PFG Investments LLC acquired a new position in shares of Ginkgo Bioworks Holdings, Inc. (NYSE:DNA - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The fund acquired 189,030 shares of the company's stock, valued at approximately $1,541,000. PFG Investments LLC owned about 0.34% of Ginkgo Bioworks at the end of the most recent quarter.

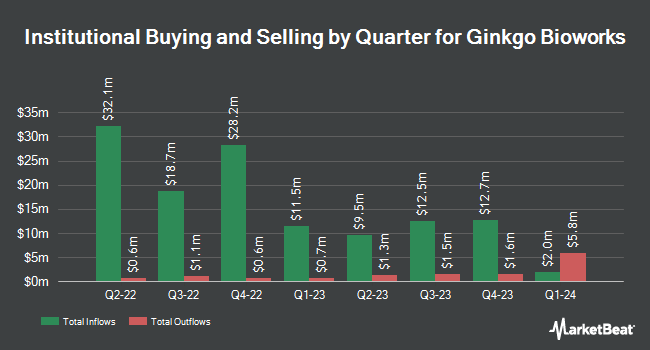

Several other institutional investors have also modified their holdings of DNA. AQR Capital Management LLC purchased a new stake in shares of Ginkgo Bioworks during the 2nd quarter worth approximately $3,391,000. Monaco Asset Management SAM purchased a new stake in Ginkgo Bioworks in the 2nd quarter valued at $3,276,000. Renaissance Technologies LLC purchased a new stake in Ginkgo Bioworks in the 2nd quarter valued at $2,128,000. Cetera Investment Advisers raised its position in Ginkgo Bioworks by 2,683.7% in the 1st quarter. Cetera Investment Advisers now owns 2,264,107 shares of the company's stock valued at $2,626,000 after purchasing an additional 2,182,773 shares during the last quarter. Finally, XTX Topco Ltd purchased a new stake in Ginkgo Bioworks in the 2nd quarter valued at $312,000. Hedge funds and other institutional investors own 78.63% of the company's stock.

Ginkgo Bioworks Stock Performance

Ginkgo Bioworks stock traded up $0.22 during trading hours on Friday, reaching $8.16. 891,795 shares of the stock were exchanged, compared to its average volume of 1,146,326. The stock has a market capitalization of $18.04 billion, a PE ratio of -18.55 and a beta of 1.10. Ginkgo Bioworks Holdings, Inc. has a 52-week low of $5.26 and a 52-week high of $75.20. The company's 50 day moving average price is $7.51.

Ginkgo Bioworks (NYSE:DNA - Get Free Report) last announced its quarterly earnings data on Thursday, August 8th. The company reported ($3.20) EPS for the quarter, hitting analysts' consensus estimates of ($3.20). The company had revenue of $56.21 million during the quarter, compared to the consensus estimate of $41.46 million. Ginkgo Bioworks had a negative net margin of 486.98% and a negative return on equity of 63.09%. Equities research analysts anticipate that Ginkgo Bioworks Holdings, Inc. will post -12.6 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several research firms recently commented on DNA. TD Cowen upped their price target on shares of Ginkgo Bioworks from $3.00 to $10.00 and gave the company a "buy" rating in a research report on Friday, September 20th. The Goldman Sachs Group reduced their price target on shares of Ginkgo Bioworks from $0.80 to $0.30 and set a "sell" rating for the company in a research report on Tuesday, July 9th. Finally, BTIG Research upped their price target on shares of Ginkgo Bioworks from $0.20 to $7.00 and gave the company a "sell" rating in a research report on Friday, August 23rd. Three research analysts have rated the stock with a sell rating, two have issued a hold rating and one has assigned a buy rating to the stock. Based on data from MarketBeat, Ginkgo Bioworks has a consensus rating of "Hold" and an average target price of $4.16.

Check Out Our Latest Analysis on Ginkgo Bioworks

Ginkgo Bioworks Company Profile

(

Free Report)

Ginkgo Bioworks Holdings, Inc, together with its subsidiaries, develops platform for cell programming in the United States. Its platform is used to program cells to enable biological production of products, such as novel therapeutics, food ingredients, and chemicals derived from petroleum. It serves pharma and biotech, agriculture, industrial and environment, food and nutrition, consumer and technology, and government and defense industries.

Read More

Before you consider Ginkgo Bioworks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ginkgo Bioworks wasn't on the list.

While Ginkgo Bioworks currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.