Brinker International (NYSE:EAT - Get Free Report) had its target price boosted by research analysts at Barclays from $66.00 to $76.00 in a research note issued to investors on Tuesday, Benzinga reports. The brokerage presently has an "equal weight" rating on the restaurant operator's stock. Barclays's price objective points to a potential downside of 18.21% from the stock's previous close.

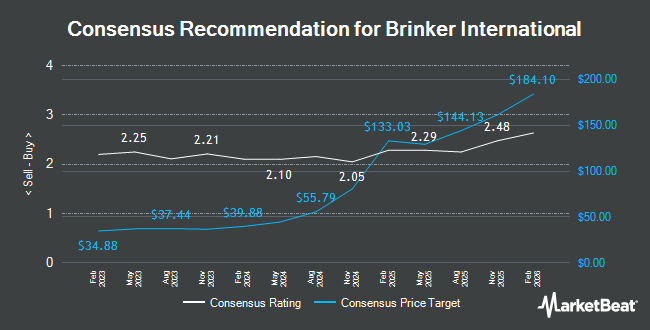

Several other equities research analysts also recently weighed in on the company. BMO Capital Markets decreased their target price on Brinker International from $85.00 to $80.00 and set an "outperform" rating for the company in a research report on Thursday, August 15th. Morgan Stanley increased their price objective on shares of Brinker International from $42.00 to $50.00 and gave the company an "underweight" rating in a research report on Tuesday, July 16th. KeyCorp lifted their price objective on shares of Brinker International from $72.00 to $100.00 and gave the company an "overweight" rating in a research note on Friday. Wedbush restated a "neutral" rating and issued a $68.00 target price on shares of Brinker International in a research note on Thursday, August 15th. Finally, Stifel Nicolaus lifted their price target on shares of Brinker International from $62.00 to $90.00 and gave the stock a "buy" rating in a research note on Tuesday, June 25th. Two research analysts have rated the stock with a sell rating, eleven have assigned a hold rating and five have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $74.62.

Get Our Latest Stock Analysis on EAT

Brinker International Trading Down 0.8 %

Shares of NYSE:EAT traded down $0.79 during trading on Tuesday, reaching $92.92. 1,000,940 shares of the stock were exchanged, compared to its average volume of 1,442,451. The firm's 50-day moving average price is $75.76 and its 200 day moving average price is $67.05. The firm has a market cap of $4.13 billion, a price-to-earnings ratio of 27.90, a price-to-earnings-growth ratio of 1.35 and a beta of 2.51. Brinker International has a 12-month low of $31.95 and a 12-month high of $94.39. The company has a debt-to-equity ratio of 19.96, a quick ratio of 0.32 and a current ratio of 0.38.

Brinker International (NYSE:EAT - Get Free Report) last released its quarterly earnings data on Wednesday, August 14th. The restaurant operator reported $1.61 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.65 by ($0.04). Brinker International had a negative return on equity of 274.62% and a net margin of 3.52%. The business had revenue of $1.21 billion for the quarter, compared to analysts' expectations of $1.17 billion. During the same quarter in the prior year, the firm earned $1.39 earnings per share. Brinker International's quarterly revenue was up 12.3% compared to the same quarter last year. On average, sell-side analysts anticipate that Brinker International will post 4.66 earnings per share for the current fiscal year.

Institutional Trading of Brinker International

Institutional investors have recently added to or reduced their stakes in the business. Cetera Advisors LLC bought a new position in Brinker International in the first quarter worth about $714,000. Lazard Asset Management LLC lifted its holdings in shares of Brinker International by 36.7% in the 1st quarter. Lazard Asset Management LLC now owns 279,974 shares of the restaurant operator's stock worth $13,908,000 after purchasing an additional 75,225 shares during the last quarter. Vanguard Group Inc. boosted its position in Brinker International by 2.5% during the 1st quarter. Vanguard Group Inc. now owns 5,535,500 shares of the restaurant operator's stock valued at $275,004,000 after purchasing an additional 135,580 shares during the period. Boston Partners grew its stake in Brinker International by 231.8% during the 1st quarter. Boston Partners now owns 1,583,239 shares of the restaurant operator's stock worth $78,602,000 after buying an additional 1,106,046 shares during the last quarter. Finally, Assenagon Asset Management S.A. increased its position in Brinker International by 1,686.8% in the second quarter. Assenagon Asset Management S.A. now owns 192,972 shares of the restaurant operator's stock worth $13,969,000 after buying an additional 182,172 shares during the period.

Brinker International Company Profile

(

Get Free Report)

Brinker International, Inc, together with its subsidiaries, engages in the ownership, development, operation, and franchising of casual dining restaurants in the United States and internationally. It operates and franchises Chili's Grill & Bar and Maggiano's Little Italy restaurant brands.

Further Reading

Before you consider Brinker International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brinker International wasn't on the list.

While Brinker International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.