HF Sinclair (NYSE:DINO - Get Free Report) is scheduled to announce its earnings results before the market opens on Thursday, October 31st. Analysts expect the company to announce earnings of $0.84 per share for the quarter. Individual interested in participating in the company's earnings conference call can do so using this link.

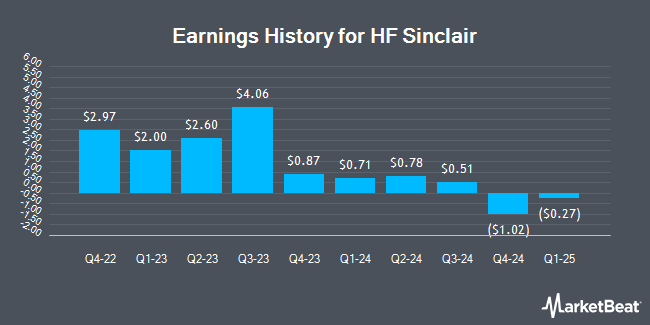

HF Sinclair (NYSE:DINO - Get Free Report) last released its quarterly earnings results on Thursday, August 1st. The company reported $0.78 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.72 by $0.06. HF Sinclair had a return on equity of 11.85% and a net margin of 3.80%. The business had revenue of $7.85 billion during the quarter, compared to analyst estimates of $7.65 billion. During the same quarter in the previous year, the company posted $2.60 earnings per share. HF Sinclair's revenue for the quarter was up .2% on a year-over-year basis. On average, analysts expect HF Sinclair to post $3 EPS for the current fiscal year and $4 EPS for the next fiscal year.

HF Sinclair Price Performance

Shares of DINO traded up $0.03 during trading hours on Thursday, reaching $42.92. 1,331,203 shares of the stock traded hands, compared to its average volume of 2,020,868. HF Sinclair has a 52-week low of $42.42 and a 52-week high of $64.16. The company has a current ratio of 2.12, a quick ratio of 0.97 and a debt-to-equity ratio of 0.26. The company has a market cap of $8.25 billion, a P/E ratio of 5.30 and a beta of 1.16. The company's 50-day moving average price is $46.07 and its two-hundred day moving average price is $50.76.

HF Sinclair Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, September 5th. Shareholders of record on Wednesday, August 21st were issued a dividend of $0.50 per share. This represents a $2.00 dividend on an annualized basis and a yield of 4.66%. The ex-dividend date was Wednesday, August 21st. HF Sinclair's dividend payout ratio (DPR) is currently 24.75%.

Analysts Set New Price Targets

Several equities analysts have weighed in on DINO shares. Argus upgraded HF Sinclair to a "hold" rating in a report on Wednesday, June 26th. Barclays cut their target price on shares of HF Sinclair from $53.00 to $44.00 and set an "equal weight" rating for the company in a report on Monday, October 7th. Scotiabank decreased their price target on shares of HF Sinclair from $66.00 to $57.00 and set a "sector outperform" rating on the stock in a research note on Thursday, October 10th. JPMorgan Chase & Co. dropped their price objective on shares of HF Sinclair from $60.00 to $51.00 and set a "neutral" rating for the company in a research note on Wednesday, October 2nd. Finally, Morgan Stanley decreased their target price on shares of HF Sinclair from $63.00 to $57.00 and set an "overweight" rating on the stock in a research report on Monday, September 16th. Six analysts have rated the stock with a hold rating and seven have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $55.82.

View Our Latest Report on DINO

HF Sinclair Company Profile

(

Get Free Report)

HF Sinclair Corporation operates as an independent energy company. The company produces and markets gasoline, diesel fuel, jet fuel, renewable diesel, specialty lubricant products, specialty chemicals, specialty and modified asphalt, and others. It owns and operates refineries located in Kansas, Oklahoma, New Mexico, Utah, Washington, and Wyoming; and markets its refined products principally in the Southwest United States and Rocky Mountains, Pacific Northwest, and in other neighboring Plains states.

Featured Stories

Before you consider HF Sinclair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HF Sinclair wasn't on the list.

While HF Sinclair currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.