International Assets Investment Management LLC acquired a new position in shares of Carnival Co. & plc (NYSE:CUK - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 42,142 shares of the company's stock, valued at approximately $7,030,000.

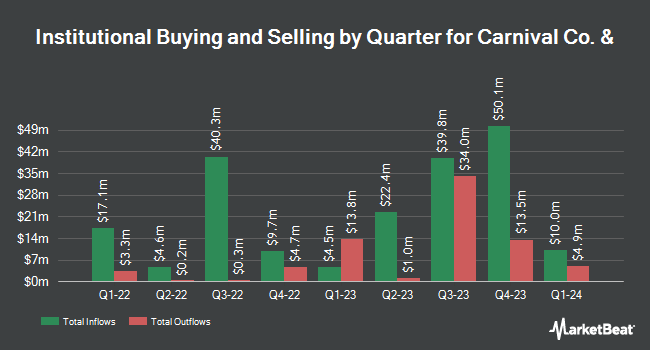

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in CUK. Renaissance Technologies LLC raised its position in Carnival Co. & by 13.5% in the second quarter. Renaissance Technologies LLC now owns 2,360,800 shares of the company's stock worth $40,653,000 after acquiring an additional 281,300 shares during the period. Millennium Management LLC raised its holdings in shares of Carnival Co. & by 20.0% in the 2nd quarter. Millennium Management LLC now owns 1,061,079 shares of the company's stock worth $18,272,000 after purchasing an additional 177,207 shares during the period. Acadian Asset Management LLC purchased a new position in Carnival Co. & in the first quarter valued at approximately $9,001,000. Palliser Capital UK Ltd grew its holdings in Carnival Co. & by 29.4% during the second quarter. Palliser Capital UK Ltd now owns 310,219 shares of the company's stock valued at $5,342,000 after purchasing an additional 70,555 shares during the period. Finally, Cubist Systematic Strategies LLC increased its position in Carnival Co. & by 65.6% in the second quarter. Cubist Systematic Strategies LLC now owns 147,010 shares of the company's stock worth $2,532,000 after buying an additional 58,261 shares during the last quarter. 23.80% of the stock is owned by institutional investors.

Insider Buying and Selling

In related news, Director Sir Jonathon Band sold 17,500 shares of Carnival Co. & stock in a transaction on Tuesday, October 29th. The stock was sold at an average price of $21.72, for a total transaction of $380,100.00. Following the completion of the sale, the director now owns 65,789 shares of the company's stock, valued at approximately $1,428,937.08. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. 0.08% of the stock is currently owned by insiders.

Carnival Co. & Stock Performance

Shares of CUK stock traded down $0.09 on Friday, hitting $19.91. 1,087,996 shares of the stock were exchanged, compared to its average volume of 2,000,958. The firm's 50 day moving average is $17.01 and its two-hundred day moving average is $15.41. Carnival Co. & plc has a one year low of $10.54 and a one year high of $20.88. The firm has a market capitalization of $3.74 billion, a PE ratio of 17.87 and a beta of 2.74. The company has a current ratio of 0.30, a quick ratio of 0.26 and a debt-to-equity ratio of 3.10.

Carnival Co. & (NYSE:CUK - Get Free Report) last announced its quarterly earnings results on Monday, September 30th. The company reported $1.27 EPS for the quarter. Carnival Co. & had a net margin of 6.39% and a return on equity of 22.30%. The company had revenue of $7.90 billion for the quarter.

Carnival Co. & Company Profile

(

Free Report)

Carnival Corporation & plc engages in the provision of leisure travel services in North America, Australia, Europe, Asia, and internationally. The company operates through four segments: NAA Cruise Operations, Europe Cruise Operations, Cruise Support, and Tour and Other. It operates port destinations, private islands, and a solar park, as well as owns and operates hotels, lodges, glass-domed railcars, and motor coaches.

See Also

Before you consider Carnival Co. &, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carnival Co. & wasn't on the list.

While Carnival Co. & currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.