HF Sinclair (NYSE:DINO - Get Free Report) had its price objective reduced by investment analysts at UBS Group from $58.00 to $55.00 in a note issued to investors on Monday, Benzinga reports. The brokerage currently has a "buy" rating on the stock. UBS Group's target price indicates a potential upside of 40.99% from the stock's current price.

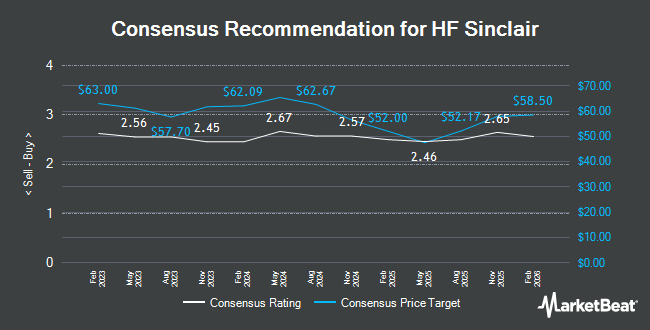

A number of other equities research analysts have also issued reports on DINO. Piper Sandler cut their price target on shares of HF Sinclair from $58.00 to $49.00 and set an "overweight" rating on the stock in a report on Friday, September 20th. Wolfe Research initiated coverage on HF Sinclair in a research report on Thursday, July 18th. They set a "peer perform" rating for the company. JPMorgan Chase & Co. cut their price objective on HF Sinclair from $60.00 to $51.00 and set a "neutral" rating on the stock in a research report on Wednesday, October 2nd. Barclays decreased their target price on HF Sinclair from $53.00 to $44.00 and set an "equal weight" rating for the company in a report on Monday, October 7th. Finally, Scotiabank cut their price target on shares of HF Sinclair from $66.00 to $57.00 and set a "sector outperform" rating on the stock in a report on Thursday, October 10th. Six investment analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat.com, HF Sinclair presently has a consensus rating of "Moderate Buy" and a consensus price target of $54.45.

Check Out Our Latest Report on DINO

HF Sinclair Trading Up 0.8 %

Shares of NYSE:DINO traded up $0.31 on Monday, reaching $39.01. 1,721,150 shares of the company traded hands, compared to its average volume of 2,040,831. HF Sinclair has a 52 week low of $38.25 and a 52 week high of $64.16. The company has a current ratio of 2.12, a quick ratio of 0.97 and a debt-to-equity ratio of 0.26. The business's 50-day simple moving average is $44.89 and its 200 day simple moving average is $49.65. The stock has a market capitalization of $7.44 billion, a P/E ratio of 24.08 and a beta of 1.18.

HF Sinclair (NYSE:DINO - Get Free Report) last announced its quarterly earnings data on Thursday, October 31st. The company reported $0.51 earnings per share for the quarter, beating the consensus estimate of $0.32 by $0.19. HF Sinclair had a return on equity of 5.44% and a net margin of 1.10%. The firm had revenue of $7.21 billion during the quarter, compared to the consensus estimate of $7.11 billion. During the same quarter in the previous year, the company posted $4.06 earnings per share. The business's revenue was down 19.1% on a year-over-year basis. As a group, equities analysts anticipate that HF Sinclair will post 2.32 EPS for the current fiscal year.

Insider Activity

In other news, Director Franklin Myers bought 5,000 shares of the company's stock in a transaction dated Friday, November 1st. The shares were purchased at an average price of $38.76 per share, for a total transaction of $193,800.00. Following the completion of the purchase, the director now owns 145,293 shares in the company, valued at approximately $5,631,556.68. This represents a 0.00 % increase in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Corporate insiders own 0.28% of the company's stock.

Institutional Investors Weigh In On HF Sinclair

Several large investors have recently bought and sold shares of DINO. Vanguard Group Inc. boosted its stake in shares of HF Sinclair by 3.8% in the 1st quarter. Vanguard Group Inc. now owns 18,910,599 shares of the company's stock worth $1,141,633,000 after buying an additional 696,031 shares during the last quarter. Pacer Advisors Inc. increased its position in shares of HF Sinclair by 58.3% during the 2nd quarter. Pacer Advisors Inc. now owns 7,784,939 shares of the company's stock valued at $415,249,000 after purchasing an additional 2,868,273 shares during the last quarter. Dimensional Fund Advisors LP increased its position in shares of HF Sinclair by 7.5% during the 2nd quarter. Dimensional Fund Advisors LP now owns 5,749,406 shares of the company's stock valued at $306,665,000 after purchasing an additional 399,988 shares during the last quarter. AQR Capital Management LLC lifted its stake in shares of HF Sinclair by 54.9% in the 2nd quarter. AQR Capital Management LLC now owns 2,816,084 shares of the company's stock worth $147,873,000 after purchasing an additional 997,629 shares during the period. Finally, AustralianSuper Pty Ltd grew its position in HF Sinclair by 11.7% during the third quarter. AustralianSuper Pty Ltd now owns 1,678,196 shares of the company's stock valued at $74,797,000 after buying an additional 175,925 shares during the period. 88.29% of the stock is currently owned by institutional investors.

HF Sinclair Company Profile

(

Get Free Report)

HF Sinclair Corporation operates as an independent energy company. The company produces and markets gasoline, diesel fuel, jet fuel, renewable diesel, specialty lubricant products, specialty chemicals, specialty and modified asphalt, and others. It owns and operates refineries located in Kansas, Oklahoma, New Mexico, Utah, Washington, and Wyoming; and markets its refined products principally in the Southwest United States and Rocky Mountains, Pacific Northwest, and in other neighboring Plains states.

Featured Articles

Before you consider HF Sinclair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HF Sinclair wasn't on the list.

While HF Sinclair currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.