SFE Investment Counsel trimmed its position in shares of Camping World Holdings, Inc. (NYSE:CWH - Free Report) by 43.2% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 89,256 shares of the company's stock after selling 67,923 shares during the quarter. SFE Investment Counsel owned 0.11% of Camping World worth $2,162,000 at the end of the most recent quarter.

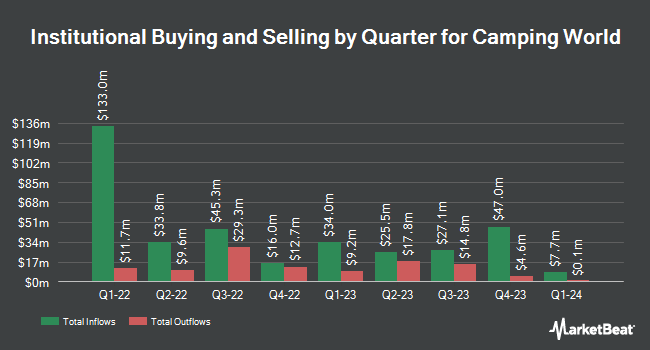

A number of other large investors have also modified their holdings of the business. Vanguard Group Inc. boosted its stake in shares of Camping World by 3.1% during the 4th quarter. Vanguard Group Inc. now owns 4,035,275 shares of the company's stock worth $105,966,000 after acquiring an additional 122,856 shares in the last quarter. SG Capital Management LLC purchased a new stake in shares of Camping World in the 1st quarter worth about $3,889,000. Capital Research Global Investors grew its stake in Camping World by 31.2% in the 1st quarter. Capital Research Global Investors now owns 2,159,037 shares of the company's stock valued at $60,129,000 after acquiring an additional 513,320 shares during the last quarter. Coronation Fund Managers Ltd. increased its holdings in Camping World by 42.8% during the 2nd quarter. Coronation Fund Managers Ltd. now owns 228,676 shares of the company's stock valued at $4,084,000 after acquiring an additional 68,517 shares in the last quarter. Finally, Eminence Capital LP raised its position in Camping World by 79.8% during the second quarter. Eminence Capital LP now owns 4,344,303 shares of the company's stock worth $77,589,000 after acquiring an additional 1,927,977 shares during the last quarter. 52.54% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of equities research analysts recently issued reports on the company. Roth Mkm reduced their target price on Camping World from $28.00 to $26.00 and set a "buy" rating on the stock in a research note on Monday, August 5th. Truist Financial lifted their price objective on Camping World from $26.00 to $28.00 and gave the stock a "buy" rating in a research report on Friday, September 20th. KeyCorp cut their target price on shares of Camping World from $26.00 to $25.00 and set an "overweight" rating for the company in a research note on Friday, August 2nd. Monness Crespi & Hardt lifted their price target on shares of Camping World from $24.00 to $30.00 and gave the stock a "buy" rating in a report on Friday, September 27th. Finally, JPMorgan Chase & Co. restated a "neutral" rating and set a $24.00 target price (down previously from $25.00) on shares of Camping World in a research report on Monday, October 21st. One research analyst has rated the stock with a sell rating, one has given a hold rating and six have given a buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $27.29.

Check Out Our Latest Analysis on Camping World

Insiders Place Their Bets

In related news, CEO Marcus Lemonis sold 125,000 shares of the stock in a transaction on Friday, September 13th. The stock was sold at an average price of $22.84, for a total value of $2,855,000.00. Following the completion of the sale, the chief executive officer now directly owns 155,268 shares in the company, valued at approximately $3,546,321.12. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. 43.80% of the stock is owned by insiders.

Camping World Trading Up 6.8 %

NYSE:CWH traded up $1.46 during trading hours on Tuesday, reaching $22.87. 3,731,226 shares of the company were exchanged, compared to its average volume of 992,882. Camping World Holdings, Inc. has a 52-week low of $16.18 and a 52-week high of $28.72. The stock has a 50 day simple moving average of $22.73 and a 200 day simple moving average of $21.15. The firm has a market cap of $1.93 billion, a price-to-earnings ratio of -571.75 and a beta of 2.47. The company has a debt-to-equity ratio of 10.08, a current ratio of 1.19 and a quick ratio of 0.19.

Camping World (NYSE:CWH - Get Free Report) last posted its quarterly earnings results on Wednesday, July 31st. The company reported $0.38 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.48 by ($0.10). The firm had revenue of $1.80 billion for the quarter, compared to analysts' expectations of $1.87 billion. Camping World had a negative net margin of 0.22% and a negative return on equity of 10.04%. Camping World's revenue was down 5.3% on a year-over-year basis. During the same period last year, the firm posted $0.60 EPS. As a group, analysts predict that Camping World Holdings, Inc. will post -0.6 EPS for the current year.

Camping World Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Wednesday, September 25th. Shareholders of record on Friday, September 13th were given a dividend of $0.125 per share. The ex-dividend date was Friday, September 13th. This represents a $0.50 dividend on an annualized basis and a yield of 2.19%. Camping World's dividend payout ratio (DPR) is -1,250.00%.

About Camping World

(

Free Report)

Camping World Holdings, Inc, together its subsidiaries, retails recreational vehicles (RVs), and related products and services in the United States. It operates in two segments, Good Sam Services and Plans; and RV and Outdoor Retail. The company provides a portfolio of services, protection plans, products, and resources in the RV industry.

Further Reading

Before you consider Camping World, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Camping World wasn't on the list.

While Camping World currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.