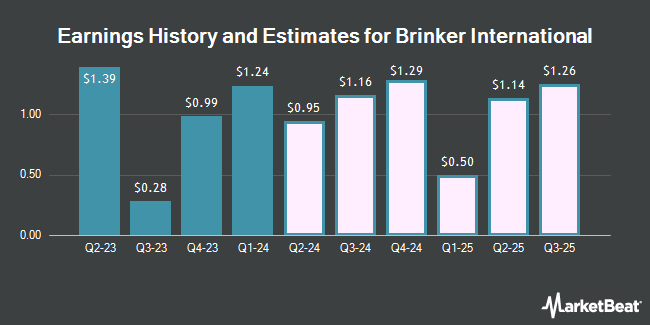

Brinker International, Inc. (NYSE:EAT - Free Report) - Wedbush increased their Q2 2025 earnings per share estimates for shares of Brinker International in a note issued to investors on Thursday, October 31st. Wedbush analyst N. Setyan now anticipates that the restaurant operator will earn $1.42 per share for the quarter, up from their prior estimate of $1.18. Wedbush has a "Neutral" rating and a $68.00 price target on the stock. The consensus estimate for Brinker International's current full-year earnings is $5.60 per share. Wedbush also issued estimates for Brinker International's FY2025 earnings at $5.43 EPS, Q1 2026 earnings at $1.14 EPS, Q2 2026 earnings at $1.64 EPS and FY2026 earnings at $6.24 EPS.

A number of other equities research analysts also recently issued reports on the stock. Morgan Stanley boosted their target price on shares of Brinker International from $42.00 to $50.00 and gave the company an "underweight" rating in a report on Tuesday, July 16th. KeyCorp upped their price objective on Brinker International from $100.00 to $115.00 and gave the stock an "overweight" rating in a report on Thursday. Stifel Nicolaus lifted their target price on Brinker International from $110.00 to $120.00 and gave the company a "buy" rating in a report on Monday. Argus downgraded Brinker International from a "buy" rating to a "hold" rating in a research report on Tuesday, October 1st. Finally, Raymond James downgraded shares of Brinker International from an "outperform" rating to a "market perform" rating in a research note on Thursday, October 17th. Two investment analysts have rated the stock with a sell rating, fourteen have given a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $86.45.

Read Our Latest Report on EAT

Brinker International Trading Up 2.9 %

NYSE:EAT traded up $3.02 during mid-day trading on Monday, reaching $107.94. The company's stock had a trading volume of 1,361,786 shares, compared to its average volume of 1,457,082. Brinker International has a twelve month low of $33.24 and a twelve month high of $108.50. The company's fifty day simple moving average is $81.21 and its two-hundred day simple moving average is $70.34. The company has a debt-to-equity ratio of 63.54, a current ratio of 0.32 and a quick ratio of 0.32. The stock has a market cap of $4.80 billion, a P/E ratio of 26.28, a P/E/G ratio of 1.44 and a beta of 2.46.

Brinker International (NYSE:EAT - Get Free Report) last announced its earnings results on Wednesday, October 30th. The restaurant operator reported $0.95 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.69 by $0.26. The firm had revenue of $1.14 billion for the quarter, compared to analyst estimates of $1.10 billion. Brinker International had a net margin of 4.11% and a negative return on equity of 839.19%. Brinker International's revenue was up 12.5% compared to the same quarter last year. During the same quarter last year, the business earned $0.28 earnings per share.

Insiders Place Their Bets

In related news, CFO Michaela M. Ware sold 3,753 shares of the business's stock in a transaction dated Thursday, October 31st. The shares were sold at an average price of $103.02, for a total transaction of $386,634.06. Following the completion of the sale, the chief financial officer now owns 23,071 shares of the company's stock, valued at $2,376,774.42. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 1.72% of the stock is owned by corporate insiders.

Institutional Trading of Brinker International

Hedge funds have recently made changes to their positions in the stock. Cetera Advisors LLC bought a new position in shares of Brinker International during the first quarter worth about $714,000. Lazard Asset Management LLC boosted its stake in Brinker International by 36.7% during the 1st quarter. Lazard Asset Management LLC now owns 279,974 shares of the restaurant operator's stock valued at $13,908,000 after purchasing an additional 75,225 shares during the period. Vanguard Group Inc. increased its stake in shares of Brinker International by 2.5% in the first quarter. Vanguard Group Inc. now owns 5,535,500 shares of the restaurant operator's stock valued at $275,004,000 after purchasing an additional 135,580 shares during the period. Boston Partners raised its holdings in shares of Brinker International by 231.8% during the first quarter. Boston Partners now owns 1,583,239 shares of the restaurant operator's stock valued at $78,602,000 after buying an additional 1,106,046 shares during the last quarter. Finally, Assenagon Asset Management S.A. boosted its position in shares of Brinker International by 1,686.8% during the second quarter. Assenagon Asset Management S.A. now owns 192,972 shares of the restaurant operator's stock worth $13,969,000 after buying an additional 182,172 shares during the period.

Brinker International Company Profile

(

Get Free Report)

Brinker International, Inc, together with its subsidiaries, engages in the ownership, development, operation, and franchising of casual dining restaurants in the United States and internationally. It operates and franchises Chili's Grill & Bar and Maggiano's Little Italy restaurant brands.

See Also

Before you consider Brinker International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brinker International wasn't on the list.

While Brinker International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.