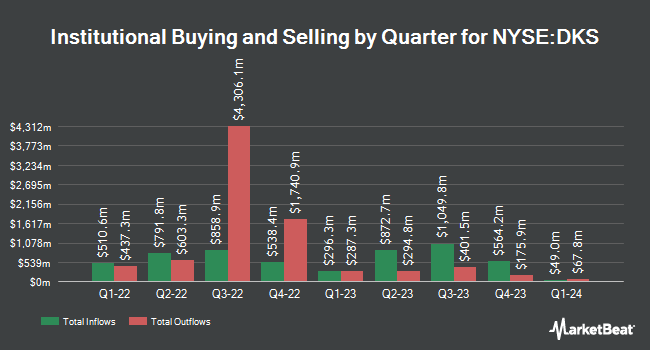

Central Bank & Trust Co. lowered its stake in shares of DICK'S Sporting Goods, Inc. (NYSE:DKS - Free Report) by 9.6% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 34,468 shares of the sporting goods retailer's stock after selling 3,640 shares during the period. Central Bank & Trust Co.'s holdings in DICK'S Sporting Goods were worth $7,193,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also modified their holdings of the stock. Van ECK Associates Corp lifted its stake in shares of DICK'S Sporting Goods by 6.9% in the 1st quarter. Van ECK Associates Corp now owns 9,427 shares of the sporting goods retailer's stock valued at $2,120,000 after purchasing an additional 609 shares during the last quarter. Private Advisor Group LLC grew its position in DICK'S Sporting Goods by 86.3% in the 1st quarter. Private Advisor Group LLC now owns 2,735 shares of the sporting goods retailer's stock worth $615,000 after purchasing an additional 1,267 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. increased its stake in DICK'S Sporting Goods by 19.3% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 41,658 shares of the sporting goods retailer's stock valued at $8,538,000 after acquiring an additional 6,732 shares during the period. BNP Paribas Financial Markets raised its holdings in DICK'S Sporting Goods by 53.3% in the 1st quarter. BNP Paribas Financial Markets now owns 67,519 shares of the sporting goods retailer's stock valued at $15,182,000 after acquiring an additional 23,471 shares in the last quarter. Finally, Janney Montgomery Scott LLC grew its holdings in shares of DICK'S Sporting Goods by 18.8% during the 1st quarter. Janney Montgomery Scott LLC now owns 15,882 shares of the sporting goods retailer's stock worth $3,571,000 after purchasing an additional 2,512 shares in the last quarter. 89.83% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several brokerages recently commented on DKS. Barclays raised their target price on DICK'S Sporting Goods from $247.00 to $254.00 and gave the stock an "overweight" rating in a research report on Thursday, September 5th. Telsey Advisory Group increased their price target on shares of DICK'S Sporting Goods from $255.00 to $260.00 and gave the stock an "outperform" rating in a research report on Friday, August 30th. Robert W. Baird reaffirmed a "neutral" rating and set a $235.00 price objective on shares of DICK'S Sporting Goods in a report on Wednesday, August 28th. Loop Capital increased their target price on DICK'S Sporting Goods from $200.00 to $220.00 and gave the stock a "hold" rating in a report on Thursday, September 5th. Finally, TD Cowen boosted their price target on DICK'S Sporting Goods from $266.00 to $270.00 and gave the company a "buy" rating in a research note on Tuesday, September 3rd. Nine equities research analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $244.62.

Get Our Latest Research Report on DKS

DICK'S Sporting Goods Trading Up 0.7 %

Shares of NYSE:DKS traded up $1.37 during midday trading on Tuesday, hitting $198.10. The company had a trading volume of 694,305 shares, compared to its average volume of 1,069,226. The company has a current ratio of 1.77, a quick ratio of 0.69 and a debt-to-equity ratio of 0.51. DICK'S Sporting Goods, Inc. has a 12 month low of $110.07 and a 12 month high of $239.30. The firm has a fifty day simple moving average of $212.01 and a 200 day simple moving average of $210.66. The stock has a market cap of $16.13 billion, a price-to-earnings ratio of 14.50, a PEG ratio of 2.20 and a beta of 1.64.

DICK'S Sporting Goods (NYSE:DKS - Get Free Report) last issued its earnings results on Wednesday, September 4th. The sporting goods retailer reported $4.37 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $3.77 by $0.60. The firm had revenue of $3.47 billion for the quarter, compared to analysts' expectations of $3.44 billion. DICK'S Sporting Goods had a return on equity of 45.14% and a net margin of 8.46%. The company's revenue was up 7.6% compared to the same quarter last year. During the same quarter last year, the business earned $2.82 earnings per share. On average, analysts predict that DICK'S Sporting Goods, Inc. will post 13.9 EPS for the current year.

DICK'S Sporting Goods Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, October 4th. Investors of record on Friday, September 20th were paid a dividend of $1.10 per share. This represents a $4.40 annualized dividend and a yield of 2.22%. The ex-dividend date of this dividend was Friday, September 20th. DICK'S Sporting Goods's payout ratio is presently 32.28%.

DICK'S Sporting Goods Profile

(

Free Report)

DICK'S Sporting Goods, Inc, together with its subsidiaries, operates as an omni-channel sporting goods retailer primarily in the United States. The company provides hardlines, includes sporting goods equipment, fitness equipment, golf equipment, and fishing gear products; apparel; and footwear and accessories.

Read More

Before you consider DICK'S Sporting Goods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DICK'S Sporting Goods wasn't on the list.

While DICK'S Sporting Goods currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.