Brinker International (NYSE:EAT - Get Free Report) issued an update on its FY 2025 earnings guidance on Wednesday morning. The company provided earnings per share (EPS) guidance of 5.200-5.500 for the period, compared to the consensus estimate of 4.830. The company issued revenue guidance of $4.7 billion-$4.8 billion, compared to the consensus revenue estimate of $4.6 billion.

Brinker International Stock Up 7.5 %

Shares of EAT traded up $7.24 during trading hours on Wednesday, reaching $104.25. 3,076,530 shares of the stock traded hands, compared to its average volume of 1,451,584. The company has a current ratio of 0.38, a quick ratio of 0.32 and a debt-to-equity ratio of 19.96. The stock has a fifty day simple moving average of $79.86 and a 200 day simple moving average of $69.33. Brinker International has a 52 week low of $32.90 and a 52 week high of $106.21. The company has a market cap of $4.64 billion, a price-to-earnings ratio of 30.93, a PEG ratio of 1.35 and a beta of 2.51.

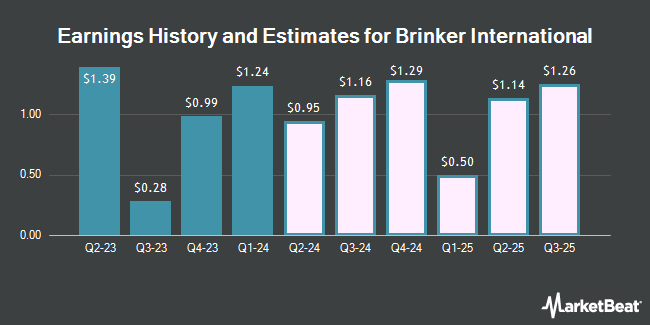

Brinker International (NYSE:EAT - Get Free Report) last released its quarterly earnings results on Wednesday, August 14th. The restaurant operator reported $1.61 earnings per share for the quarter, missing analysts' consensus estimates of $1.65 by ($0.04). Brinker International had a net margin of 3.52% and a negative return on equity of 274.62%. The firm had revenue of $1.21 billion for the quarter, compared to the consensus estimate of $1.17 billion. During the same period in the previous year, the business earned $1.39 earnings per share. The firm's revenue for the quarter was up 12.3% on a year-over-year basis. On average, equities analysts forecast that Brinker International will post 4.66 EPS for the current year.

Wall Street Analysts Forecast Growth

EAT has been the topic of a number of recent analyst reports. Raymond James lowered shares of Brinker International from an "outperform" rating to a "market perform" rating in a research report on Thursday, October 17th. Citigroup lifted their price objective on shares of Brinker International from $69.00 to $83.00 and gave the stock a "neutral" rating in a research report on Tuesday, October 8th. Argus lowered shares of Brinker International from a "buy" rating to a "hold" rating in a research report on Tuesday, October 1st. KeyCorp lifted their target price on shares of Brinker International from $72.00 to $100.00 and gave the stock an "overweight" rating in a research note on Friday, October 18th. Finally, Barclays boosted their price objective on shares of Brinker International from $66.00 to $76.00 and gave the company an "equal weight" rating in a research note on Tuesday, October 22nd. Two investment analysts have rated the stock with a sell rating, eleven have issued a hold rating and five have given a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $75.86.

View Our Latest Stock Analysis on EAT

Brinker International Company Profile

(

Get Free Report)

Brinker International, Inc, together with its subsidiaries, engages in the ownership, development, operation, and franchising of casual dining restaurants in the United States and internationally. It operates and franchises Chili's Grill & Bar and Maggiano's Little Italy restaurant brands.

Read More

Before you consider Brinker International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brinker International wasn't on the list.

While Brinker International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.