Smith Salley Wealth Management decreased its holdings in shares of Diageo plc (NYSE:DEO - Free Report) by 18.6% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 81,644 shares of the company's stock after selling 18,678 shares during the quarter. Smith Salley Wealth Management's holdings in Diageo were worth $11,458,000 as of its most recent SEC filing.

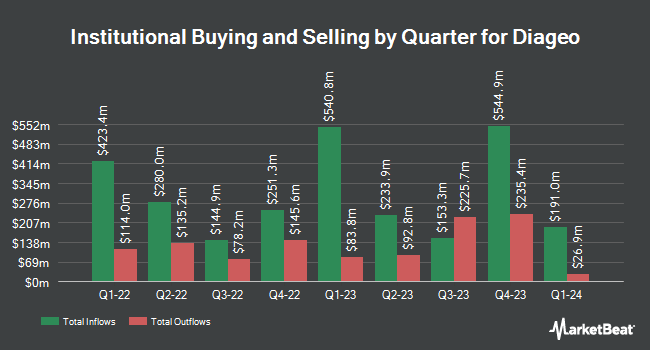

A number of other hedge funds also recently bought and sold shares of the business. J.W. Cole Advisors Inc. increased its position in Diageo by 3.8% during the first quarter. J.W. Cole Advisors Inc. now owns 2,158 shares of the company's stock valued at $321,000 after acquiring an additional 78 shares during the last quarter. Financial Counselors Inc. increased its position in Diageo by 3.3% during the second quarter. Financial Counselors Inc. now owns 2,587 shares of the company's stock valued at $326,000 after acquiring an additional 83 shares during the last quarter. PFG Investments LLC increased its position in Diageo by 3.4% during the second quarter. PFG Investments LLC now owns 2,516 shares of the company's stock valued at $317,000 after acquiring an additional 83 shares during the last quarter. Global Retirement Partners LLC increased its position in Diageo by 1.1% during the third quarter. Global Retirement Partners LLC now owns 8,146 shares of the company's stock valued at $1,143,000 after acquiring an additional 85 shares during the last quarter. Finally, Gradient Investments LLC increased its position in Diageo by 2.8% during the second quarter. Gradient Investments LLC now owns 3,181 shares of the company's stock valued at $401,000 after acquiring an additional 86 shares during the last quarter. Hedge funds and other institutional investors own 8.97% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have weighed in on DEO shares. Royal Bank of Canada upgraded shares of Diageo from an "underperform" rating to a "sector perform" rating in a research report on Monday, August 12th. The Goldman Sachs Group cut shares of Diageo from a "neutral" rating to a "sell" rating in a report on Friday, July 12th. Bank of America upgraded shares of Diageo from a "neutral" rating to a "buy" rating in a report on Thursday, September 12th. Finally, Citigroup upgraded shares of Diageo from a "neutral" rating to a "buy" rating in a report on Wednesday, July 3rd. Three analysts have rated the stock with a sell rating, three have issued a hold rating and two have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Hold".

Read Our Latest Stock Analysis on Diageo

Diageo Stock Down 0.9 %

NYSE:DEO traded down $1.17 during mid-day trading on Friday, reaching $133.27. The company's stock had a trading volume of 261,449 shares, compared to its average volume of 599,604. Diageo plc has a 1 year low of $119.48 and a 1 year high of $161.64. The stock has a fifty day moving average of $134.02 and a 200-day moving average of $133.42. The firm has a market capitalization of $74.13 billion, a PE ratio of 18.98, a price-to-earnings-growth ratio of 3.84 and a beta of 0.69. The company has a quick ratio of 0.55, a current ratio of 1.53 and a debt-to-equity ratio of 1.62.

Diageo Dividend Announcement

The firm also recently disclosed a semi-annual dividend, which was paid on Thursday, October 17th. Investors of record on Friday, August 30th were paid a $1.62 dividend. This represents a yield of 3.2%. The ex-dividend date was Friday, August 30th. Diageo's dividend payout ratio (DPR) is presently 71.51%.

About Diageo

(

Free Report)

Diageo plc, together with its subsidiaries, engages in the production, marketing, and sale of alcoholic beverages. The company offers scotch, gin, vodka, rum, raki, liqueur, wine, tequila, Chinese white spirits, cachaça, and brandy, as well as beer, including cider and flavored malt beverages. It also provides Chinese, Canadian, Irish, American, and Indian-Made Foreign Liquor whiskies, as well as flavored malt beverages, ready to drink, and non-alcoholic products.

Featured Stories

Before you consider Diageo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diageo wasn't on the list.

While Diageo currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.