Allspring Global Investments Holdings LLC grew its holdings in shares of Deutsche Bank Aktiengesellschaft (NYSE:DB - Free Report) by 329,898.6% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 699,597 shares of the bank's stock after buying an additional 699,385 shares during the quarter. Allspring Global Investments Holdings LLC's holdings in Deutsche Bank Aktiengesellschaft were worth $12,101,000 at the end of the most recent reporting period.

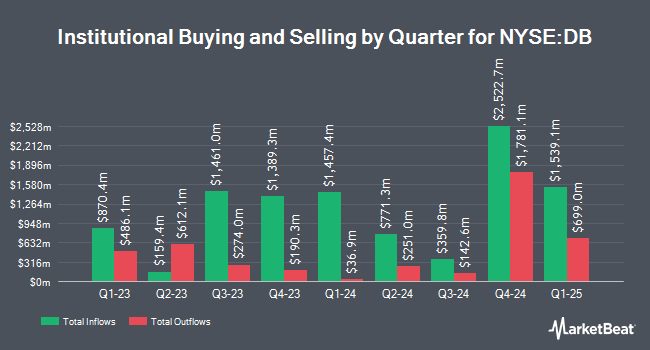

Several other large investors also recently made changes to their positions in DB. Capital International Investors lifted its holdings in shares of Deutsche Bank Aktiengesellschaft by 163.4% during the 1st quarter. Capital International Investors now owns 48,638,662 shares of the bank's stock worth $765,173,000 after acquiring an additional 30,173,405 shares during the period. Legal & General Group Plc lifted its stake in shares of Deutsche Bank Aktiengesellschaft by 8,267.7% in the 2nd quarter. Legal & General Group Plc now owns 20,181,236 shares of the bank's stock valued at $322,438,000 after purchasing an additional 19,940,056 shares during the period. Acadian Asset Management LLC boosted its stake in Deutsche Bank Aktiengesellschaft by 81.9% during the first quarter. Acadian Asset Management LLC now owns 16,069,955 shares of the bank's stock worth $253,048,000 after acquiring an additional 7,237,525 shares in the last quarter. Capital International Inc. CA grew its stake in Deutsche Bank Aktiengesellschaft by 414.1% in the first quarter. Capital International Inc. CA now owns 7,371,601 shares of the bank's stock valued at $115,971,000 after acquiring an additional 5,937,749 shares during the period. Finally, Marshall Wace LLP lifted its stake in shares of Deutsche Bank Aktiengesellschaft by 102.7% in the second quarter. Marshall Wace LLP now owns 4,778,014 shares of the bank's stock valued at $76,353,000 after buying an additional 2,420,905 shares in the last quarter. Institutional investors and hedge funds own 27.90% of the company's stock.

Deutsche Bank Aktiengesellschaft Trading Down 1.6 %

Shares of NYSE DB traded down $0.28 during trading hours on Friday, hitting $16.84. 1,531,531 shares of the company traded hands, compared to its average volume of 2,397,143. The company has a current ratio of 0.78, a quick ratio of 0.78 and a debt-to-equity ratio of 1.43. The company's 50 day moving average price is $16.77 and its 200 day moving average price is $16.38. Deutsche Bank Aktiengesellschaft has a 12 month low of $10.83 and a 12 month high of $17.95. The stock has a market capitalization of $34.80 billion, a price-to-earnings ratio of 7.35 and a beta of 1.21.

Deutsche Bank Aktiengesellschaft (NYSE:DB - Get Free Report) last released its earnings results on Wednesday, July 24th. The bank reported ($0.41) EPS for the quarter, missing analysts' consensus estimates of $0.49 by ($0.90). The company had revenue of $7.87 billion during the quarter, compared to analyst estimates of $8.18 billion. Deutsche Bank Aktiengesellschaft had a return on equity of 4.63% and a net margin of 5.58%.

Analyst Ratings Changes

A number of research firms recently weighed in on DB. Barclays upgraded shares of Deutsche Bank Aktiengesellschaft from an "equal weight" rating to an "overweight" rating in a research note on Tuesday, September 3rd. StockNews.com upgraded Deutsche Bank Aktiengesellschaft from a "hold" rating to a "buy" rating in a report on Monday, October 7th. Two research analysts have rated the stock with a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy".

Check Out Our Latest Analysis on DB

Deutsche Bank Aktiengesellschaft Company Profile

(

Free Report)

Deutsche Bank Aktiengesellschaft, a stock corporation, provides corporate and investment banking, and asset management products and services to private individuals, corporate entities, and institutional clients in Germany, the United Kingdom, rest of Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Read More

Before you consider Deutsche Bank Aktiengesellschaft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Deutsche Bank Aktiengesellschaft wasn't on the list.

While Deutsche Bank Aktiengesellschaft currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.