratio of 0.03, a current ratio of 0.03 and a debt-to-equity ratio of 1.03. The business has a fifty day moving average of $51.36 and a 200-day moving average of $47.08.

CubeSmart (NYSE:CUBE - Get Free Report) last released its earnings results on Thursday, August 1st. The real estate investment trust reported $0.41 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.64 by ($0.23). CubeSmart had a return on equity of 14.33% and a net margin of 37.79%. The business had revenue of $266.20 million for the quarter, compared to analyst estimates of $260.68 million. During the same quarter last year, the company earned $0.66 earnings per share. CubeSmart's quarterly revenue was up 2.1% compared to the same quarter last year. As a group, analysts expect that CubeSmart will post 2.65 earnings per share for the current year.

CubeSmart Company Profile

(

Free Report)

CubeSmart is a self-administered and self-managed real estate investment trust. The Company's self-storage properties are designed to offer affordable, easily accessible and, in most locations, climate-controlled storage space for residential and commercial customers. According to the 2023 Self-Storage Almanac, CubeSmart is one of the top three owners and operators of self-storage properties in the United States.

Featured Articles

Before you consider CubeSmart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CubeSmart wasn't on the list.

While CubeSmart currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.