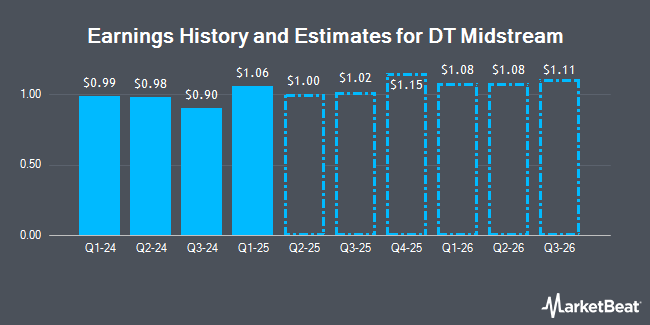

DT Midstream, Inc. (NYSE:DTM - Free Report) - Analysts at US Capital Advisors lifted their Q3 2024 earnings per share estimates for shares of DT Midstream in a research report issued on Monday, October 28th. US Capital Advisors analyst J. Carreker now anticipates that the company will post earnings per share of $0.99 for the quarter, up from their previous forecast of $0.95. The consensus estimate for DT Midstream's current full-year earnings is $3.99 per share. US Capital Advisors also issued estimates for DT Midstream's Q4 2024 earnings at $1.08 EPS and FY2024 earnings at $4.03 EPS.

A number of other analysts have also issued reports on DTM. JPMorgan Chase & Co. increased their target price on DT Midstream from $78.00 to $83.00 and gave the company a "neutral" rating in a report on Friday, October 4th. Citigroup lifted their price objective on DT Midstream from $62.00 to $76.00 and gave the company a "neutral" rating in a research report on Wednesday, September 4th. Stifel Nicolaus lifted their price objective on DT Midstream from $70.00 to $78.00 and gave the company a "buy" rating in a research report on Wednesday, July 31st. Barclays lifted their price objective on DT Midstream from $76.00 to $85.00 and gave the company an "overweight" rating in a research report on Thursday, October 3rd. Finally, Morgan Stanley boosted their price target on DT Midstream from $82.00 to $92.00 and gave the stock an "underweight" rating in a research report on Friday. One research analyst has rated the stock with a sell rating, five have given a hold rating and three have given a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of $77.38.

Check Out Our Latest Stock Report on DTM

DT Midstream Price Performance

Shares of DTM traded up $1.84 during trading hours on Tuesday, hitting $89.26. 1,249,445 shares of the company were exchanged, compared to its average volume of 639,225. The firm has a fifty day simple moving average of $80.52 and a 200-day simple moving average of $72.95. The company has a market capitalization of $8.67 billion, a PE ratio of 21.77 and a beta of 0.74. DT Midstream has a one year low of $51.17 and a one year high of $89.32. The company has a debt-to-equity ratio of 0.71, a current ratio of 0.84 and a quick ratio of 0.84.

DT Midstream (NYSE:DTM - Get Free Report) last issued its quarterly earnings results on Tuesday, July 30th. The company reported $0.98 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.92 by $0.06. The firm had revenue of $244.00 million during the quarter, compared to analyst estimates of $236.83 million. DT Midstream had a return on equity of 9.45% and a net margin of 42.10%. During the same period last year, the company posted $0.93 EPS.

Hedge Funds Weigh In On DT Midstream

A number of institutional investors have recently made changes to their positions in DTM. Allspring Global Investments Holdings LLC increased its stake in shares of DT Midstream by 76.9% in the first quarter. Allspring Global Investments Holdings LLC now owns 759 shares of the company's stock worth $46,000 after purchasing an additional 330 shares during the period. State of Michigan Retirement System increased its stake in shares of DT Midstream by 2.6% in the first quarter. State of Michigan Retirement System now owns 23,855 shares of the company's stock worth $1,458,000 after purchasing an additional 600 shares during the period. Maryland State Retirement & Pension System increased its stake in shares of DT Midstream by 1.5% in the first quarter. Maryland State Retirement & Pension System now owns 90,197 shares of the company's stock worth $5,592,000 after purchasing an additional 1,369 shares during the period. Sequoia Financial Advisors LLC increased its stake in shares of DT Midstream by 8.9% in the first quarter. Sequoia Financial Advisors LLC now owns 6,596 shares of the company's stock worth $403,000 after purchasing an additional 537 shares during the period. Finally, Mirae Asset Global Investments Co. Ltd. increased its stake in DT Midstream by 14.1% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 809,126 shares of the company's stock valued at $49,438,000 after acquiring an additional 99,755 shares during the period. 81.53% of the stock is currently owned by institutional investors.

DT Midstream Company Profile

(

Get Free Report)

DT Midstream, Inc, together with its subsidiaries, provides integrated natural gas services in the United States. The company operates through two segments, Pipeline and Gathering. The Pipeline segment owns and operates interstate and intrastate natural gas pipelines, storage systems, and natural gas gathering lateral pipelines.

Read More

Before you consider DT Midstream, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DT Midstream wasn't on the list.

While DT Midstream currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.