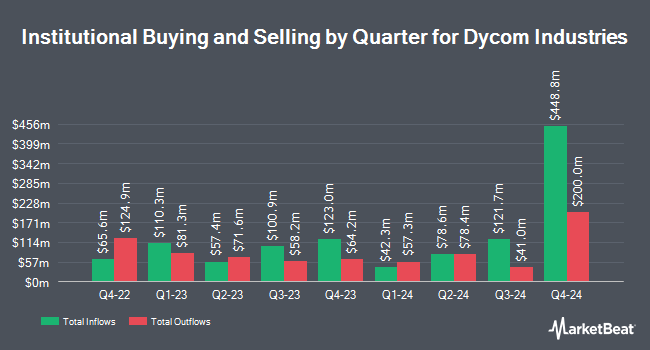

International Assets Investment Management LLC bought a new position in shares of Dycom Industries, Inc. (NYSE:DY - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund bought 98,550 shares of the construction company's stock, valued at approximately $19,424,000. International Assets Investment Management LLC owned approximately 0.34% of Dycom Industries as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also added to or reduced their stakes in DY. Alexander Labrunerie & CO. Inc. purchased a new position in shares of Dycom Industries in the 3rd quarter worth about $206,000. FLC Capital Advisors purchased a new position in shares of Dycom Industries in the 3rd quarter worth about $224,000. Annapolis Financial Services LLC purchased a new position in shares of Dycom Industries in the 3rd quarter worth about $29,000. Vontobel Holding Ltd. purchased a new position in shares of Dycom Industries in the 3rd quarter worth about $261,000. Finally, NBC Securities Inc. boosted its holdings in shares of Dycom Industries by 304.5% in the 3rd quarter. NBC Securities Inc. now owns 20,162 shares of the construction company's stock worth $3,973,000 after purchasing an additional 15,177 shares in the last quarter. 98.33% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently issued reports on DY shares. Bank of America upped their price objective on Dycom Industries from $198.00 to $204.00 and gave the stock a "buy" rating in a report on Friday, August 23rd. KeyCorp boosted their target price on Dycom Industries from $200.00 to $227.00 and gave the company an "overweight" rating in a research note on Tuesday, October 8th. Wells Fargo & Company boosted their target price on Dycom Industries from $185.00 to $200.00 and gave the company an "overweight" rating in a research note on Wednesday, July 17th. B. Riley boosted their target price on Dycom Industries from $205.00 to $208.00 and gave the company a "buy" rating in a research note on Thursday, August 22nd. Finally, StockNews.com lowered Dycom Industries from a "buy" rating to a "hold" rating in a research note on Friday, July 26th. One analyst has rated the stock with a hold rating, six have given a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Buy" and an average target price of $203.43.

Get Our Latest Research Report on Dycom Industries

Dycom Industries Trading Down 3.6 %

DY traded down $6.39 during midday trading on Wednesday, reaching $172.85. 622,515 shares of the company's stock traded hands, compared to its average volume of 277,843. The firm has a fifty day moving average of $186.55 and a two-hundred day moving average of $174.00. The stock has a market capitalization of $5.03 billion, a price-to-earnings ratio of 22.27, a P/E/G ratio of 1.61 and a beta of 1.41. The company has a debt-to-equity ratio of 0.81, a current ratio of 3.44 and a quick ratio of 3.25. Dycom Industries, Inc. has a 52 week low of $78.42 and a 52 week high of $207.20.

Dycom Industries (NYSE:DY - Get Free Report) last released its quarterly earnings results on Wednesday, August 21st. The construction company reported $2.46 EPS for the quarter, beating analysts' consensus estimates of $2.26 by $0.20. The business had revenue of $1.20 billion during the quarter, compared to analyst estimates of $1.20 billion. Dycom Industries had a return on equity of 22.28% and a net margin of 5.37%. Dycom Industries's quarterly revenue was up 15.5% compared to the same quarter last year. During the same quarter in the prior year, the company posted $2.03 EPS. On average, equities analysts anticipate that Dycom Industries, Inc. will post 8.02 earnings per share for the current fiscal year.

About Dycom Industries

(

Free Report)

Dycom Industries, Inc provides specialty contracting services to the telecommunications infrastructure and utility industries in the United States. The company offers engineering services to telecommunications providers, including the planning and design of aerial, underground, and buried fiber optic, copper, and coaxial cable systems; wireless networks in connection with the deployment of macro cell and new small cell sites; and program and project management and inspection personnel.

Featured Articles

Before you consider Dycom Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dycom Industries wasn't on the list.

While Dycom Industries currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.