Stanley Laman Group Ltd. lessened its position in shares of Sprinklr, Inc. (NYSE:CXM - Free Report) by 16.4% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 774,578 shares of the company's stock after selling 151,412 shares during the quarter. Sprinklr makes up about 0.8% of Stanley Laman Group Ltd.'s holdings, making the stock its 22nd largest position. Stanley Laman Group Ltd. owned about 0.29% of Sprinklr worth $5,987,000 at the end of the most recent quarter.

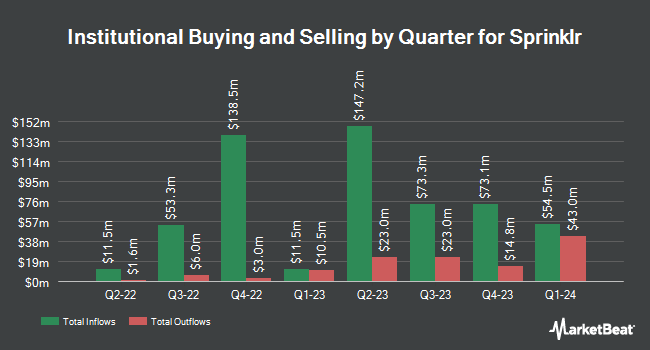

Several other hedge funds and other institutional investors have also made changes to their positions in the company. Mather Group LLC. acquired a new stake in Sprinklr during the 1st quarter valued at $28,000. CWM LLC raised its holdings in Sprinklr by 111.0% in the 2nd quarter. CWM LLC now owns 3,620 shares of the company's stock valued at $35,000 after acquiring an additional 1,904 shares during the last quarter. Everence Capital Management Inc. acquired a new stake in shares of Sprinklr during the third quarter worth $105,000. CIBC Asset Management Inc grew its position in shares of Sprinklr by 15.6% in the second quarter. CIBC Asset Management Inc now owns 12,523 shares of the company's stock valued at $120,000 after purchasing an additional 1,694 shares during the period. Finally, Simplicity Wealth LLC acquired a new position in Sprinklr in the second quarter valued at $148,000. Institutional investors and hedge funds own 40.19% of the company's stock.

Insider Transactions at Sprinklr

In related news, major shareholder Roger H. Lee sold 44,884 shares of the stock in a transaction on Monday, September 9th. The stock was sold at an average price of $7.83, for a total transaction of $351,441.72. Following the completion of the sale, the insider now directly owns 739,799 shares in the company, valued at approximately $5,792,626.17. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other Sprinklr news, major shareholder Roger H. Lee sold 44,884 shares of the business's stock in a transaction that occurred on Monday, September 9th. The shares were sold at an average price of $7.83, for a total value of $351,441.72. Following the completion of the sale, the insider now directly owns 739,799 shares of the company's stock, valued at $5,792,626.17. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, major shareholder Roger H. Lee sold 225,000 shares of Sprinklr stock in a transaction on Wednesday, September 11th. The shares were sold at an average price of $7.37, for a total transaction of $1,658,250.00. Following the completion of the sale, the insider now directly owns 514,799 shares of the company's stock, valued at approximately $3,794,068.63. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 338,220 shares of company stock valued at $2,548,988 over the last quarter. Company insiders own 30.12% of the company's stock.

Sprinklr Price Performance

CXM stock traded down $0.04 on Wednesday, reaching $7.10. The company's stock had a trading volume of 1,163,556 shares, compared to its average volume of 2,182,317. Sprinklr, Inc. has a 52 week low of $6.91 and a 52 week high of $17.14. The firm has a fifty day moving average of $7.93 and a two-hundred day moving average of $9.59. The company has a market capitalization of $1.88 billion, a P/E ratio of 33.48, a price-to-earnings-growth ratio of 2.10 and a beta of 0.76.

Sprinklr (NYSE:CXM - Get Free Report) last announced its earnings results on Wednesday, September 4th. The company reported $0.01 EPS for the quarter, hitting the consensus estimate of $0.01. Sprinklr had a return on equity of 8.40% and a net margin of 6.54%. The firm had revenue of $197.21 million for the quarter, compared to analysts' expectations of $194.58 million. As a group, equities analysts expect that Sprinklr, Inc. will post 0.11 EPS for the current fiscal year.

Analyst Ratings Changes

A number of research firms have recently commented on CXM. Rosenblatt Securities dropped their price objective on shares of Sprinklr from $14.00 to $11.00 and set a "buy" rating for the company in a research note on Tuesday, September 3rd. JMP Securities restated a "market outperform" rating and set a $17.00 target price on shares of Sprinklr in a report on Thursday, September 5th. Wells Fargo & Company dropped their price target on shares of Sprinklr from $9.00 to $8.00 and set an "equal weight" rating on the stock in a research note on Thursday, September 5th. Morgan Stanley reduced their target price on Sprinklr from $12.00 to $10.00 and set an "equal weight" rating for the company in a research note on Thursday, September 5th. Finally, KeyCorp reduced their price target on shares of Sprinklr from $16.00 to $12.00 and set an "overweight" rating on the stock in a research report on Thursday, September 5th. One analyst has rated the stock with a sell rating, eight have given a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $10.00.

Check Out Our Latest Report on Sprinklr

About Sprinklr

(

Free Report)

Sprinklr, Inc provides enterprise cloud software products worldwide. The company operates Unified Customer Experience Management platform, a software that enables customer-facing teams to collaborate across internal silos, communicate across digital channels, and leverage a complete suite of capabilities to deliver customer experiences.

Featured Articles

Before you consider Sprinklr, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sprinklr wasn't on the list.

While Sprinklr currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.